TFSA investors got good news again in 2021. The TFSA contribution limit was increased by another $6,000. This means that Canadians now have cumulative TFSA contribution limit of $75,500. So, we all have some decisions to make in 2021. Which stocks should we buy for our TFSAs?

Without further ado, let me introduce you to a gold stock to buy now. Your TFSA is the perfect place for this dividend-growth stock.

Gold prices rally off of the crisis year of 2020

It’s no secret that 2020 was a rough year. It’s also no secret that gold and gold stocks are safe-haven investments. For example, gold protects against inflation. It also protects against uncertainty and fear. It is, as they say, a safe haven that is a good store of value. As such, investors flock to it in times of crisis. Let’s think about this for our TFSA.

So, 2020 was certainly a year of crisis. The coronavirus ripped through the world. Its health toll has been severe. The economic toll is also building as a result of shutdowns. The long-term effects of this crisis are not known. But I think we can say with much confidence that they will be huge.

All of this creates fear. It creates uncertainty. The government’s reaction to all of this economic pain has been to increase fiscal stimulus. It is really the one thing that the government can do to try to save the economy. But, of course, the result of this stimulus is an increased risk of inflation. And this is positive for gold prices. I want exposure to these rising gold prices for my TFSA. So, I’m looking for the perfect gold stock.

Gold prices have rallied more than 20% since the end of 2019. They have been volatile, but they’re still up big. And the latest round of stimulus proposed by Biden is huge. It’s meaningful. And it appears necessary, as Americans struggle under the economic toll of the virus. But this type of stimulus has no doubt given rise to more inflation fears. If it has not already, we can expect that it will. As a result, gold prices should climb even higher.

Here’s a gold stock to buy now for your TFSA — with a 75% dividend-growth rate

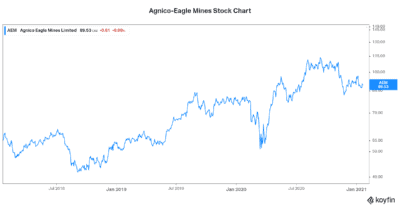

One thing that all investors like to see is dividend growth. This leads me to my recommended gold stock to buy now, Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM). I’m pleased to report that my recommendation has delivered on many fronts. It has shown strong dividend growth over time. It has grown production. And it has remained one of the safest gold stocks out there.

Most recently, Agnico-Eagle announced a 75% dividend increase. While AEM stock’s dividend yield is only 2%, we can expect more increases. These increases will be the result of many factors. For example, gold prices are expected to continue to climb. As I outline in this article, it seems to be a given conclusion. Also, Agnico-Eagle is a best-in-class operator. Its costs are industry leading. And its balance sheet is top tier. If any company can milk rising gold prices to the maximum, it’s Agnico-Eagle.

Motley Fool: The bottom line

TFSA investors would be wise to consider Agnico-Eagle stock now. This stock will provide shelter in a year that may be extremely tumultuous. It will provide increasing dividend income. And it will provide your TFSA with that diversification to lessen your overall risk profile.