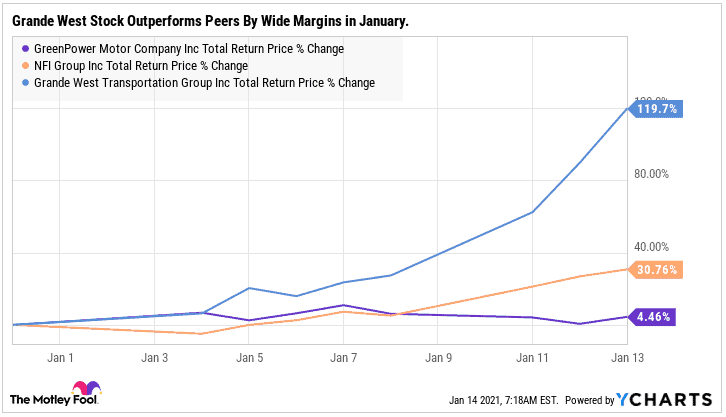

Electric vehicle (EV) stocks are the place to be in 2021. Any company, big or small, that affiliated itself with electric vehicles since late 2020 has attracted increased investor attention. Most have been rewarded in the form of rising stock prices. This is true for one tiny and seldom-covered Canadian small-cap, Grande West Transportation Group (TSXV:BUS) stock, which is on a tear. Grande West’s stock price has rallied by 820% over the past six months. Its shares have outperformed established EV bus manufacturing peers by a wide margin so far this year.

Why is Grande West’s stock rising?

Grande West Transportation is a small Canadian-based bus manufacturer that has been in business for 12 years. The bus manufacturer made its first bus deliveries in 2013, but it’s already a market leader in the mid-sized, heavy-duty bus market segment in Canada. It claims to have achieved an over 90% market share in Canada and has over 500 vehicles currently operating in the country.

However, after making all these achievements in the past, Grande West’s stock price never got the stock market’s attention.

Up until recently, BUS stock had a sub-$100 million market cap and no analyst coverage.

Things changed abruptly when Grande West announced on November 17, 2020, that it has entered the EV market race. Its stock price has since gone parabolic.

Grande West has chosen to work with BMW’s battery modules and components and to ride on a Hofer Germany powertrain. The company has combined proven EV tech offerings to create its Vicinity Lightning bus, which charges like a car.

The rally on the new EV stock gathered momentum on January 8 after the company released an investor presentation that wowed the market. Analysts expect strong battery-electric bus sales revenue growth over the next decade, and the market believes in the growth path ahead.

North America’s exciting EV bus growth path

The North American battery-electric bus market could grow at a 10-year compound annual growth rate (CAGR) of 28.5% until 2030. This was claimed in a Bloomberg NEF report, which EV bus manufacturers keep referencing lately. The report also points to a potential 99% CAGR in total battery-electric medium- and heavy-duty commercial vehicle sales between 2020 and 2025.

Grande West reports that momentum has already started in the U.S. with recent large orders.

The company is opening a new factory in the U.S. this year. It will deliver Buy America Compliant buses built using 70% U.S.-sourced parts. Its buses are said to have best in class Altoona testing, too. The two certifications are critical for success in the U.S. market. They unlock eligibility for state subsidies. Grande West is well equipped to successfully compete in the growing EV bus market. It has an annual production capacity of 1,000 units and an additional 2,000 units from contract manufacturing partners.

Investors are indeed taking notice.

Time to buy?

Despite a massive rally lately, Grande West Transportation Group is still a small-cap stock with a $280 million market capitalization. The company is has created a nice track record over the years, while establishing industry connections and a distribution network. It’s faced with a huge addressable market. The business should continue to grow over the next decade, as world cities adopt EVs for public transport solutions.

Momentum on the small Canadian EV stock is strong and buying into the surge now could result produce capital growth. Shares may indeed look too hot now. The EV craze has caught up with bs manufacturers too. However, valuation isn’t as stretched as it is for a younger EV bus manufacturer GreenPower Motors stock. Grande West has a forward enterprise-value-to-sales multiple of 5.2 against GreenPower’s 18. Green Power’s market cap has surpassed $800 million after a strong rally.

If keen to participate in the trending EV play, then Grande West stock is a promising buy candidate for sizeable investment returns.