The last week of January will be one that goes down in stock market history. Several rookie retail investors assembled on Reddit and waged war against the hedge fund titans — and nearly succeeded in bringing down the whales with the help of a “short squeeze.”

What is short selling?

Short-selling happens in the options market. When you rent a car, you pay a refundable deposit that is refunded to you when you return the car. This way you can enjoy the car without owning it.

Similarly, in short selling, you borrow a stock into your margin account and keep a certain deposit as a cash margin. Now you may ask why borrow? Look at BlackBerry (TSX:BB)(NYSE:BB) stock. It has been declining for three years as its revenue kept declining. Many hedge funds became pessimistic on the stock and expected it to fall further.

When you expect a stock to fall, you can profit from it by doing short-selling, wherein you borrow BlackBerry stock to sell it. But you have to return this stock from whom you borrowed. How you do it? You buy the stock again and return it to the broker. Like all rental contracts, short selling has a time limit.

When will you make a profit in short-sale? For instance, hedge fund managers borrowed and sold BlackBerry stock at $10.5 in mid-December. They gained $2.5 per share when the stock fell to $8.5 in early January. They made a profit without even owning the stock. In the stock market, it is called “closing the short position.”

January 28 – D day

Many hedge fund managers shorted BlackBerry and other stocks like GameStop and AMC Entertainment as these stocks were cheap and not doing quite well. The subreddit r/WallStreetbets launched a full-blown retail raid targeting the short books of hedge fund managers.

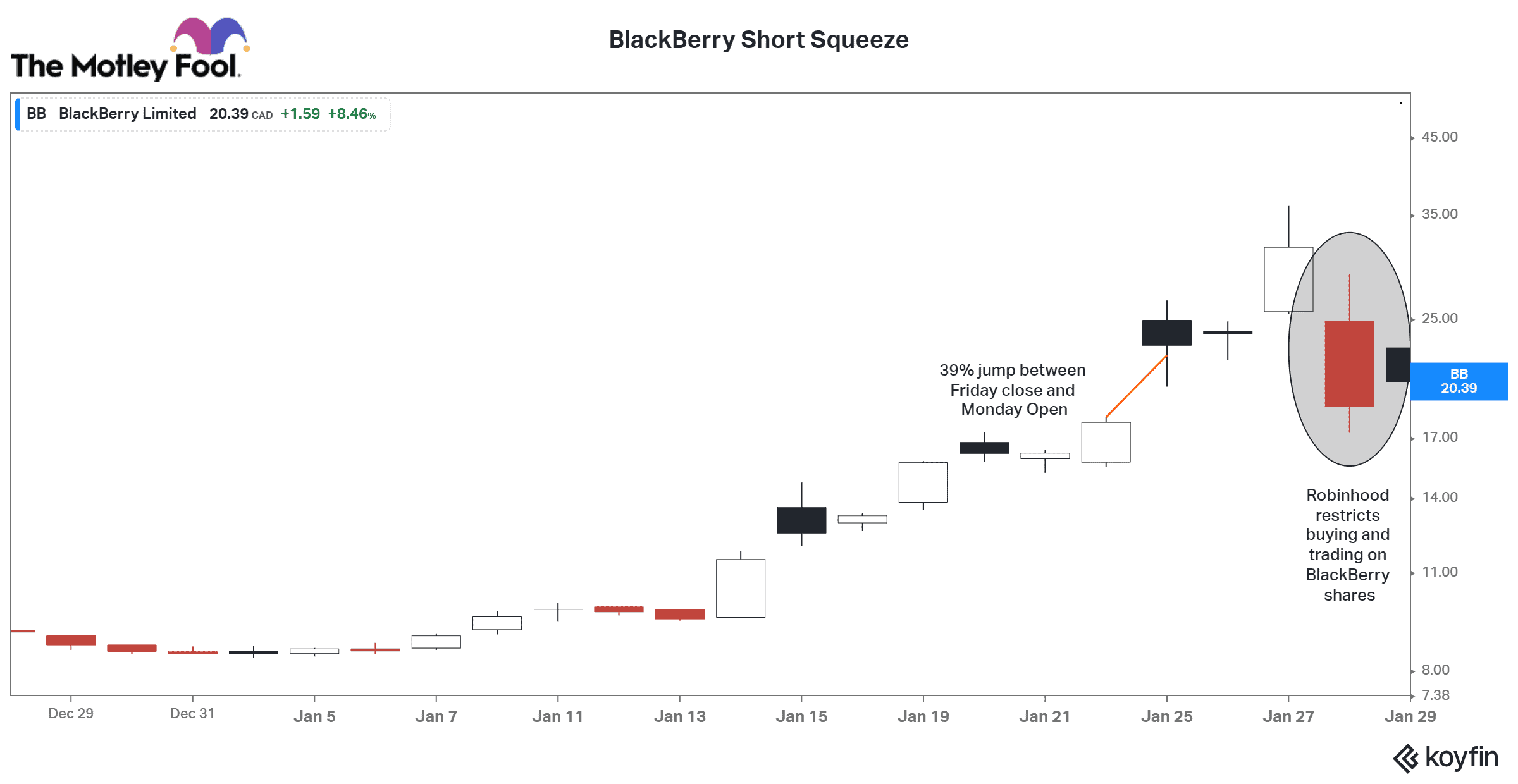

In the first three days of the week, BlackBerry and GameStop stocks surged 79% and 434%, respectively. On January 22, BlackBerry stock surged 10.5% to $17.86 as retail traders started buying these stocks. The following Monday, the stock opened at $24.86, 39% above the Friday close. The trading volume surged from around 18 million to 26 million.

This gap in the close and open price shows that some big investors jumped to buy huge volumes of stocks for a premium. That’s called a short squeeze, in which hedge fund managers try to cover their losses and retail investors gain from them.

What is a short squeeze?

In a short squeeze, short-sellers are forced to buy the stock at a higher price. Let’s take an example of Robert, a hedge fund manager who short sells BlackBerry stock at $16.17 on January 21. The next day the stock surged unexpectedly to $17.86, and his rental contract is coming to an end. He has to close his short position and time is ticking. So Robert buys the stock at a premium of $24.86 as soon as the market opens and closes his position — and Robert lost $8.7 per share.

Like Robert, all those who had short positions in BlackBerry were forced to buy the stock at a premium to limit their losses. Thus, retail investors and hedge funds were buying the stock. Such a sudden surge in demand caused BlackBerry stock to more than double in three days.

Free trading app Robinhood and other brokers then restricted buying and trading on BlackBerry and GameStop on January 28. Brokers allowed traders to close their long positions, creating massive selling, and the two stocks dipped more than 40%. Why traders restricted the trade is a different story — one I’ll leave it for some other day.

What should you do in a short squeeze?

As I said before, if you already own BlackBerry stock when it was trading normally below $10, this is a good time to get a premium price. But don’t jump to buy the stock or you could end up with casualties in the retail investors versus hedge fund war.