Did you take advantage of Bitcoin ‘s recent price surge? Beware: You will have to pay taxes on your gain.

You can’t buy Bitcoin in a TFSA or an RRSP

At the end of 2020, the price of Bitcoin began to climb, initially driven by the growing appetite of investment funds and companies.

The price of Bitcoin has soared by more than 300% over the past year and is now trading close to US$40,000.

Analysts at JPMorgan compare Bitcoin to digital gold. They have warned that a price correction is likely, but they see the price of Bitcoin hitting US$146,000 in the long term.

The surge in the price of Bitcoin in recent weeks has been synonymous with substantial profit for many investors. But remember that this is a capital gain and is therefore taxable. Unfortunately, you cannot buy Bitcoin in a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) .

The Canada Revenue Agency (CRA) is tightening the screws on those trying to benefit from the lack of oversight in cryptocurrency exchanges.

The CRA set up a unit specializing in cryptocurrencies in 2018 and intends to strike hard soon. In an email, the CRA says it is seeking to ask a major Canadian cryptocurrency exchange for certain information about its clients.

In its guide on virtual currency, the CRA invites investors to keep a record for each of their transactions.

The simple exchange of one cryptocurrency for another or for a monetary currency is likely to generate a capital gain or loss. Each transaction must be declared.

In Canada, half of the capital gain is subject to tax. Let’s say you bought $10,000 worth of Bitcoin a year ago and you sold it for $30,000. You have realized a gain of $20,000, but you need to declare half of that gain — that is, $10,000. However, if you have experienced capital losses, you can use half of them to reduce your gains.

A tax-efficient way to bet on the cryptocurrency

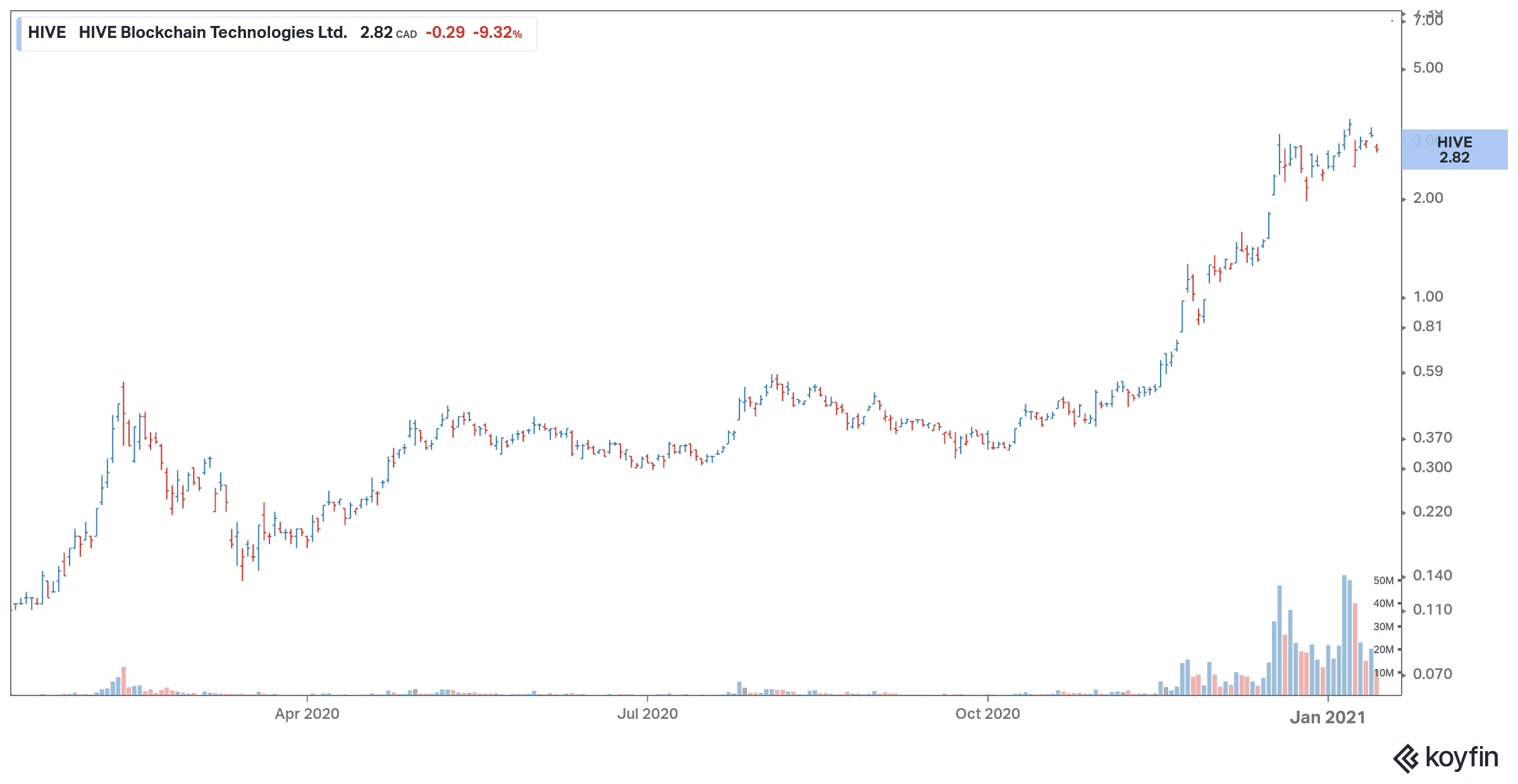

For small investors who want to avoid this tax planning, a simpler solution exists to bet on Bitcoin. Blockchain stock HIVE Blockchain Technologies (TSXV:HIVE) aims to build a bridge between the blockchain industry and traditional financial markets. It owns cryptocurrency mining facilities in Canada, Iceland, and Sweden.

The latest buzz is that the company is doubling its Bitcoin production capacity. It recently acquired a new generation of Bitcoin miners. HIVE is also the leading Ethereum producer, a better-performing digital coin than Bitcoin. The cryptocurrency miner has a market cap over $700 million.

Having this stock in a TFSA or an RRSP could cause you a lot less hassle, since you won’t have to pay taxes on your capital gains. You can contribute $6,000 for 2021 if you have contributed the maximum since the TFSA’s inception in 2009. The total contribution room available in 2021 for someone who has never contributed and has been eligible for the TFSA since its introduction in 2009 is $75,500.

You could invest a portion of your TFSA in HIVE to profit from the rise in Bitcoin price. But since this is a volatile investment, it would be more prudent to not put all your money in this one stock and to diversify in less-volatile sectors.