The recent surge in marijuana stock prices has brought a major relief to cannabis investors. Industry stocks had suffered a severe beating since signs of oversupply emerged in 2019 and companies went on painful restructuring exercises. The relief hasn’t been confined to the investor community alone. Even some management teams at badly hit cannabis companies have taken a welcome and refreshing breather too.

Marijuana stocks generally rallied upon speculation that a Joe Biden win in the 2020 U.S. elections could mean potential federal legalization for cannabis in America. A recent United Nations vote to remove cannabis from the same category as dangerous drugs like cocaine, and the U.S. House vote on a bill that could potentially lead to federal legalization added icing to the cake.

HEXO benefits from recent marijuana stock surge

HEXO (TSX:HEXO)(NYSE:HEXO) is one pot company that has seen early benefits from the recent surge in North American pot stocks. The company’s share price had drifted below the US$1 a share on the New York Stock Exchange.

Together with Aurora Cannabis, the company enjoyed a grace period from the New York Stock Exchange earlier during the year. However, action was now required to bring its stock price back into compliance with the exchange’s continued listing rules.

An 8:1 share consolidation was proposed on October 28 this year. Investors would receive one new share for every eight common shares held in the recently restructured firm. The proposal was scheduled to be approved in a shareholders’ vote during the December 11 annual meeting.

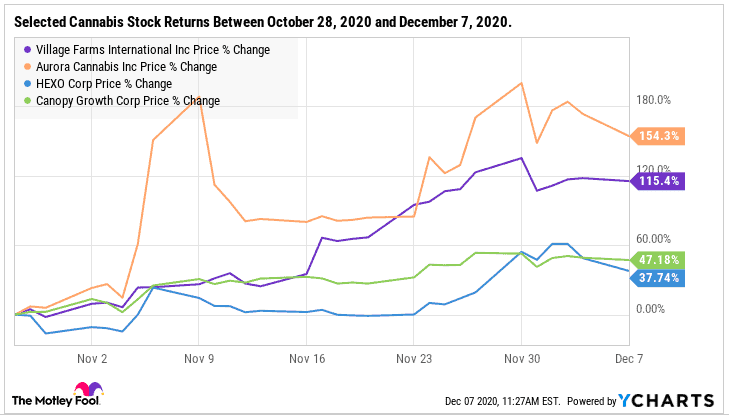

Since the October 28 announcement, shares are up by over 37%. Some peers have seen their share prices double.

Although HEXO’s stock has underperformed peers, management has good reason to adjust prior “painful” plans.

Instead of the original eight-to-one consolidation ratio, the company proposed on Monday (December 7, 2020) to reduce the ratio by half to four-to-one. Investors will receive one new common share for every four such shares held in the company.

Benefits to the consolidation ratio adjustment

Share consolidations rarely change much of a company’s fundamentals, besides reducing the number of outstanding shares, and any other metrics associated with the total share count.

That said, perception is that a share consolidation is a negative sign from management that they expect the share price to either drop further, or remain weak for a prolonged period.

Therefore, one could say that HEXO executives expect the company’s shares to hold gained ground after the recent surge. The company’s share price closed just above the US$1 mark on the NYSE on Friday. The revised ratio would value the new share at US$4 instead of US$8 a share at the old consolidation ratio.

The revised conversion rate is therefore too close to the minimum US$1 threshold. Hence it’s safe to conclude that management expects the recent industry valuation surge to stay for much longer.

“The company believes the original consolidation ratio should be revised downward in light of the recent increase in the trading price of the common shares and in order to maintain a liquid share float and reflect the company’s confidence that it can execute on its growth strategy,” management explained in a press release on Monday.

Most noteworthy, I believe that the revised ratio could keep many more HEXO shares available to be traded on the market. The lower ratio helps maintain liquidity while bringing the company into compliance with a major exchange’s rules.

Thanks to a recent surge in marijuana stocks, HEXO investors will keep more shares in the company than they would have at the old consolidation rate. Psychologically, more shares may be better than fewer.

Bottom line

If the market perceives a share consolidation as a negative signal, then a lower consolidation ratio should be better than a higher one. The magnitude of management negative perception should matter, at least to some larger extent.

The recent surge in marijuana stocks has been uplifting for HEXO. Management is already upbeat about the future.