Alimentation Couche-Tard (TSX:ATD.B) has been around a long time. It has a mostly good history. But the company has also received its share of investor skepticism, and it has battled its way forward through it all. Today, the company is again feeling this skepticism.

The market is notoriously skeptical, and for good reason. But sometimes, the market thinks in a linear and limited fashion. It has trouble seeing outside the box. So, let’s look at Alimentation Couche-Tard more closely. I think you will agree that this company is a shining example of capital discipline. For this reason, ATD.B stock remains a long-term buy today.

Alimentation Couche-Tard’s acquisition of Carrefour is dead

We all know that the attempted acquisition of Carrefour is no longer. Essentially, the French government is concerned with food security. Especially in these pandemic times, France wants to keep control over its food supply. Let’s explore this attempted acquisition to find its strategic sense.

Have you ever gone to a convenient store for a quick fix? Hungry and tired, you search for something. But in your search, you only come across junk food. Chocolate bars, chips, gummies, and the like. If you’re like me, you’ve lamented. “Why can’t these convenience stores have healthy snacks?”

How can a convenience store offer fresh produce without losing money? The logistics, distribution, and storage of fresh, healthy produce and meals is a complicated task. Well, grocery stores have mastered this. Maybe that’s one good reason for Couche-Tard’s interest in Carrefour? Maybe this was one of the many synergies that Couche-Tard had in mind. Clearly, the company is in touch with customers. And this brings me to another one of the many strengths of Couche-Tard: this company knows the retail landscape, and it knows its customers.

Couche Tard: A good steward of capital

As a company, Couche-Tard does its work. Its top-quality management team researches and analyses its markets and its customers. This gives them quality research and knowledge. And this informs their acquisition and organic growth decisions. It is this extensive research and analysis that warms me up to the company. But that’s not all.

Alimentation Couche-Tard has also shown capital discipline, and this clinches it for me. A company that can withstand outside pressure to do the right things for its shareholders is a keeper. Today, Alimentation Couche-Tard is displaying this quality once again. It’s been three years since it’s made an acquisition. And the pressure is on. Analysts are questioning whether the company will meet its goals of growth through acquisitions.

But management is not phased. They simply stated that they will not buy if valuation is not right. And these days, the valuation is not right. The market in general is expensive. Recent fiscal stimulus coupled with low interest rates have sent markets flying. Management sees that this is not the time to be buying. So, they are happily sitting on the sidelines until the time is right. This capital discipline is always rewarded in the market. It may take time, but it is always rewarded.

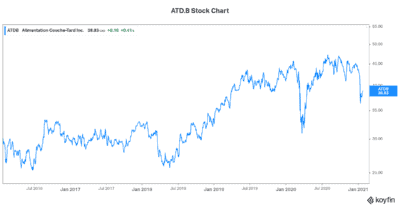

Further to this, Couche-Tard is also a big generator of free cash flow. This free cash flow is the basis of the company’s successful business model. Its use of this cash flow is the key to its success. The stock chart below for ATD.B demonstrates this.

Motley Fool: The bottom line

Alimentation Couche-Tard is a stock to buy today. This is because this company has the right mentality and the right priorities. This company is a good steward of capital. It has an exceptional track record. And it has discipline and patience. These are all qualities that we should look for in a company. These qualities make ATD.B stock a stock to buy today.