In one investment strategy, long-term-focused investors will buy the dips on growth stocks undergoing a consolidation. Such pullbacks provide good entry points on winning stocks for potentially outsized capital gains. Enghouse Systems (TSX:ENGH) is one high-flying COVID-19 stock that’s undergoing some correction right now, Long-term investors may welcome yet another opportunity to buy the dip.

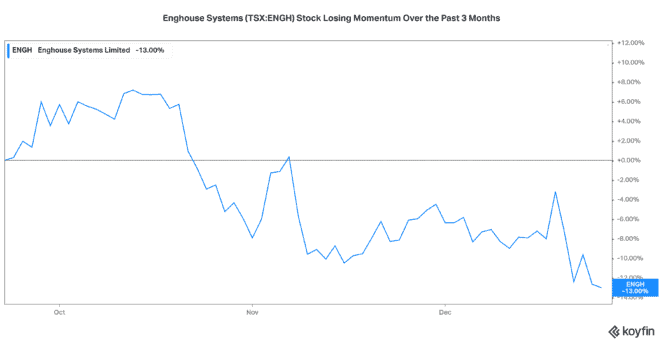

Canadian tech firm Enghouse Systems’s stock price declined by 8.8% 0n Friday last week after presenting its full-year results for fiscal 2020, which ended on October 31. Despite a strong rally during a second-quarter COVID-19 trade, ENGH’s stock price has slid by 13% over the past three months to December 24.

Why did Enghouse Systems stock lose momentum?

Enghouse Systems reported a 58% year-over-year surge in quarterly revenue, as COVID-19 struck, and clients panicked when the coronavirus hit North American shores. The company’s remote-working solutions like Vidyo saw increased demand, as companies prepared for an unprecedented work-from-home migration.

ENGH’s stock price surged over 120% from March 23rd lows, as investors realized the company would be one of the best-placed winners during the pandemic. However, shares are up just 29% for this year after a consolidation took place beginning in late October.

The recent weakness in ENGH shares shouldn’t be surprising. The arrival of COVID-19 vaccines has allowed traders to take profits on the pandemic’s winning stocks, as normalization is expected in the near future.

The company’s revenue growth trend has since reverted back to the normal 10% compound annual growth rate by October this year. Management recently commented that the prior surge in sales during the early days of the pandemic has been temporary. The executive team expects low-single-digit organic growth going forward.

Justifiably, shares should take a short-term breather. It could be time to buy the dip.

Is the COVID-19 stock still a buy?

Long-term investors in a COVID-19-winning ENGH stock would know that organic revenue growth has historically been very low. Yet the company remains a trusted and favourite growth stock because of its tried, tested, and proven successful acquisitions-led growth strategy.

Enghouse Systems can buy an ailing but well-positioned target and restructure it into a profitable operation in a few short months.

Back in March 2019, I was of the opinion that “new acquisitions may bring back the mojo that investors look for, and buying the current dip could be a wise idea.” Shares have almost doubled since then.

Although the rate of acquisitions slowed during the pandemic, the executive team is still conducting due diligence on new targets.

The company retains its history of strong free cash flow generation. This attribute will sustain its growth strategy for longer. Interestingly, management decided to pay out part of the cash windfall received during the pandemic to shareholders through a special dividend of $1.50 a share to be paid in February 2021. The special dividend comes on top of double-digit increases in the quarterly dividend over the past three consecutive years, the recent one being a hefty 22.5% annual increment for 2020.

Analysts expect the company to continue on a low double-digit growth trend, at least over the next two years. Profit margins remain intact. The cash-generating machine remains well oiled, as the business’s revenue run-rate normalizes in 2021.

Investor takeaway

Given sustained growth, healthy profit margins, strong cash flow generation, no leverage, and a clean balance sheet, I would continue to load up on Enghouse Systems stock for long-term capital gains after the COVID-19 pandemic. The average analyst price target on the stock of $82 indicates a potential 28% return over the next 12 months.