Let’s take a look back at 2019. It wasn’t the best year, but it wasn’t terrible either. The air was filled with worry. Economists around the world were warning that a market crash was coming, potentially a recession. Yet to look at the market, you wouldn’t believe it. We were seeing all-time highs continue to trade over a decade after the last recession. Yet there were some warning signs.

The first sign was the cannabis market. After legalization in Canada hit on Oct. 17, 2018, the cannabis bubble burst. People wanted out, to take their profits and run. The next warning was the inverted yield curve by the United States Federal Reserve. As the world continued to take on more debt, it was clear something had to give.

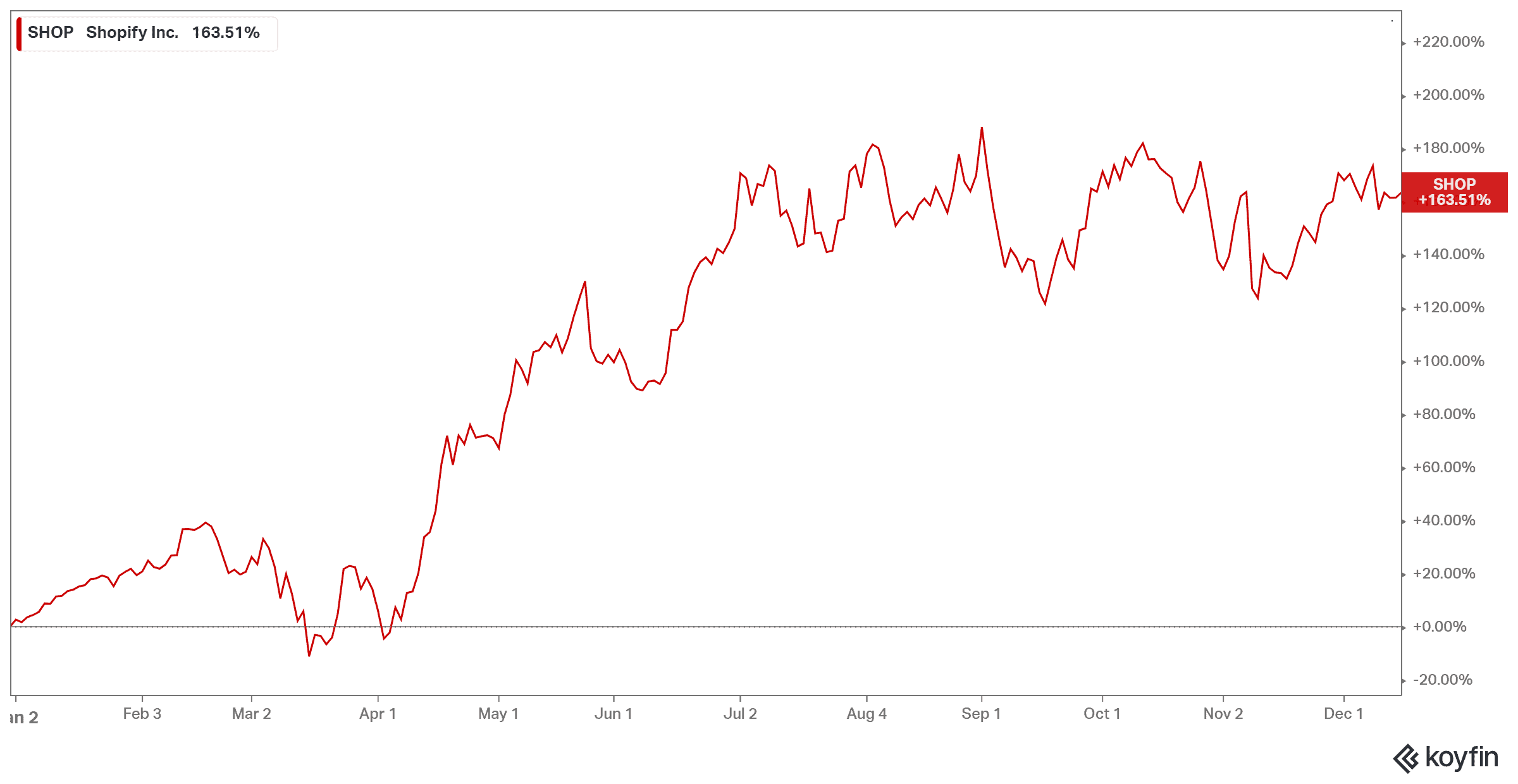

But then, there was Shopify (TSX:SHOP)(NYSE:SHOP). Throughout all of this, Shopify lived in its own little bubble. The company was there to take advantage of the boom in cannabis by becoming the online provider for much of Canada. It was there to bring e-commerce even further. It was there to provide an interface for local shops. And today, it continues to boom.

So, let’s get nostalgic and take a look at what’s been going on with Shopify this year and what could happen next.

Dec. 31, 2019

On New Year’s Eve of last year, Shopify was worth exactly $509.90 at closing. Now, let’s say you put aside the $6,000 you were going to put in your TFSA the next morning towards this stock. That would mean you would have bought just shy of 12 shares, but we’ll round up for this example.

Now, this was a time when many were still worried that Shopify could, in fact, fall by half. Many analysts believed the stock was overpriced, and it was; it still is! But investors didn’t seem to care. Shares continued to rise, as the company reported record revenue after record revenue. Yet analysts continued to warn: this stock has not been through a market crash and recession. When it does, it won’t last.

March 2020

Then the pandemic hit. As country after country saw COVID-19 sweep through, businesses closed their doors. Industries collapsed under the pressure. Only essential services were able to remain in many cases. When the market crashed in March of 2020, this was the time when Shopify had to prove it would either sink or swim.

The stock did, in fact, fall. At its lowest point, shares fell to about $435, leaving many to wonder whether shares would fall even further. But Shopify stock didn’t fall, instead it rebounded to heights never seen before. This came from the rise in e-commerce from the work-from-home economy. Merchants signed up to Shopify in droves, needing a place to bring clients or be at risk of closing up shop forever. Subscription revenue poured in and continues to today.

Today

Now, almost a year later, shares of Shopify are worth $1,358 as of writing. That’s an increase of 167% in the last year. If you were to own those 12 shares today, your original $6,000 would be worth an incredible $16,296. But those who have owned it for longer know: don’t give up shares yet. Revenue came in recently at a 96% increase year over year. While these records might not be sustainable, the company continues to do well. Should another market crash hit, it might be a great opportunity to buy up shares and hold on for decades. You may never see the opportunity again.