Leading pipeline giant Enbridge’s (TSX:ENB)(NYSE:ENB) stock price is yet to fully recover from the 2020 COVID-19 market crash. Shares are still down 20% on a year-to-date basis by December 30. However, investors who continued to hold ENB stock in their retirement portfolios still received juicy dividends and will receive even higher quarterly payouts in 2021.

Enbridge is a high-quality TSX dividend-growth stock that has fallen victim to a rotation out of the energy sector during the 2020 market crash. Although the decline in energy stocks remains justifiable during the pandemic, there’s a significant chance that industry stocks could recover in 2021 as coronavirus vaccination programs rollout during the next year.

Is Enbridge stock a buy for 2021?

The sudden decline in ENB’s stock price during the 2020 market crash wiped off five years of total investment gains. However, the unprecedented pandemic is an outlier event that shouldn’t cloud our long-term investment judgment. A long term “normalized” view could give us a better picture of whether one should consider adding Enbridge stock to a retirement portfolio in 2021.

Irrespective of the vicious headwinds ravaging the North American energy industry, this is one blue-chip Dividend Aristocrat that can make up a significant part of a retirement portfolio for both young millennials and those nearing retirement.

The stock ticks three important boxes one needs to consider when selecting stocks to buy in a retirement-focused TFSA or RRSP portfolio for 2021. These include a resilient business model with wide moats, a safe and reliably growing dividend, and the potential for capital gains.

A resilient business model

The company is North America’s largest crude oil pipeline company by pipeline length. It transported 25% of the continent’s crude in 2019 and 20% of North America’s gas during the past year. The company retains a wide moat in the liquid transportation business, and its cash flows enjoy protection from long-term customer contracts, most of which (95%) are with investment grade-rated customers.

Coupled with energy production and gas distribution contracts in its other segments, the company’s business cash flows are utility-like. About 98% of cash flows are regulated or under long-term contacts. The company retains an investment-grade rating for a good reason.

Most noteworthy, Enbridge’s pipeline contracts are based on customer volumes and not on commodity prices. The company’s cash flows are thus shielded from the volatility in commodity prices.

Reliably growing dividends

ENB recently announced a 3% increase in its quarterly dividend to $0.835 per share. The December announcement marked 26 years of consecutive dividend increases. Management will keep growing the dividend (as usual), as the company continuously invests in multi-billion-dollar capital projects.

The company’s dividend yields nearly 8.2% at the time of writing. The payout is one of the safest in the industry with a 60-70% payout rate on distributable cash flow.

Anyone who buys the Dividend Aristocrat’s stock right now could expect a juicy 8.2% return for 2021 just from the dividend alone. Any capital gains will be a bonus, and this bonus is very much likely on its way.

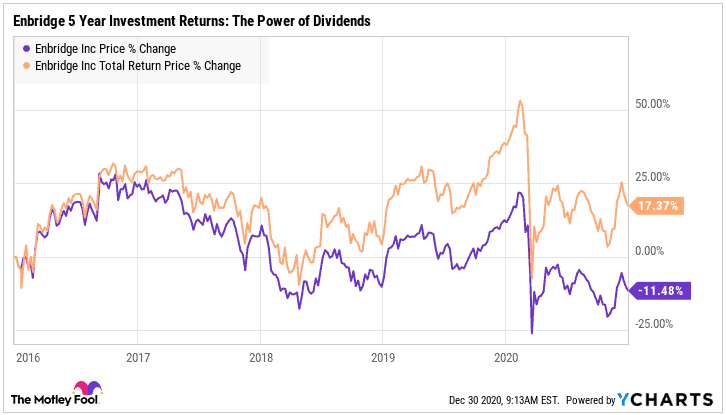

Actually, Enbridge’s dividend meant the difference between investment losses and position gains over the past five years. The payout reversed an 11% capital loss into a positive 17% investment return during the period.

Enbridge (ENB) five-year stock performance: Dividends Changed the Story (December 30, 2020).

Capital gains potential over the next decade

I’d expect significant capital gains on Enbridge stock as soon as the pandemic is over. The negativity on oil names should weaken as economies recover across the world and international travel resumes, leading to a surge in oil demand once again.

ENB has one of the strongest balance sheets in the industry. Actually, the balance sheet strengthened further during the pandemic with an increase in available liquidity from $9 billion to $13 billion. The company maintained an investment-grade rating, reduced, and maintained its debt-to-EBITDA leverage ratio within the target 4.5-5 times range during the market turmoil.

Long-term-focused investors may appreciate that the company continues to self-finance multi-billion-dollar growth projects while diversifying into green energy production since 2002. Management expects a 5-7% compound annual growth rate in distributable cash flows over the next three years.

Investors takeaway

ENB could continue to thrive, even in a post-fossil fuel world. Your $6,000 TFSA investment for 2021 could be safely parked in this high-yield dividend-growth stock for decades.