The best stock to buy right now is usually not the obvious one. I say this to prepare you for what I’m about to recommend. Remember Cenovus Energy Inc. (TSX:CVE)(NYSE:CVE) stock? It’s not easy going against the market. And buying this energy stock would be doing just that. But those are often the best moves you can make.

Cenovus Energy was always applauded for its operational excellence. Yet, Cenovus stock could never get any traction. First it was a terrible political environment, then pipeline constraints. And finally, the COVID-19 pandemic hit. This was the final blow. Oil and gas demand plummeted. There was little hope.

As 2020 progressed, glimmers of hope appeared. And now, Cenovus Energy stock stands out as one of the best, if not the best stock to buy right now.

Cenovus may emerge a winner

In Biden’s first hours as president of the United States, much has already changed. And much of what has changed impacts oil and gas companies. President Biden’s goal is to get tough on climate change. He aims to reduce carbon emissions in the States. He aims to make progress on protecting our planet — very noble goals.

President Biden has enacted a variety of new policies to achieve this. For example, he’s pausing new oil and gas leases on federal lands. He’s also cutting fossil fuel subsidies. This is a sharp reversal of the prior administration’s policies. Those policies meant the U.S. didn’t need our oil and gas as much. Biden’s policies will have the opposite effect. Lower U.S. supply and production is a positive for Canadian oil and gas companies.

Canadian oil and gas may have gotten a needed break

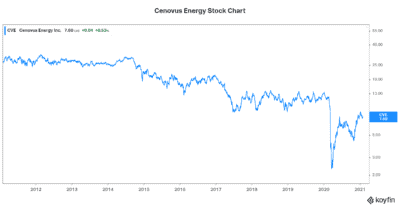

Along with the Biden administration’s new policies, the pandemic has also meant reduced production. It’s a fact that investment in the fossil fuel industry has fallen. Weaker commodity prices and rampant uncertainty have guaranteed this. The following chart of CVE stock price illustrates this.

So the two forces that are hitting the oil and gas industry may end up being the positive catalyst for 2021 and beyond. Reduced production means reduced supply. Reduced supply in a time of low demand is fine. But what happens when the economy starts to reopen and recover? Reduced supply along with increasing demand is a big deal. It is what can set up rising oil and gas prices. It would send Cenovus Energy stock soaring.

Cenovus’ Husky acquisition makes it a top stock to buy

Valuations in the oil and gas industry have been dismal. They reflect a disaster scenario. Yes, there are issues with the industry. But are valuations taking any of the positives into account? I think not. For example, fossil fuels will still be necessary to power our lives for years to come. Also, there have been positive changes in the industry. And technology will result in more carbon-reducing changes.

Cenovus Energy’s acquisition of Husky Energy was very well timed from a valuation perspective. The situation was best described by Cenovus CEO Alex Pourbaix. He said that Cenovus acquired Husky at a “once in a generation valuation.” I agree. This is the way to create long-term shareholder value. Acquiring companies when they’re trading at deep cyclical lows creates long-term value. It’s a winning strategy.

The bottom line

The new Cenovus Energy is one of the best value stocks today. The Husky acquisition was completed at bargain valuations. It brings with it billions of dollars in synergies, giving Cenovus a more diversified, integrated business model.

The oil and gas industry is likely setting up for a strong run. And Cenovus Energy stock is looking good today. If you’re worried about a stock market correction, this shouldn’t change your decision, as any market correction may not hit CVE stock as hard as others. The stock is pretty much down in the dumps already. This value stock is already reflecting a great share of negativity.