Air Canada (TSX:AC) stock has been one of the hottest topics of the year. The massive Canadian airline tanked in February and March and has been of the most impacted businesses in the country.

Air Canada has been so cheap that it’s caught the eye of almost every investor, looking for some sort of way to play the eventual recovery.

In fact, Air Canada stock has been such a popular topic that it was the third most popular google search for news in 2020 amongst Canadians. Only CERB and coronavirus got more searches in the Canadian news category.

Although the topic has been extremely popular, the situation has never really changed with Air Canada. Of course, the situation concerning a vaccine has changed in recent weeks. However, for long-term investors, the prospects of an investment in Air Canada hasn’t changed much since the start of the pandemic.

Forget Air Canada

Way back in the early stages of the pandemic, one of the first verdicts on the airline industry came from Warren Buffett. Buffett quickly sold all his airline stocks at the beginning of the pandemic and never looked back.

Soon after, I also warned investors to avoid Air Canada stock. Of course, Air Canada was undervalued on a long-term basis. However, because of the massive uncertainty and no catalysts, the stock underperformed for a while.

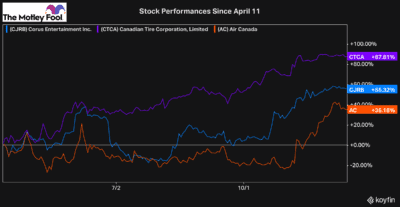

That’s why at the time, I suggested investors avoid the stock and find higher-quality investments. I instead recommended investors consider Canadian Tire or Corus Entertainment Inc.

Since the day of that article, it’s clear that Air Canada stock has underperformed. Even with its recent rally after the vaccine news, the stock has still underperformed, dating back to April.

The situation is actually getting worse for Air Canada at the moment. Only a little over a month ago, management said that the company would burn between $12 million to $14 million a day of cash. That estimate was increased this week, with management now expecting the company will burn between $14 million and $16 million a day. It also once again raised more cash through a share offering.

There are a lot of headwinds for Air Canada right now, and there aren’t many catalysts on the horizon. That’s making it very difficult for the stock to see a rally, which is why I would continue to avoid Air Canada and instead focus on other cheap TSX stocks.

Where to go from here

While Air Canada has looked cheap throughout most of 2020, investors have been focusing on what the apparent reward will be if it recovers and forgetting about all the additional risk. When you analyze the risk to reward, it quickly becomes apparent that Air Canada stock is not yet worth an investment.

So even though Air Canada still remains well below its pre-pandemic high, there continue to be several better opportunities. For starters, even after Corus’ significant rally recently, the stock is still considerably undervalued.

Corus’ business has been recovering, yet the stock still trades extremely cheap. On a forward basis, Corus is trading at a price to earnings ratio of just 5.6 times. That’s an incredible deal. Plus, these earnings are based on a pandemic-effected 2021.

Over the next few years, as the economy recovers fully, Corus has much more room to rebound. And over the long term, it offers a tonne of growth potential.

Corus has recently shifted its strategy to focus more on content creation, as well as its streaming services. These two operations go hand in hand and give Corus a tonne of long-term growth potential.

Bottom line

Although Air Canada stock may seem like a great deal due to how cheap it looks, because there is still so much risk, an investment is not worth it.

Investors should look elsewhere for value until it’s clear that airlines no longer have these significant headwinds.