When it comes to the Tax-Free Savings Account (TFSA), Canadians have been given a golden opportunity. Since its creation back in 2009, the Canada Revenue Agency (CRA) has added between $5,000 and $10,000 each year to the TFSA in contribution room. Just recently, the CRA announced a further addition of $6,000 would be added in January. That brings the total TFSA contribution limit to $75,500 as of Jan. 1, 2021.

So what?

If you’ve already opened a TFSA, you’ll know why its such a big deal to pay attention to contribution limits. This goes on the positive and negative side. On the positive side, each year you are given another maximum amount of room to put towards investments. All of those returns and dividends you receive are completely tax free. The CRA cannot bill you for a penny, as long as you use it properly.

Hence the negative side. If you go beyond the contribution limit, you can be penalized. If you go over your contribution limit by, say, $1,500, you will be subject to a 1% per month penalty tax to the CRA until that’s corrected. So, in this example that would mean you pay $15 per month as long as the excess isn’t there.

It’s not so easy to figure out sometimes. Let’s say you contributed the maximum amount, then took out $10,000 as a loan to yourself. Then you want to go put that $10,000 back during the same year. Not so fast! You’ve already reached your limit. You now have to wait to add more cash to your TFSA next year. Even then, always check with the CRA either online or by phone to make sure you don’t go over your limit.

Now what?

So, you have your TFSA open. You have your contribution limit ready to go. How are you going to invest those $6,000? Whether you’re a millennial looking to start up a nest egg or a retiree looking to create a fund for the next few decades, the TFSA works for you. The best thing you can do for yourself is invest in stocks you don’t plan on selling any time soon.

That means you want top stocks that will be around decades from now. If you hold onto top stocks, there’s practically no chance that you’ll lose money. In fact, if you’re able to see historical data, you can figure out almost exactly how much you can make in another decade or two.

Solid stocks you can always bank on, are bank stocks (yes, I went there). Canada’s Big Six banks fared as some of the best in the world during the last market crash. During this past crash, these banks are now back at pre-crash prices as of writing. Even with another market crash on the way, you can’t go wrong. You can always start by buying a smaller stake, and adding to it over time if prices go down.

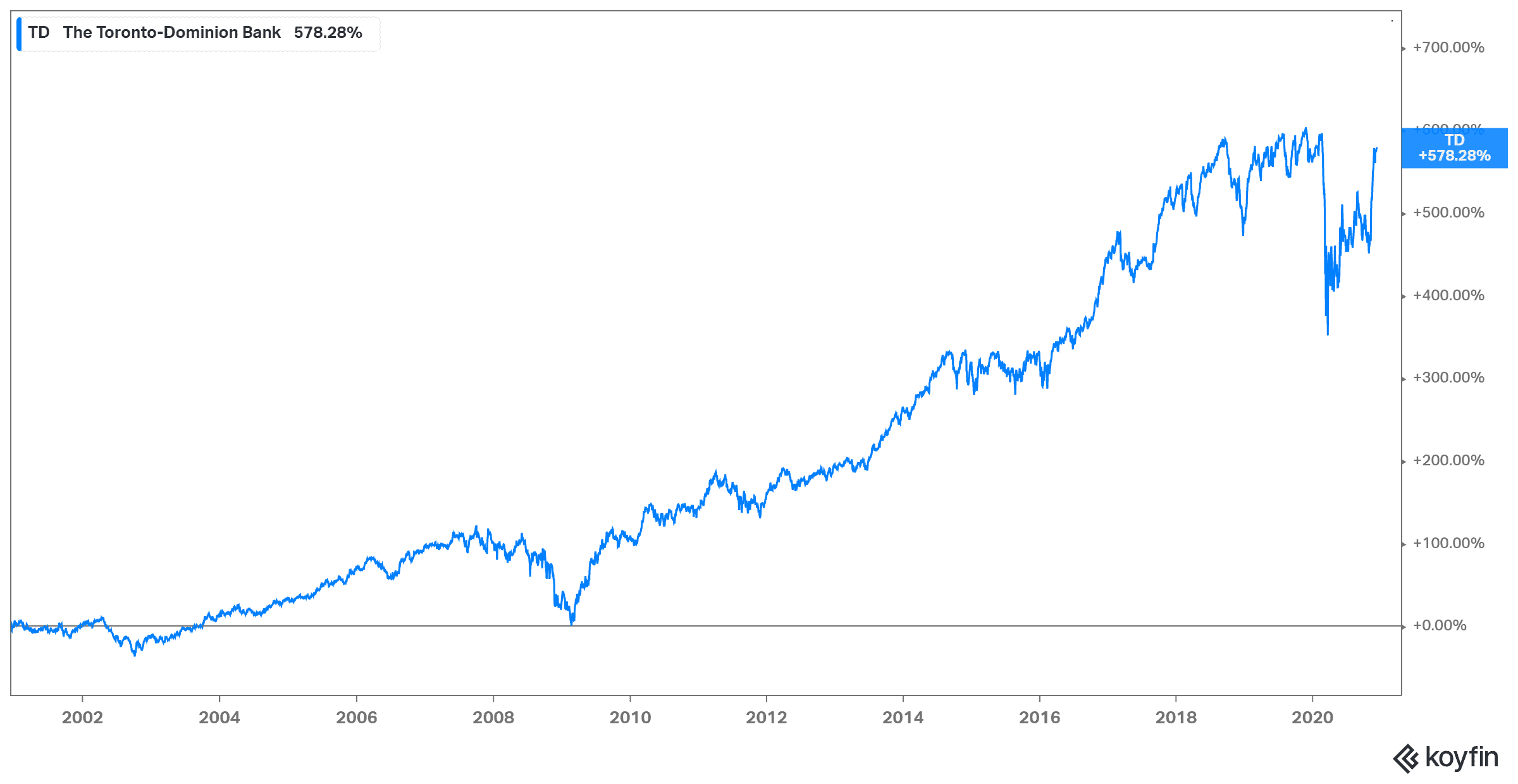

A great bank stock to consider is Toronto-Dominion Bank (TSX:TD)(NYSE:TD). The bank has expanded into wealth and commercial management, as is now one of the top 10 banks in the United States. It therefore has plenty of cash coming in for those looking to see strong revenue growth during the next several years. And right now, you can receive a solid dividend yield of 4.45% as of writing. That yield has grown at a compound annual growth rate (CAGR) of 9.23% during the last five years, and shares have grown 578% in the last 20 years for a CAGR of 28.9%!

Bottom line

If you were to just take that $6,000 of TFSA contribution room in January and use it towards a bank stock like TD, you could have serious cash on your hands in another 20 years. That $6,000 could be worth $1,059,384.62 with dividends reinvested at the same rate of growth as the last two decades.