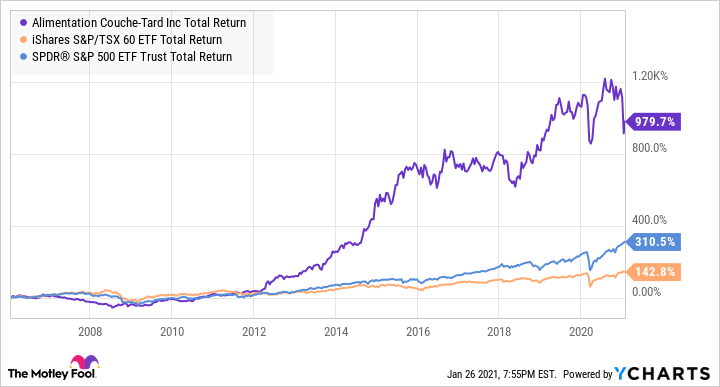

Alimentation Couche-Tard (TSX:ATD.B) has been an admired M&A growth story for the past 30-odd years. In the past 15 years or so, it generated total returns of close to 17% per year. That’s outperformance!

Data by YCharts. A chart showing the growth stock’s 15-year total returns against the North American benchmarks.

Surely, there was volatility along the way. At times, the TSX stock would appreciate accordingly after making sizable strategic acquisitions and generating value from the integrations. Consequently, ATD.B stock forms an upward trend over the long haul.

Its fabulous track record is highlighted by returns on equity (ROE) of more than 20% every single year since fiscal 2011. Its return on assets (ROA) is not bad either. In the last 12 months, its ROE and ROA were 25.4% and 8.6%, respectively.

Why is the growth stock battered?

You’ll notice that the growth stock has greatly underperformed the market recently. In fact, it has fallen about 15% in the last six months and is trading about 12% lower from a year ago.

Data by YCharts. A chart showing the growth stock’s one-year total returns against the North American benchmarks.

Why is the growth stock depressed? Why isn’t it growing?

A large part of Couche-Tard’s growth comes from acquisitions. In the past, growth accounted for about 70% of its growth. The fact of the matter is that the convenience store consolidator has not made a substantial acquisition since CST Brands in 2018.

Couche-Tard is the kind of wonderful business that Mr. Warren Buffett likes. It generates tonnes of free cash flow, pays down debt, makes acquisitions, and draws value from the mergers. And it keeps doing that over and over.

It’s not as though management hasn’t tried making meaningful acquisitions, either. It attempted to acquire Caltex Australia in 2019 and France-based Carrefour recently. But they didn’t work out.

Now, Couche-Tard is sitting on a very low leverage ratio — 1.13 at the end of fiscal Q1 2021, while its target leverage ratio is below 2.25. This means the large-cap $43-billion market cap company has tonnes of cash for acquisitions but it hasn’t been able to deploy it meaningfully yet.

How will Couche-Tard grow from here?

Going forward, the growth stock expects M&A to play a smaller (but still significant role) in its growth. Specifically, management plans for half of the growth to come from M&A and the other half from organic growth.

Investors can buy ATD.B stock at a blended price-to-earnings ratio of about 13.6 today. This is cheap for a proven stock with a track record of profitability, high returns, and dividend growth. Its five-year dividend growth rate is 24%.

Since Couche-Tard is a global company, it can look for fitting acquisitions around the globe. I’m sure it will find something sooner or later.

Even if the company doesn’t make any substantial acquisition anytime soon, it’d still be able to generate nice returns of about 8% on its assets.

The Foolish takeaway

While the last fiscal year was during a pandemic with far-and-wide economic impacts, but Couche-Tard’s revenue was moderately shaved off and the company was able to expand its margins across the board and increase its earnings. If the company can deliver such resilient results in a bad year, imagine what it can do in a good year!

Couche-Tard stock is a no-brainer buy after it has been battered. In time, the business qualities will shine through the clouds and the stock will make new heights. Investors just need to exercise some patience and just buy and hold the wonderful business.