Warren Buffett has parted ways with many tidbits of wisdom. Much of this wisdom can be found in the many Warren Buffett books that out there. In this article, I would like to talk about one of his lesser known quotes: “The stock market is designed to transfer money from the active to the patient.” While the concept is simple, it’s also extremely relevant. And it’s simply true.

This quote will remind you hang on to great stock ideas, just as it did for me with Northland Power Inc. (TSX:NPI) stock, when it was going nowhere. It will lead you to wealth-building moves. Let’s dissect this quote from Warren Buffett. Its analysis will surely provide readers with valuable investing tips, so add it to your collection of wisdom and let it help guide you in your investing.

Warren Buffett doesn’t pretend to be able to time the market

There are many things that Warren Buffett has no problem doing. One of them is admitting his limitations. Timing the market and active trading is another one. In fact, accurately timing the market is a limitation that we all have. It is not because something is wrong with us; it’s because the market is its own beast. It’s emotional. And it’s also very sensitive to changes in a multitude of factors. Furthermore, it’s moody and doesn’t follow any sort of timeline.

So knowing this, isn’t it easy to admit that we can’t time the market to a satisfactory degree? Like Warren Buffett, I have no problem admitting that. Because if I have patience, I’m one step ahead. And if I own the right companies, all I have to do is wait. Wait for them to fulfill their promise. Time is a good company’s friend.

Active traders don’t have a great track record

Active trading can be a very seductive game. The dream of trading in and out of stocks is alive and well in many. And of course, the dream assumes buying at lows and selling at highs. It probably doesn’t take long for active traders to realize that this is a dangerous game – and that maybe just holding your positions over time is better. This is what Warren Buffett swears by.

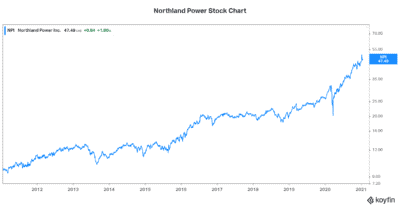

One stock that I have been patient with is Northland Power stock. While I bought it for its renewable energy assets, I bought Northland Power stock in 2011 before clean energy really took off. So I watched Northland stock go sideways for five years, while remaining patient and confident in this renewable energy company and collecting a generous annual dividend along the way.

I mean, I could’ve traded the ups and downs, which of course appears simple in hindsight. And I might be tempted to think I would buy and sell at the right times. But in reality, patiently riding the stock higher was the way to go. Northland stock return plus its dividend yield provided a stellar 10-year return. The stock rose 200%, while the annual dividend yield was roughly 5%. Patience does pay off. Warren Buffet’s book, The Warren Buffett Way, outlines this in great detail.

The bottom line

As Warren Buffett so eloquently states, active investors transfer money to patient investors. With my Northland Power stock example, I remained patient. The payoff was Northland’s 10-year return of 200% plus annual dividends.

Warren Buffett has sprinkled many tidbits of wisdom for us to enjoy. This one about patience is underrated, in my view. It seems that the “sexy” world of active trading attracts more believers. It is misleading, however, as patience is better. Holding a quality stock for the long term is better. Timing the market may actually be a loser’s game.