Enbridge Inc (TSX:ENB)(NYSE:ENB) is a massive Canadian stock, that whether you know it or not, is crucial to your everyday life. The company’s shore size and robust operations have made it an investor favourite for years.

When you think of the qualities that make up a great long-term investment, Enbridge ticks all the boxes.

The company is a high-quality business. Its business is crucial to the economy. It’s the most dominant company in its industry. Plus, it offers significant growth potential over the long term.

Because it’s such a great business, if you’re buying it for the long term, you can be comfortable buying it at any price. However, it’s a lot more attractive when you can get such top core stocks that regularly trade at a premium for a significant discount.

That’s why Enbridge looks so attractive today and why investors have the potential to see returns of up to 25% this year.

The business

When most investors hear the name Enbridge, the first thing they think of is an oil pipeline stock. That’s understandable given Enbridge is a massive pipeline company that transports roughly 25% of all the oil produced in North America. While this is a main part of its business, Enbridge has several more complementary businesses.

In addition to the oil, Enbridge also transports roughly 20% of all the natural gas consumed in the United States. Furthermore, the company also operates North America’s third-largest natural gas utility company.

In addition to the main businesses above, Enbridge has also been diversifying its investments, making early investments in renewable energy.

Clearly, Enbridge’s long-term business operations are robust. However, the stock has still struggled due to the fears from the coronavirus pandemic. This is more due to market sentiment around the oil industry. Enbridge itself has given investors no reason to worry on its end.

The company has managed to continue earning robust cash flows and even raised its dividend toward the end of last year. So with a high-quality, long-term business that you can count on, Enbridge is clearly a stock that’s worth an investment.

Enbridge the stock

As with any company, once you’ve researched the business and like what you see, only then is it time to start analyzing the stock to see if it’s worth an investment.

In Enbridge’s case, for most investors, the answer will likely be yes. The stock has been extremely cheap since the start of the pandemic offering exceptional potential for capital gains. Plus, that dividend that gets increased each year yields a whopping 7.7%.

Analysts tend to agree, too, with almost every rating on the stock a buy or strong buy.

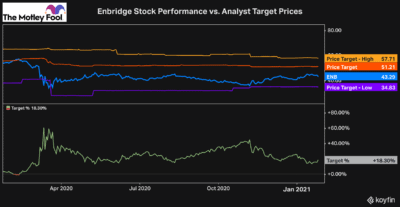

As you can see, the stock has traded well below the red line since the coronavirus market crash. The red line represents the consensus price target among all analysts.

Furthermore, you can see by the chart on the bottom just how much of a discount to the target price Enbridge is trading at. This means, according to analysts, Enbridge is trading at more than an 18% discount to its one-year target price.

Therefore, when you combine the more than 7% dividend yield, Enbridge investors could see a big return of more than 25% over the next 12 months.

Bottom line

Enbridge is the type of high-quality stock that you buy and hold for decades. The incredible size and robust operations it offers makes it ideal to both grow and protect your capital over the long run.

So while it looks ideal as a buy today for its incredible discount, even if the stock was to rally in the short-term, it’s a company I’d be holding onto for a while.