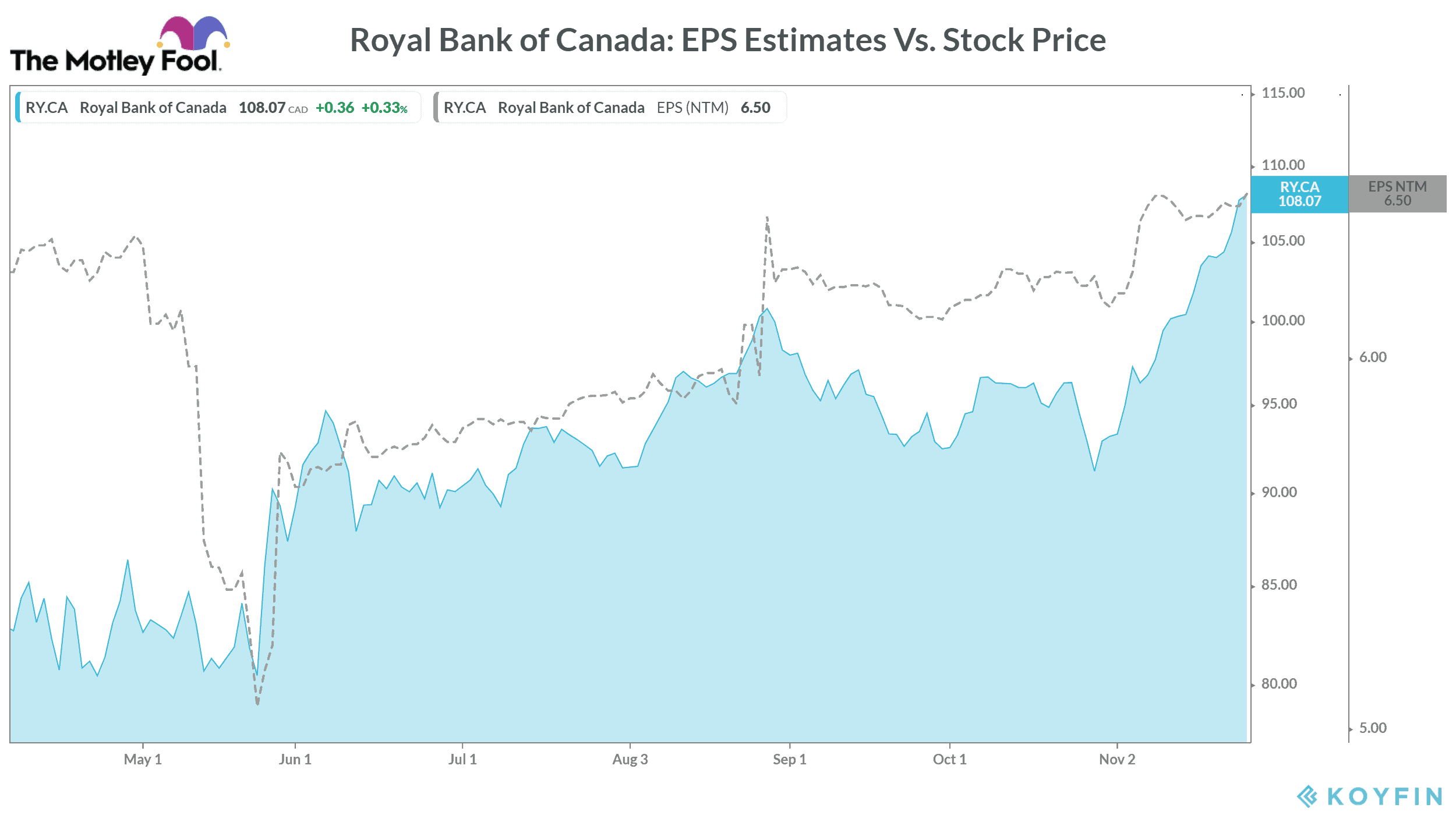

The share of the largest Canadian bank — Royal Bank of Canada (TSX:RY)(NYSE:RY) — have been rallying for the last four weeks in a row. Its stock has surged by over 15% during this period. The bank will release its Q4 of fiscal 2020 results next week on December 2. Apart from other positive factors, investors’ high expectations from its upcoming quarterly results could be one reason why its stock has been soaring lately.

Before exploring analysts’ consensus estimates for Royal Bank of Canada’s upcoming earnings, let’s take a quick look at the trend in its recent financials.

Royal Bank of Canada recent earnings trend

In the third quarter of fiscal 2020, the Royal Bank of Canada’s earnings trend improved as it reported adjusted net earnings of $2.23 per share. While it was 1.3% lower on a year-over-year (YoY) basis, it was about 24% higher than analysts’ expectations.

After missing analysts’ estimates by a wide margin in the second quarter, the bank’s third-quarter results came as a big relief for investors. However, its stock tanked by over 10% in the next couple of months following its Q2 results.

Investors’ fears that the prolonged COVID-19 could further hurt RBC’s core banking operations in the coming quarters and increase its overall costs likely affected its stock price movement.

The recent recovery

After posting its multi-month low on October 29, Royal Bank of Canada’s stock turned positive and has seen 16% gains in the weeks since. As of November 25, its stock is trading at $107.70 — not far away from its all-time high of $109.68 posted about a year ago.

While in one of my articles right after its Q3 earnings, I warned investors against buying its stock back then as COVID-19 related uncertainties made the banking sector look quite risky. Most bank stocks remained weak for the next couple of months — in line with my expectations.

However, the business scenario for banks seems to be changing at a fast pace. Despite the pandemic related continued restrictions at some places in North America, the overall economic activities have risen. Recent positive developments related to multiple COVID-19 vaccine candidates could also help boost bank investors’ confidence further.

What to expect from the Royal Bank of Canada’s Q4 earnings

Bay Street analysts expect Royal Bank of Canada to report a 9.5% drop in its fourth-quarter bottom line to about $2.9 billion. The bank’s net profit margin could improve sequentially to 25.1% in Q4 compared to 24.6% in the previous quarter.

If Royal Bank of Canada reports a notable improvement in its core banking operations next week, it would be a big positive sign for its business recovery. Such a positive signal could help Royal Bank of Canada’s stock continue its ongoing rally and go beyond its all-time high — which is why you may want to include this top banking stock in your watch list right now.