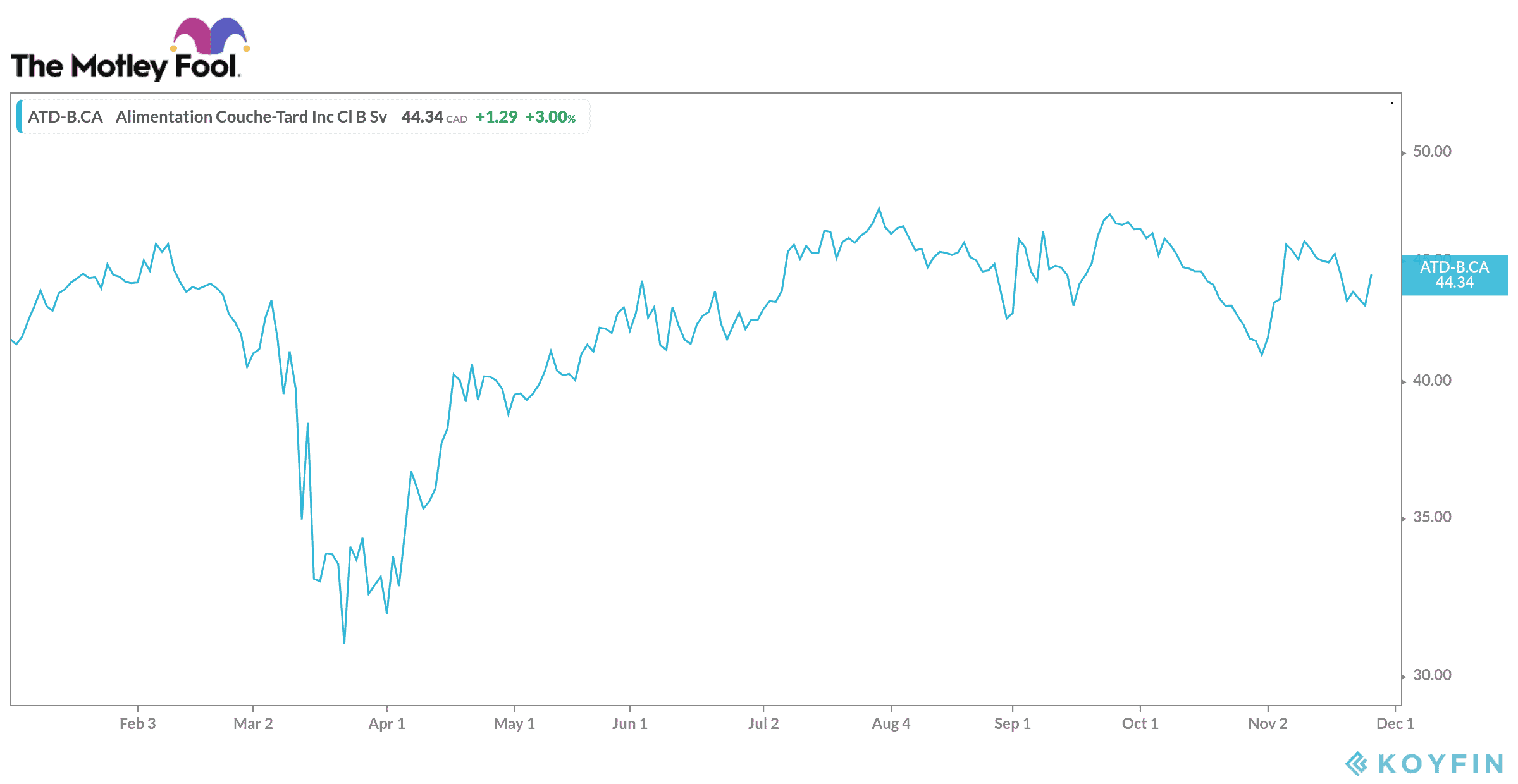

Alimentation Couche-Tard (TSX:ATD.B) posted its second-quarter results on Tuesday after the closing bell. The company’s profits increased 30.8% from a year ago in the three months ending October 11, as shoppers consolidated their purchases at convenience stores amid the COVID-19 pandemic. Investors reacted positively to Couche-Tard, as the stock rose by 3% on Wednesday morning.

Couche-Tard Q2 profit was higher than expected

The Laval-based convenience store chain reported net income attributable to shareholders of US$757 million, or US$0.68 per share, in the second quarter. By comparison, it had made a profit of US$578.6 million, or US$0.51 per share, in the same quarter a year earlier.

Couche-Tard’s revenues were US$10.7 billion, down 22.1% from the same quarter last year. The company mainly attributed the decline in revenue to the decline in the average price of gasoline, the negative impact of COVID-19 on fuel demand, and the divestiture of its interest in CrossAmerica Partners.

After adjustments to exclude certain non-recurring items, Couche-Tard achieved an adjusted profit of US$735 million, or US$0.66 per share, compared to US$569 million, or US$0.50 per share, for the same period. last year.

Analysts on average expected adjusted earnings of US$0.51 per share on revenues of US$11.2 billion, according to forecasts collected by financial data firm Refinitiv.

The revenue losses in the most recent quarter were partially offset by organic growth in merchandise and service sales as well as the net positive impact of the conversion to U.S. dollars of revenues from its Canadian and European operations.

Fuel sales volumes increased from the previous quarter, however, particularly in Europe, the company said.

Couche-Tard said its same-store merchandise sales increased 4.4% in the United States, 8.6% in Europe, and 11.4% in Canada.

The convenience store chain increased its dividend by 25%

In addition, Couche-Tard’s board of directors authorized a 25% increase in the company’s quarterly dividend. Shareholders of record on December 3 will thus receive on December 17 a payment of $8.75 per share.

Claude Tessier, Couche-Tard’s CFO, said: “Our business continues to show a lot of flexibility and resilience despite the disruptions on shopping and commuting behaviors caused by the pandemic. Once again, we executed well during the second quarter on our cost optimization initiatives including solid labor efficiencies, savings in goods-not-for-resale and strong control on discretionary expenses. Our balance sheet, with $6.0 billion of cash, on hand and available under our credit facility, remains well-positioned to support our global growth ambition. We continue to favor a balanced approach towards capital allocation and have announced the renewal of our share repurchase program representing 4.0% of the public float of our Class B shares to complement our quarterly dividend, for which an increase of 25.0% was approved on November 24, 2020.”

At the end of the most recent quarter, Couche-Tard’s network numbered 9,261 stores in North America, of which 8,085 had a gas station. In Europe, its network consisted of 2,722 stores, the majority of which offer fuel for road transport. Taking into account its licensing agreements elsewhere in the world, the company has a total of more than 14,200 stores.

Couche-Tard stock has soared by about 40% since its March low. It’s still a great buy, as people won’t stop shopping at convenience stores anytime soon. Plus, oil prices should go up in 2021, which will help boost Couche-Tard’s revenue. This Canadian stock is a great defensive investment in the current context.