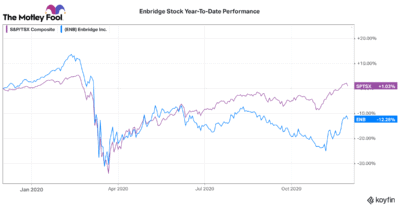

Throughout this year, while almost every stock crashed back in March, many have recovered exceptionally. Most stocks are now either slightly below their pre-pandemic high or have already passed it and are continuing to rally. One of the biggest stocks on the TSX, though, that’s noticeably underperformed throughout most of the year is Enbridge (TSX:ENB)(NYSE:ENB).

Enbridge is one of the biggest companies in Canada. It’s a massive energy business transporting 25% of oil in North America, 20% of natural gas consumed in the United States, and owning the largest gas utility company in North America, among several other assets.

Traditionally, Enbridge has been a great core stock for investors. The dividend aristocrat provides a stable and growing income stream in one of the most defensive businesses in the energy industry.

Unfortunately, the energy industry has been one of the worst impacted industries of the pandemic, and Enbridge has suffered as a result.

A weird year

2020 started off just like any other normal year. Enbridge stock was performing well, and investors had optimism about its long-term potential. Plus, the stock had just increased the dividend at the end of 2019.

Then, almost out of nowhere, the coronavirus pandemic spread across the world, and unsurprisingly, the stock market tanked.

Enbridge became extremely cheap, nearly offering a 10% dividend yield at its lowest point in March. The stock then recovered quickly with the market but has since underperformed.

You can see that the stock has had a bit of a rally due to the vaccine news in more recent weeks. However, it’s still down over 10% more than the TSX index and has been struggling again the last few trading days.

It also hasn’t helped that Joe Biden won the election. Investors have been cautious when it comes to energy and pipeline businesses during a Joe Biden presidency, so it’s safe to say several investors are avoiding the stock for that reason.

Is Enbridge stock going to $0?

With the coronavirus pandemic severely impacting the energy industry and a democratic president set to take office in January, there are significant headwinds ahead for Enbridge.

However, there is almost no chance that Enbridge will ever go to $0. That’s why many consider it such a great long-term stock.

The company is so big and provides so many essential services that the economy relies on it. So, not only are its operations stable and defensive enough, but the North American economy wouldn’t be able to function without Enbridge or its businesses.

Energy stocks are definitely ones you’ll want to be careful of over the next few months; however, Enbridge is not included in that. As a matter of fact, now is the time to be buying Enbridge.

The stock is exceptionally cheap. It’s currently still roughly 30% off its 52-week high. In addition, the dividend aristocrat, which increases its dividend every year, has an average target price of $51 from analysts, more than 24% upside. Plus, its dividend is yielding a whopping 8%.

Bottom line

While many are avoiding Enbridge for the time being, now is the perfect time for long-term investors to buy the stock. And even if it takes six months or a year to start to rally finally, you can collect the attractive 8% dividend while you wait.