The Tax-Free Savings Account (TFSA) has been the top tool in an investor’s arsenal for over a decade now. The Canadian government introduced the TFSA contribution limit back in 2009, with only $5,000 of contribution room allocated. But since then, the government has added again and again, creating a huge opportunity for investors.

How it works

The TFSA offers investors thousands in investing opportunities each and every year. In January, the Canada Revenue Agency (CRA) will announce the increase in the TFSA contribution limit. This limit is added on to the addition room each Canadian has available. As of 2020, that room is at a whopping $69,500.

You can check on your TFSA contribution limit simply by calling the CRA, or by visiting the MyAccount page on the CRA website. This way, you don’t make any of the classic mistakes like over contributing. The last thing you want is for your tax-free account to be taxed!

When you make your investments, all returns, profits, dividends — you name it — are tax free. The CRA cannot touch it. This has been especially helpful for Canadians this year. A pandemic means many need that cash in today’s emergency scenario. Unfortunately, today’s situation could last years.

So, make sure you use the most of your TFSA contribution limit by using the key strategy of compounding. By choosing stocks with stable dividends, you can use those funds to buy more shares. This increases your returns without adding another penny of your own cash. As fellow Fool writer Andrew Walker explained, ” It’s like a snowball rolling down a mountain. When the process is combined with rising stock prices, it can have a major impact on the size of your portfolio.”

A top option for your TFSA

What you want are blue-chip stocks. These companies have been around for decades and have a solid future to be around for decades more. Each company has a long history of dividend payouts and are usually household names. That’s why bank stocks tend to be favoured by investors.

Canadian banks fared as some of the best in the world during the last recession in 2008. Within a year, each had rebounded to pre-crash prices. While no one could have predicted a pandemic, Canadian banks prepared for this economic crisis, as economists around the world predicted another recession was coming.

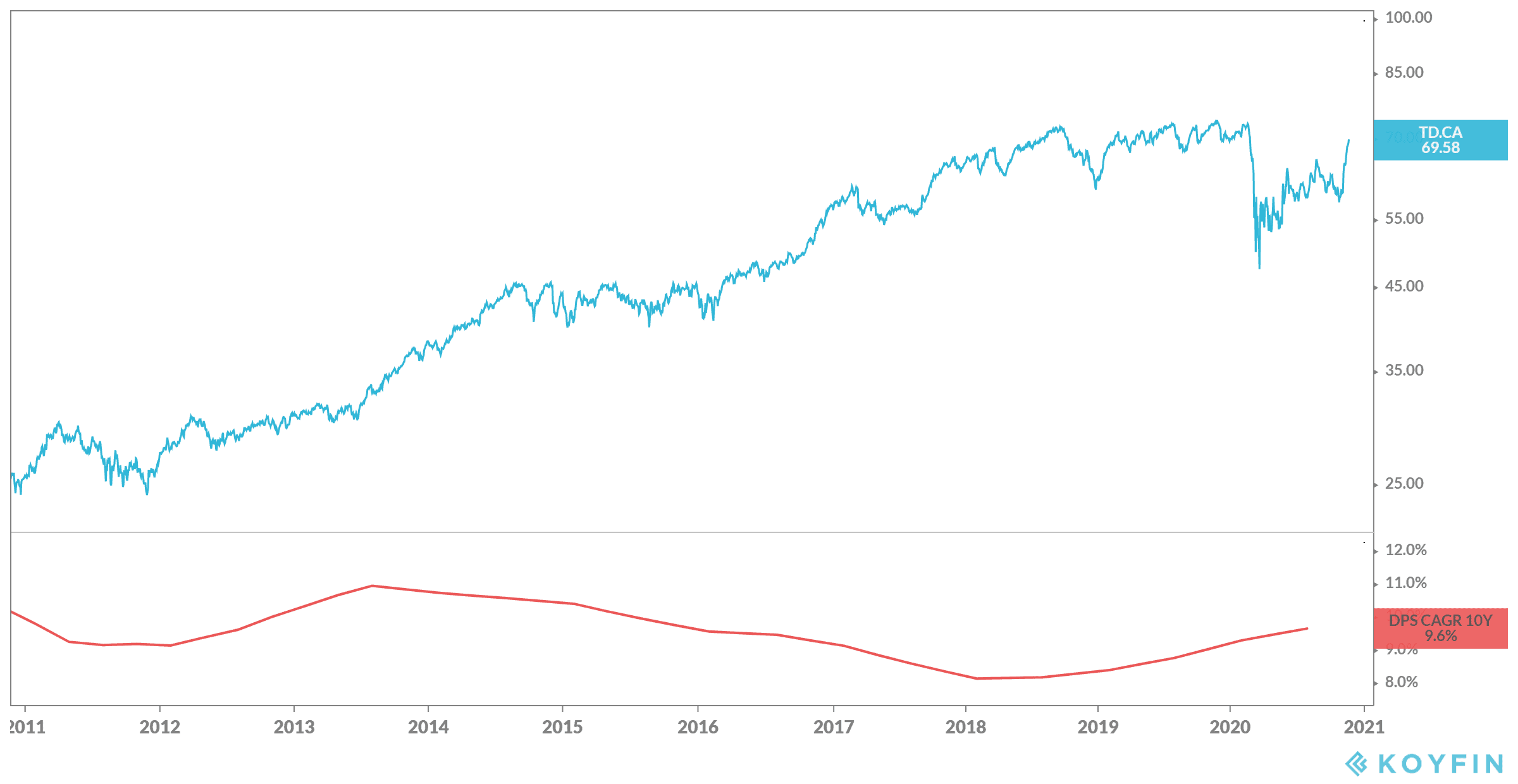

A great example, and worth your investment, is Toronto-Dominion Bank (TSX:TD)(NYSE:TD). The company is tied for first as the largest bank in Canada by market capitalization at $126 billion. While the bank’s revenue is still down, its net income soared by 27.3% during the last quarter! All during a pandemic. This is likely because of its expansion into the United States and the wealth and commercial management sector.

Bottom line

While shares aren’t at the discount prices a few months back, shares are still well below fair value. Stock prices are 5% lower than pre-crash levels and 55% higher than five years ago. Over the last decade, the company has seen a compound annual growth rate (CAGR) of 10.54%! Meanwhile, TD Bank recently increased its dividend reaching 4.57% for a CAGR of 9.6% in the last decade. If you had invested $10,000 in TD a decade ago, your portfolio would now be worth $102,279.15!