2020 has been unlike any year in recent memory. A lot has gone on, and there have been many ups and downs. This may lead many investors to wonder if there will be a Santa Claus Rally in the last few weeks of 2020.

A Santa Claus Rally is the phenomenon in stock markets most years where the market will rally in the last few weeks into the new year.

There are several reasons why this is the case. Investors tend to be more optimistic around the holiday time, and institutional investors aren’t working over the holidays. This makes it easier for lower volume to push stock prices up, which results in a significant rally.

Santa Claus Rallies can be quite significant too, which is why investors will want to be well positioned in the market. However, it’s still important we buy high-quality stocks.

After a crazy year and with uncertainty at unprecedented levels, there is no guarantee we get a Santa Claus rally. In fact, there is still a good possibility we could have a market crash.

Nevertheless, the potential for a market crash should only serve as an incentive to buy the highest-quality stocks and not act as a deterrent for investment. Risk has been high all year long, and the market has rallied considerably.

Plus, there are several high-quality stocks worth an investment today. Here is one of the best that could skyrocket significantly in a Santa Claus Rally.

A clean energy stock for a Santa Claus Rally

Throughout 2020, there have been several industries that have outperformed the rest. While many of these outperforming industries had to do with tailwinds from the pandemic, one industry that’s been booming purely based on long-term potential is the green energy industry.

This is crucial, because some stocks that may have seen a significant boost from the pandemic could lose momentum, as it starts to wind down. Whereas with green energy, the industry has a tonne of long-term potential.

There are plenty of high-quality renewable energy stocks to buy ahead of a potential Santa Claus Rally. However, my number one recommendation would be Xebec Adsorption (TSXV:XBC).

Xebec is not a traditional renewable energy company that generates renewable electricity. Instead, Xebec produces equipment that purifies and filters naturally occurring raw gasses to transform them into hydrogen or renewable natural gas.

This is a new technology that can help the environment and lower a company’s carbon footprint tremendously. So, with companies increasingly being incentivized to find more environmentally conscious ways of operating, Xebec has a tonne of long-term growth potential.

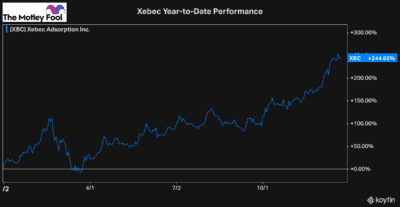

The stock has been on fire this year, already up more than 240%. However, with a market cap of less than $800 million, it still offers investors a tonne of long-term potential.

That’s why it’s a top stock I would be looking to buy soon before it gets even more expensive in a Santa Claus Rally.

Bottom line

Santa Claus Rallies tend to affect the broader market; however, they can impact growth stocks the most. So, given Xebec’s superior potential and incredible growth already this year, I wouldn’t be surprised to see it continue to skyrocket.