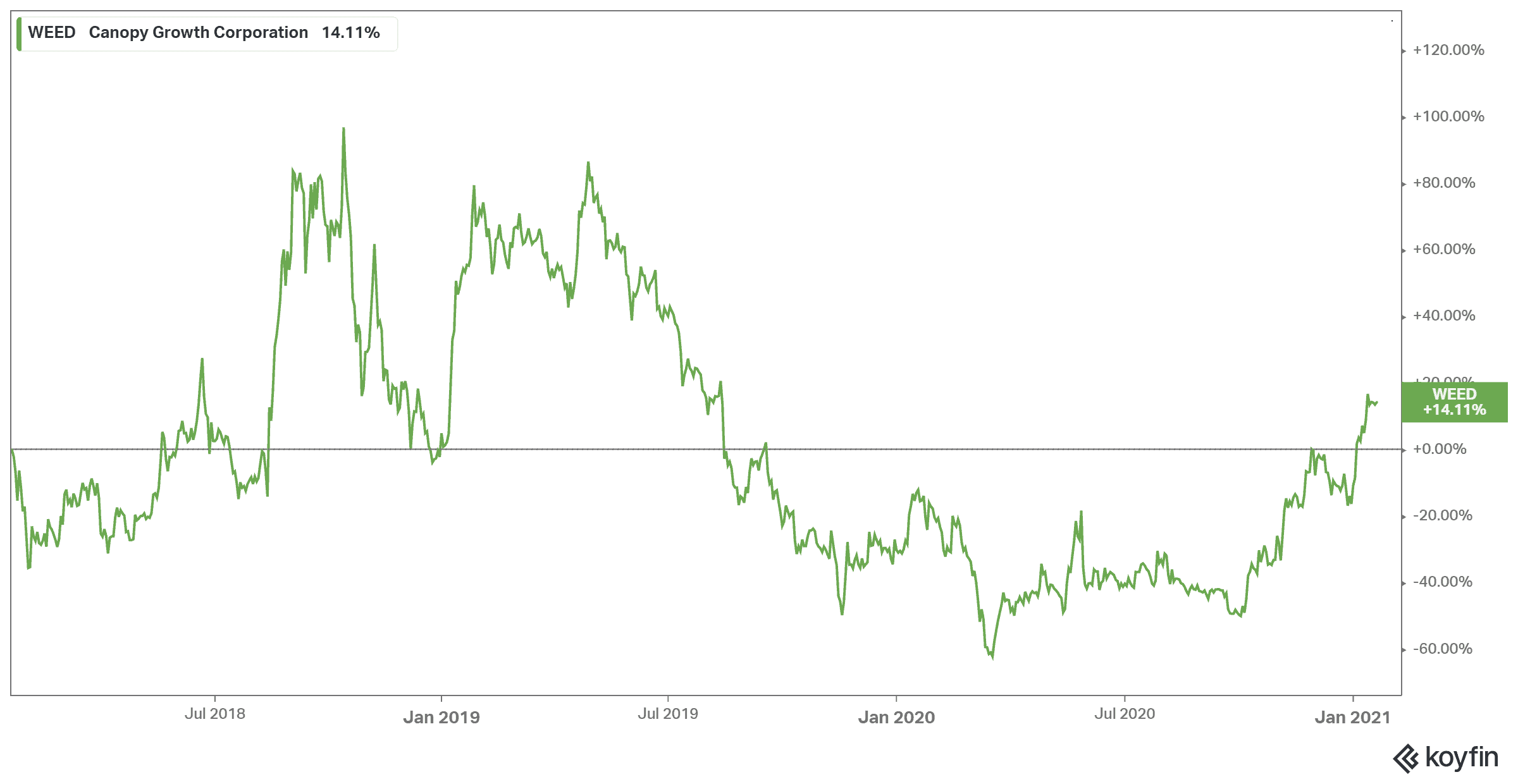

Cannabis stocks are anything but predictable. If you want to get into them, you definitely are someone willing to take on some risk. Especially over the last few years. Back in 2017 and 2018, it looked like cannabis stocks could do no wrong. But then legalization hit in October 2018. Suddenly, investors were a lot more choosing. Since that time most cannabis stocks have lost more than 50% of their value.

Despite some ups and downs over the last few years, with economists saying again and again that the cannabis bubble has burst, there’s one investors should still hold onto. Canopy Growth Corp. (TSX:WEED)(NYSE:CGC) might not be the get-rich-quick scheme it once was. However, if you’re looking to invest in cannabis, it’s probably your best bet.

The stock soared during the last few weeks as the Joe Biden administration entered the White House. Its rally can be traced back to November 2020, when news of a Biden win coupled with more states legalizing cannabis sent cannabis stocks soaring.

But if you think this is more of a game and less of value investing, you’d be wrong. That’s what make Canopy Growth so interesting and, frankly, valuable. As fellow Fool writer Joey Frenette wrote, “it’s important to remember that all investing is, in fact, value investing. You consider the price you’ll pay for a stock and weigh it against the future earnings you’ll receive.”

Undervalued cannabis stocks?

Yes, they do exist. Even those that are not yet profitable, such as Canopy Growth despite an Earnings Value over sales (EV/sales) of 31.6x as of writing, and $676.44 million in debt. The reason that’s true is for the same reason why a cannabis bubble occurred in the first place: momentum.

Cannabis stocks were the first to go during the market crash of March 2020. This is a brand new industry that still has to prove itself, and along comes a pandemic that sends production to a minimum. Canopy Growth had to close and even sell production facilities and recent acquisitions to make up the cash it lost.

But here’s the good part. That massive sell off means the company is due for a rebound, already underway. Cannabis stocks are here to stay, you just have to pick the right ones. Canopy Growth has to be the right one, as its positioned itself as the largest pot producer in the world, and even better as a powerhouse of pot in the U.S. already, priming itself for federal legalization.

Should this shift occur, the company has a number of stakes that will be increased with several companies, along with acquisitions, creating an earnings jolt that investors will be dying to get in on. Should the pandemic finally come to an end this year and production can soar, and even just the decriminalization promised by the Biden administration occur, you can bet Canopy Growth will reach all-time highs once again.

Foolish takeaway

As always, investing shouldn’t be for a quick fix but for long-term gains. As cannabis stocks are here for the long-term, choosing a solid company like Canopy Growth could be really good for your portfolio. If you’re going to pick it up and hold on tight for decades, there’s really nothing to worry about by investing in this stock.