BlackBerry Ltd (TSX:BB)(NYSE:BB) an iconic Canadian stock that almost everyone has heard of. The company made a name for itself as it was a major part of the innovation that has brought us numerous revolutionary smartphone devices. That’s why the name BlackBerry is still so popular today.

Although that’s how it came to be known, the business is a much different company today. Today hardware has little to do with its strategy. Rather, the company has shifted to a software security company.

Software security is an industry with a tonne of potential. However, it also has a tonne of competition. So let’s take a look at what the analysts have to say about BlackBerry stock. And most importantly, is the stock worth an investment today?

Analyst bull cases for BlackBerry stock

Analysts are a fan of a lot of the software that BlackBerry offers its customers. The BlackBerry Spark Suite Software is one that’s gotten some of the highest conviction from analysts. The software is a big improvement and offers a wide range of endpoint capabilities.

Analysts also like the potential BlackBerry has as autonomous vehicles grow in popularity. Autonomous vehicles continue to be the future and should create a huge runway for growth for BlackBerry and its products, especially its QNX software.

The last major reason analysts say to be bullish on BlackBerry stock is the fact that it’s well-known to be one of the best names in cyber-security. Combined with a strong market share in the application for the Internet of Things, it could make the company could be one of the best tech stocks you buy.

Analyst bear cases for BlackBerry stock

There are certainly some strong bull cases for BlackBerry stock. However, there seem to be quite a bit more bearish cases from analysts.

One of the first disadvantages, according to analysts, is that it’s still a small-scale company compared to several of its software security competitors. This will make it very difficult to compete with competitors much larger.

The company also hasn’t proven it can consistently grow its business solely as a software company. Furthermore, BlackBerry stock has slowly been losing market share for years, especially in endpoint management.

So although operations may be stabilizing as of recently, analysts still see a tough path to consistent growth for BlackBerry.

Target prices

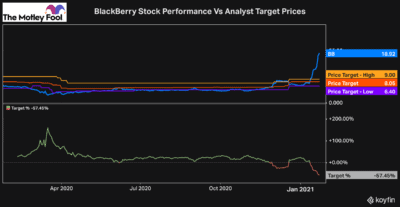

In the last month, BlackBerry shares have more than doubled. This is obviously a significant rally in the shares, and according to analyst estimates, without any real reason.

As you can see, the stock has shot up considerably in the last few weeks, far outpacing any analyst estimate. The last time BlackBerry got positive news was in Mid-December at its earnings. This was also when BlackBerry announced its partnership with Amazon.

You can see that toward the right-hand side of the graph when analyst target prices got a boost. The increase in BlackBerry stock, though, has far outpaced any estimate from analysts.

The bottom chart highlights even more clearly the target return for investors, according to analyst estimates. You can see after the recovery from the coronavirus pandemic, the stock traded flat, at a roughly 15%-25% discount to the average target price for most of the year.

Today though, it’s far exceeded the target price. So if analysts are right, a year from now, an investment in BlackBerry will be worth roughly 50% less than it is now.

Bottom line

It looks like analysts think the stock is just okay. It’s not that the business is poor. The stock is just considerably overvalued.

Analyst estimates don’t actually mean anything material. Sure, they can sometimes influence the movement of a stock, but often times stocks move regardless of analyst consensus. What they’re useful for is getting some of the best opinions and advice on certain stocks they cover.

So if you really believe in BlackBerry, you should still consider an investment. However, if you are heeding the advice of analysts, I wouldn’t bother investing in BlackBerry stock; I’d be looking somewhere else.