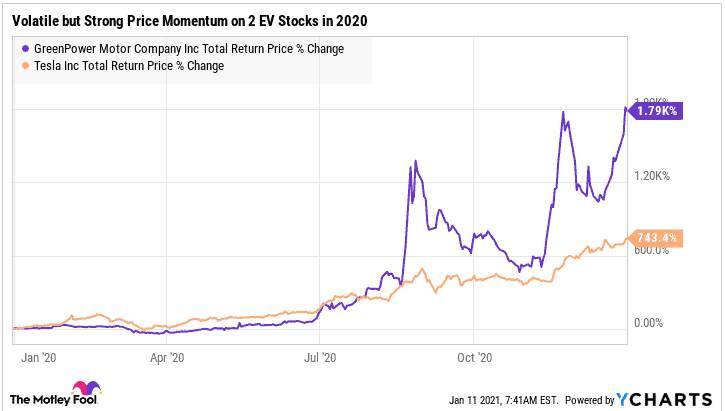

The company only delivered its first electric vehicle (EV), a battery-powered electric bus in 2018, but Vancouver headquartered GreenPower Motors’ (TSXV:GPV)(NASDAQ:GP) stock took the investing market by storm in 2020, rallying by over 1700% during a pandemic stricken year. GreenPower’s stock has returned to price growth momentum and analysts expect triple-digit revenue growth numbers during the next 12 months. However, the decision whether to buy more GPV stock right now or avoid it altogether needs careful consideration.

Today, an outperforming GreenPower Motors stock attracts high valuation multiples comparable to its North American EV-manufacturing peer Tesla Motors (NASDAQ:TSLA) which has also rallied beyond fundamental investors’s imagination.

Watch out for strong revenue growth in 2021

EV bus manufacturers are expected to cash in on the electric vehicle momentum in North America. Public transport agencies in the United States are keen to promote purchases of zero-emission electric-powered vehicles. Several subsidy programs are in place to promote purchases of largely locally manufactured EV buses in the United States.

In Canada, the Société de transport de Laval (STL), the public transit system in the city of Laval, Quebec is committed to buying electric buses only from 2023. The Société de transport de Montréal (STM) has a similar commitment beginning in 2025. Electric bus manufacturers have a growing addressable market, and GP is expected to participate.

GreenPower Motors is expected to report rapidly growing revenue numbers in 2021. Analysts expect the company to grow quarterly revenue by 1,009.4% year over year to $7.13 million for the quarter ending March 31, 2021. Sales during the calendar year 2021 are expected to increase by 306% year over year. Those are awesome growth rates, all things considered.

Shares in GreenPower Motors valued like Tesla stock!

Founded in 2010, GreenPower Motors says it develops, manufactures, and distributes electric vehicles for commercial markets in the United States and Canada. Its flagship product is the EV Star, a 19 seater battery-electric bus that has a fully autonomous driving variant since December last year.

The youthful zest of the high powered GP stock has allowed it to at-times surpass its well-established peer Tesla – valuation wise. Before a 4.3% decline on Friday last week, shares in GreenPower commanded a forward enterprise value (EV) to sales multiple of 19.69x as of Friday’s close. Tesla had a 17.62 times multiple after a strong rally in 2020. Tesla regained a narrow lead after an 8% rally on Friday, but multiples aren’t significantly further from those levels yet.

The small electric vehicle manufacturer has a more expensive forward enterprise value to earnings before interest and tax, depreciation, and amortization (EV/EBITDA) multiple of 244 times. This is several times more expensive than Tesla’s EV/EBITDA multiple of 87x today.

Investors are willing to buy shares in GreenPower at expensive valuation multiples as they anticipate that the emerging EV stock could be a Tesla 2.0 kind of story.

Should you buy GP shares today?

Shares in GreenPower have enjoyed a good run, and momentum is strong right now. This makes GP a potential short-term momentum trade candidate this month. However, long-term investors should trade with extreme caution.

A very concerning 32 paged negative research report from White Diamond Research released in December 2020 claimed the company is no EV manufacturer but just an importer of cheap Chinese made EV buses which it purportedly rebrands.

The report casts significant doubt on the company’s long-term potential to sustain market share even in its major California market. The company may lack the prerequisite “Buy America Compliant” certification, rendering its products ineligible for state subsidies.

The market has practically dismissed the report given the recent rally. However, the same market also pumped up the value of a bankrupt Hertz Global Holdings last year! The issues raised in the damning report may still haunt long-term investors.

Short-term growth momentum may justify the high valuation for now, but Tesla-level investor enthusiasm may not stick and stay on GreenPower Motors long-term. The minor lacks intellectual property.

That said, the promised demo tour of a second fully autonomous driven bus in February could boost momentum on GPV stock. However, the release from a lock-up period of a large block of shares next month could dampen valuation. Unlocked shares could flood the market and weaken GreenPower Motors’ share price from February 24 as holders take profits.

Buyer beware!