Toronto-Dominion Bank (TSX:TD)(NYSE:TD) reported its fiscal 2020 earnings last week. Almost nine months into the pandemic, the TD Bank has shown that it has great resiliency. Actually, the story is the same for most Canadian banks.

For example, Royal Bank has also shown its resiliency in Q4. It’s a reflection of banking regulations. It’s also a reflection of prudent risk management. Finally, it shows that the Canadian banks are extremely well capitalized.

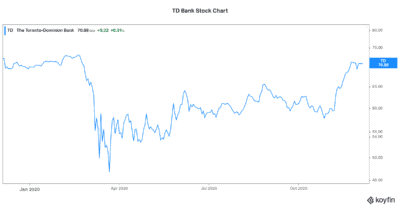

So the market has responded to this resiliency by looking past the pandemic. Investors seem to be focused on what comes after the vaccine is distributed and administered. Bank stocks, including TD Bank stock, have been riding high again. For example, TD Bank stock is up 20% since November first.

All of this positive news might have you thinking about your next step. Is it time to buy TD Bank stock now? Will this top Canadian bank stock be a good investment in 2021?

TD Bank stock: 2021 will bring new challenges

The trend in TD Bank’s fourth quarter earnings is definitely up. Here I’ll go through some numbers really quickly to give you a sense. Earnings rose more than 80%. Provisions for credit losses fell 58%. So the magnitude of sequential improvement is huge.

I personally own the stock. I’m happy with this earnings result. And it looks like most investors are as well. I mean, TD Bank’s stock price today is only 7% below pre-pandemic 2020 highs. The price graph below illustrates this.

Can the troubles of this year really be shaken off so easily?

2021 may bring TD back to reality

As a top Canadian bank, TD Bank is an example of excellence. The macro headwinds that 2020 has brought have been nothing short of disastrous. But with the help of government stimulus programs, TD Bank made it through. However, with the second wave in full swing, 2021 will present continued challenges.

Compared to 2019, TD Bank’s earnings fell dramatically in 2020. But sequentially, we can see a strong recovery happening. Most importantly, TD is seeing good consumer activity. Also, delinquency rates are muted. Lastly, the bank’s liquidity is good. All of this information more than explains the strength in TD Bank’s stock price.

But what comes after this in 2021? Well, Royal Bank of Canada (TSX:RY)(NYSE:RY) management had a very cautious tone on their Q4 earnings call. They are overweighting their most pessimistic scenarios. And they are expecting pain in 2021. Royal Bank stock, like TD Bank stock are at risk.

TD Bank management is also cautious. They acknowledge that the next few quarters will be tough. They also acknowledge that government stimulus has been the key. This is what made it possible to be in okay shape today. But now the second wave is here. And the second wave is accelerating.

Lockdowns are happening. We will need more stimulus from the government here in Canada. The United States will also need to provide government stimulus. This will be essential to TD Bank’s well-being.

It will be essential for the whole economy, of course. Because the impact of new lockdowns will be real. Health professionals always said that the second wave will be worse. The economic toll will be felt by all banks in 2021.

So in 2021, we can expect provisions for credit losses to be volatile. There’s certainly a real risk that they’ll rise dramatically again.

The bottom line

The bottom line is that uncertainty and risk remain high. We only have to remember the OSFI regulations that took hold at the beginning of the crisis. First, Canadian banks cannot raise their dividends. Second, Canadian banks cannot repurchase shares.

This is a reflection of the risk that is out there. TD Bank stock is trading only 7% lower than pre-pandemic 2020 highs. We will have a better opportunity to buy this top Canadian bank stock in the coming months. We should sit back and wait for it.