Teck Resources (TSX:TECK.B)(NYSE:TECK) has already doubled off the 2020 low, and investors wonder if this is the right time to put Teck stock in their portfolios.

Teck’s stock price history

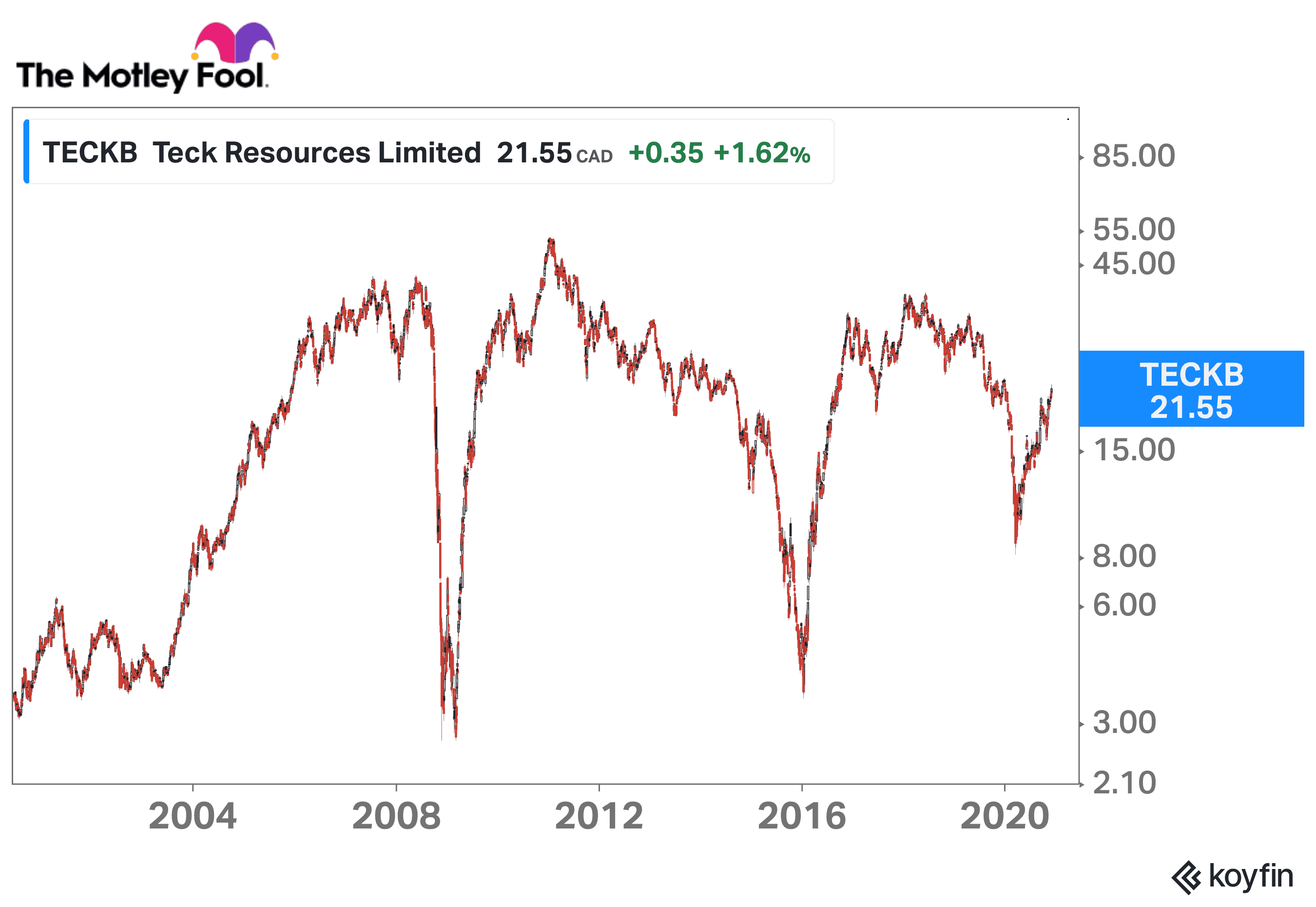

Long-term followers of Teck Resources stock know the company has a history of massive rallies followed by equally spectacular declines. This is to be expected from a commodity producer that is at the mercy of commodity prices. In good economic times Teck’s core products of metallurgical coal, copper, and zinc are in high demand.

The company also has a stake in the Fort Hills oil sands facility, so oil prices impact cash flow as well.

The cycle follows a typical pattern. Economic expansion and strong fiscal programs drive up demand and prices for base metals and metallurgical coal. Prices rise and producers invest to bring new supply on the market. The fiscal stimulus eventually runs out, and economic contraction occurs. Demand for the commodities fades, just as significant new supply hits the market. The result is a sharp drop in prices. Producer stocks normally plunge with the market.

This is what happened to Teck stock in the past decade.

The company enjoyed a great commodities boom from 2003 to 2008 when the stock price rose from $5 per share to $50. The financial crisis hammered the global economy and commodity prices plunged. Teck had loaded up on debt and the evaporation of cash flow sent the stock into a nasty decline. It eventually bottomed out near $5 in early 2009.

Governments around the world unleashed large spending programs to get their economies back on track. This drove up demand for steel, copper, and zinc, sending prices soaring. Copper hit a record high in 2011. This helped Teck pay down debt, as margins soared and sales recovered.

The stock rallied and topped $60 in early 2011.

That proved to be the top, and Teck went into a multi-year slide. Too much supply in the market occurred as governments turned off the fiscal taps. The stock fell back to $5 by early 2016.

Another commodities surge, this time led by metallurgical coal, helped Teck climb back out of the hole. Management took advantage of the market surge to reduce debt and the stock made it back to $37 in 2018. The met coal market then cooled off, and Teck stock started to drift down again until the pandemic hit this year. Teck bottomed out near $9 per share in March.

Is the stock a buy now?

At the time of writing, Teck Resources stock trades near $22 per share. Copper prices just hit a seven-year high. Zinc also bounced nicely off the lows it hit earlier this year. Steelmaking coal prices remain weak, but that might change through 2021, as stimulus programs drive up demand for steel.

Copper could be the main driver in this recovery. The metal is a key component in the manufacturing of wind turbines, solar installations, and electric cars. Green energy projects will get significant funding in the next few years. A recent Goldman Sachs analyst report on copper prices suggests the rally could continue through 2022.

Teck is a cash machine when commodity prices move higher. Copper now trades near US$3.50 per pound compared to US$2.10 in March. Zinc trades close to US$1.25 per pound compared to less than US$0.85 earlier in the year.

Based on previous rallies, it wouldn’t be a surprise to see Teck’s stock price hit $40 at some point in 2021. If you have some cash on the sidelines, this might be a good time to add Teck Resources stock to your portfolio.