Bank of Montreal (TSX:BMO)(NYSE:BMO) — one of the largest Canadian banks — will release its fourth quarter of fiscal 2020 earnings on Tuesday next week before market opening. November so far has turned out to be the best month in Bank of Montreal stock’s history. This month the stock has risen by 23% — making it a better month than April 2009 when its stock rose by 20%.

Let’s take a closer look at analysts’ expectations and find out whether its stock can maintain these outstanding gains after its upcoming fourth-quarter earnings event.

Bank of Montreal’s Q4 earnings

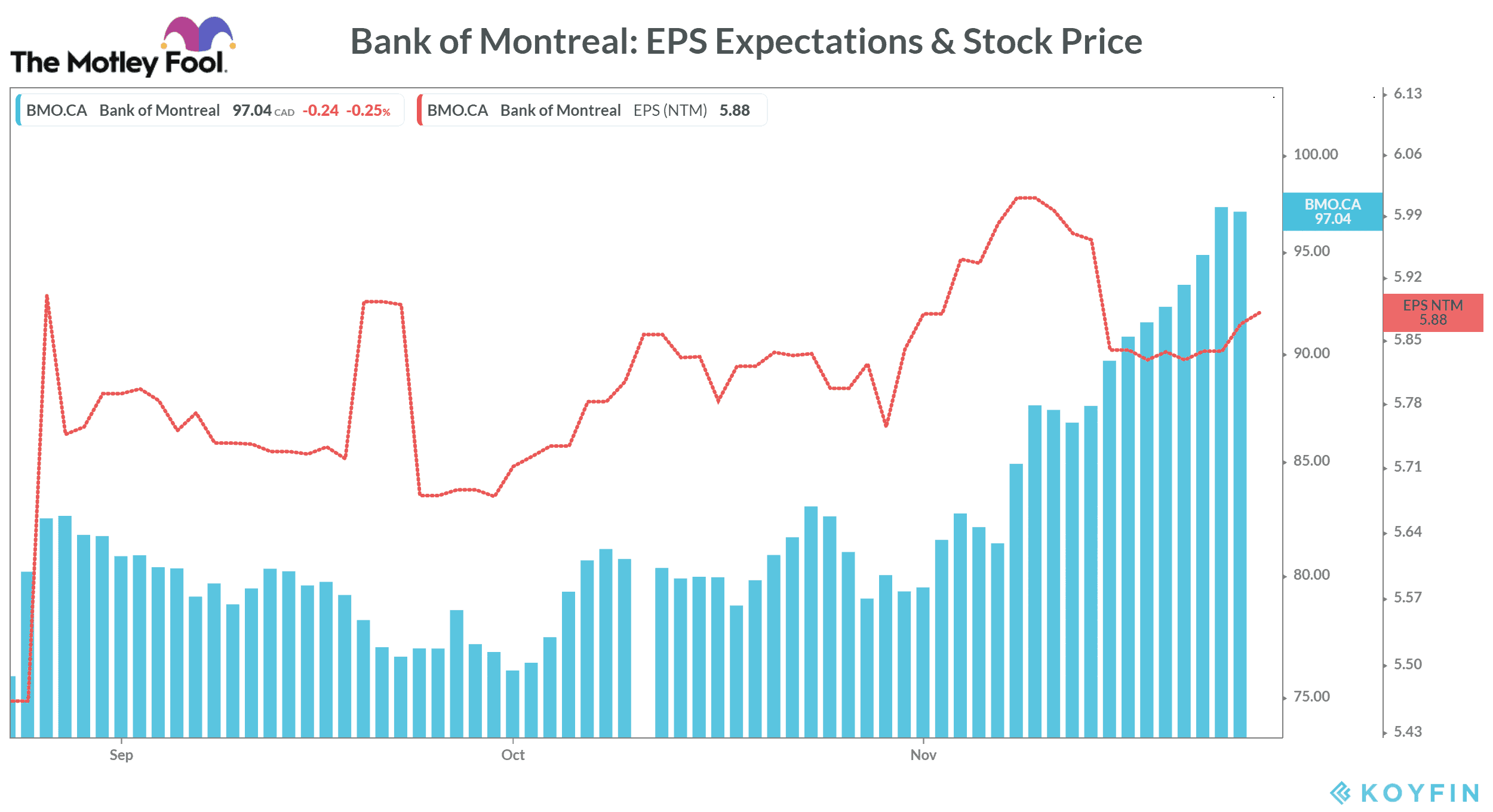

The existing trend in Bank of Montreal’s earnings is negative as its earnings have been falling on a year-over-year basis for the last couple of quarters. In the quarter ended April 2020, the bank reported a 55% YoY (year-over-year) drop in its earnings to $1.04 per share. While the trend improved in the third quarter, it still fell on a YoY basis. In Q3, BMO’s earnings stood at $1.85 per share – down 22.3% YoY but 8.4% better than analysts’ expectations.

It’s important to note that the COVID-19 restrictions badly affected most large commercial banks’ core banking operations earlier this year. On the positive side, the YoY trend in Bank of Montreal’s earnings is still much better than many of its larger peers.

In the fourth quarter, Bay Street expects BMO to report $1.90 earnings per share — down 21.8% YoY. If the bank meets this quarterly earnings expectation, it will translate into a 23.6% drop in its full fiscal 2020 earnings compared to fiscal 2019.

The positive trend in interest income

Despite the pandemic’s negative impact, Bank of Montreal’s net interest income has consistently risen sequentially in the last five quarters. In the July quarter this year, the bank reported a $3.5 billion net interest income.

While its interest income fell from $6.2 billion to $5.5 billion during the quarter, a major drop in its interest expenses helped BMO maintain a positive trend in its net interest income.

Margin expectations

In Q3 of fiscal 2020, the Bank of Montreal reported significant sequential improvement in its bottom-line margin to 20.4%. However, it was still slightly lower than 22.9% in the same quarter of the previous fiscal year.

Analysts predict the sequential improvements in its net profit margin to continue in the fourth quarter as well with expectations of 20.9%.

Is it time to book profit in its stock?

Including its outstanding November gains, the Bank of Montreal has outperformed all key banks listed on the TSX in the fourth quarter of the calendar year 2020. Its stock is trading with 25% quarter-to-date gains — much higher as compared to Royal Bank of Canada‘s 15.2% rise and Toronto-Dominion Bank‘s 15.5% surge. During the same period, the S&P/TSX Composite Index has inched up by 7.2% so far.

While Bank of Montreal’s stock is clearly outperforming all its peers and the broader market, it doesn’t make its stock is overvalued as it has many fundamental factors — as discussed above — to support its stock performance. That’s why you may want to continue holding its stock at the moment.