After a highly eventful 2020 full of several opportunities for savvy investors, 2021 looked like it was going to be far less lively. So far, that hasn’t been the case, though, with so much going on and numerous TSX stocks rallying.

What’s gone on specifically in the last few weeks with retail investors is crazy. Most of the gains have been in stocks that are significantly overvalued. So the whole notion of these stocks rallying is completely irrational. However, it should serve to remind investors of what’s possible in the stock market.

When you can find a high-quality stock ahead of others and then the stock gains momentum, the sky is the limit. And with so many more retail investors participating in the market due to the pandemic, the opportunities for gains are even greater today than they’ve been in the past.

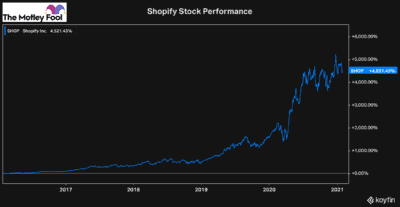

Shopify Inc (TSX:SHOP)(NYSE:SHOP) is a great example of a high-quality stock that can grow over 4,500% on its own merit.

Looking at the chart, there are a few things to highlight. First off, while most of the growth looks like its come in the last year, the stock was still up over 1,000% in the four years prior. Although the pandemic has helped Shopify’s growth, it was still a high growth company before that.

So if you have $1,000 to invest, here are the two TSX stocks I’d be buying today.

Renewable energy stocks are the TSX stocks of the future

There’s no question renewable energy stocks present an incredible long-term growth opportunity. And while green energy generators will be ideal stocks investors should strongly consider, the explosive growth will come from companies like Xebec Adsorption Inc (TSX:XBC).

Xebec doesn’t generate renewable electricity. Instead, the company manufactures equipment that transforms raw gasses into renewable natural gas and hydrogen. This a revolutionary technology and one that’s crucial to improving the world’s environmental footprint.

So over the years, as its technology gets more cost-effective and governments continue to mandate cleaner operations from businesses, Xebec could have a tonne of growth potential. This may be years down the line. However, it shows why owning a business like Xebec could be so rewarding.

Cryptocurrency offers a tonne of long-term potential

Cryptocurrency is an industry that’s offered a tonne of potential for years now. The industry is only starting to become popular again due to the insane rally many of the big-name coins have seen, such as Bitcoin and Ethereum. This has also benefitted cryptocurrency TSX stocks.

While most investors will just see the price-performance and be intrigued, these assets also offer a tonne of long-term potential. Bitcoin, on the one hand, has proven the usefulness of blockchain technology. The cryptocurrency has started a revolution of new coins looking to improve on Bitcoin’s technology.

In Ethereum’s case, the potential is far broader. It’s also a blockchain platform; however, developers can deploy smart contracts or decentralized apps, giving it an endless amount of possibilities. That’s how Ethereum has become the most actively used blockchain.

If this long-term potential is something you might be interested in, a great stock to take advantage is HIVE Blockchain Technologies Corp (TSX:HIVE).

Hive is a cryptocurrency miner with assets all over the world. Cryptocurrency mining is energy-intensive, so HIVE has its assets set up around the world to minimize costs. It also uses green energy to power its facilities and has since day one.

Since both Ethereum and Bitcoin have gained considerably since the start of 2020, HIVE is up significantly too. So if you believe these cryptocurrencies have more room to run, HIVE is an ideal stock to hold for the long term.

Bottom line

Both these TSX stocks offer investors tremendous potential. However, remember, they should be treated as long-term investments. Even if they do well over the short-term, I wouldn’t be so quick to sell.

If you had sold out of Shopify after two years and a 600% gain, you would have thought that was a pretty good return. However, fast forward three more years, and the stock’s now up over 4,500%.

You don’t want to make that mistake with these two growth stocks. So if you make an investment, ensure you’re committed to the long term.