Royal Bank of Canada (TSX:RY)(NYSE:RY) is Canada’s largest bank. It’s the Canadian bank that enjoys a dominant market share in many segments. As a result, Royal Bank leads the way in operating efficiency. This drives higher margins and return on equity.

So, when Royal Bank’s management speaks, we should pay attention. Here’s what they had to say about the 2021 outlook for Canadian banks.

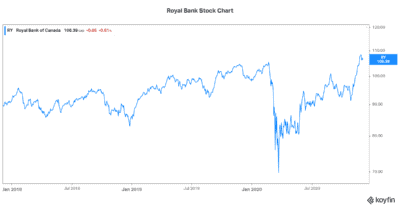

Royal Bank stock is trading as if everything is fine

I would like to start off by reviewing Royal Bank stock’s performance. We can see it in the graph below.

What do you think when you look at this graph? Doesn’t it look like everything must be totally fine in the world of banking? Judging by Royal Bank’s stock price, it may seem that way. In fact, judging by most bank stocks’ price performance, it may seem that way. But don’t be fooled. There are clear risks that the market seems to be ignoring, and they shouldn’t be.

What does Royal Bank’s management have to say about this? The bank held its fourth-quarter conference call yesterday. And the tone was that of caution. While the fourth quarter had much to celebrate, the second wave of COVID-19 is here. And 2021 will be complicated.

Royal Bank has overweighted its pessimistic scenario in its planning

The basic premise of Royal Bank’s outlook is that uncertainty remains high. And it’ll get increasingly uncertain in 2021. This is why Royal Bank has put greater weight on its downside scenarios. The bank is essentially readying itself for pretty significant hardship. Its primary pessimistic scenario has the unemployment rate above 9% until March 2023. It has housing prices declining by 8% and staying depressed until late 2023. If this scenario were to come to pass, non-performing loans could increase by 18%.

But back to 2021. In 2021, we have a confluence of events that will happen. We’re currently struggling with the second wave of the coronavirus. We should expect more pain to come from that. Also, we should expect an increase in delinquencies and impairments. According to Royal Bank, they are adequately reserved at this time. The key part of that sentence is “at this time.” The tone of the call was very cautious. I got a clear sense that 2021 could be quite bad.

The outlook for 2021

In 2021, the population will be vaccinated. Things will slowly return to some kind of normal. As this happens, deferral programs will expire, and government aid and support will end. This double-whammy will hit Canadian banks hard.

The most interesting question is this: “What would Royal Bank’s provisions and delinquencies be without the support programs?” It’s hard to quantify but easy to imagine. It would be brutal. It looks like 2021 will be a pretty brutal year. The economy has been hit hard. We can’t notice it by looking at the stock market. We can’t even notice how hard it’s been hit by looking at the Canadian banks. While their 2020 financials are lower across the board, they don’t tell the true story. Government aid and deferrals have done their job of buffering the blow, but they won’t be there for us in 2021.

Motley Fool: The bottom line

Royal Bank has many things working in its favour. As a leading Canadian bank, it has financial strength and flexibility. But even well-capitalized banks will find it tough in 2021, because the 2021 outlook is riddled with uncertainty and risk. Let’s prepare for this. If you are looking to buy bank stocks, wait. Royal Bank and all bank stocks will almost certainly be trading at more attractive prices soon.

Don't let our Poutine Day offer get cold: 65% off Stock Advisor ends at midnight!

Don't let our Poutine Day offer get cold: 65% off Stock Advisor ends at midnight!