Tech stocks seemed to be the only industry actually doing well during the pandemic. Even after the market crash took returns down a notch, most stocks have rebounded, and then some. In fact, there are tech stocks out there reaching all-time highs even as we speak!

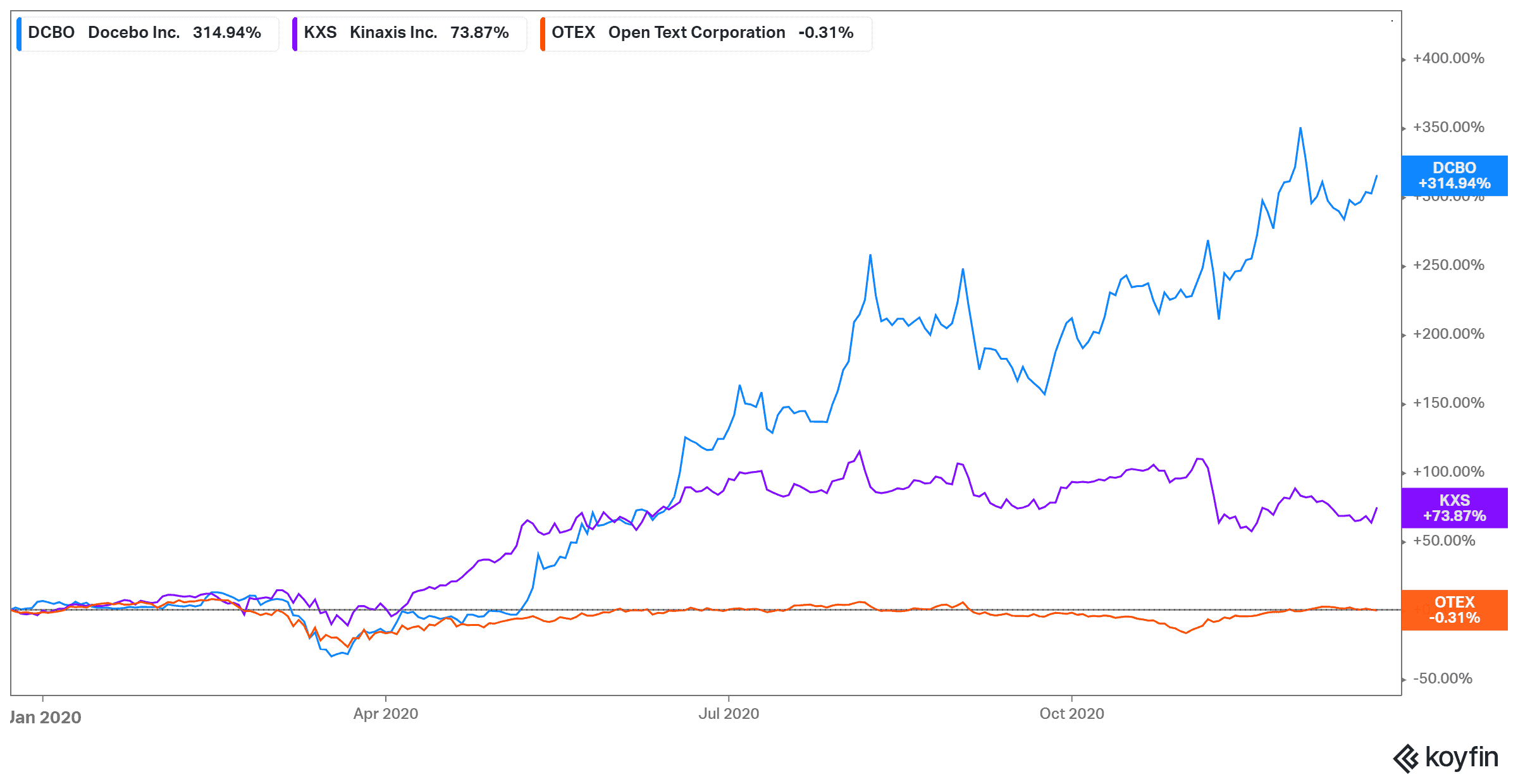

But while there are many winners, Docebo (TSX:DCBO)(NASDAQ:DCBO), Kinaxis (TSX:KXS) and Open Text (TSX:OTEX)(NASDAQ:OTEX) really saved the day this year. So, let’s dig into why, and whether that will continue in 2021.

Docebo

When Docebo came onto the TSX Composite in 2019, the company did well, but it wasn’t anything super exciting. Docebo offering learning management software so that companies can train employees any where in the world. Its artificial intelligence helps create a learning tool that anyone can use. So, it’s cool, but wasn’t a necessity — until the pandemic that is.

Suddenly, companies around the world needed a way to keep employees trained and hire new ones. The system was adopted by household names like Amazon and suddenly the stock was a must-have. The company proved that the future was here and you could now hire anyone from anywhere for a position. Shares are up a whopping 313% this year alone, with revenue increasing 52% year over year during the latest earnings report. And things don’t look likely to slow down anytime soon.

Kinaxis

While Docebo was new and exciting, Kinaxis saw major growth as a company that already proved its worth. The company’s supply management system provides artificial intelligence that makes sure companies ship and receive in the most timely manner possible. This became even more important during a pandemic, when businesses needed to stay afloat or sink altogether.

Luckily for investors, the company is supported by large firms around the world. Its subscription revenue remains stable, as companies sign up for years at a time in most cases. Kinaxis also doesn’t have one company that takes up a majority stake, so even if one were to bow out, it would keep seeing recurring revenue come in strong. Total revenue was up 17% year over year during the latest report, with shares increasing 73% in the last year.

Open Text

Another company that has history on its side, Open Text saw major growth, as enormous companies like Alphabet signed up for the company’s cloud service. Open Text provides a safe environment to house data in the cloud, a necessity as the work-from-home economy grows stronger.

Open Text was able to continue growing its bottom line, as more companies signed up to the service. The company saw a 15.4% increase year over year in total revenue, and a 43% increasing in recurring revenue during the same period. It even upped its dividend yield by 15% — something you don’t see often among tech stocks. Same goes for its 10-year compound annual growth rate of 19% as of writing.

Bottom line

Each of these companies shows how our world is moving more online. By investing in any of these stocks, you’d do well to buy and hold for decades. While other companies needed a lifeline, each of these provided a safe haven for investors in 2020. With 2021 looking like there will still be some struggles, it could be a great time to pick up these stocks during a dip.