It’s time for dividend-growth investors to consider rebalancing their portfolios for 2021. The S&P/TSX Canadian Dividend Aristocrats Index is making constituent changes, which became effective on February 1. Nine freshly minted Dividend Aristocrats have made their way into the index for 2021. The index dropped three unfortunate names this year.

Generally, Dividend Aristocrats are companies that have paid increasing dividends for over 25 consecutive years. This makes them some of the best dividend-growth stocks for income investors to buy at any time.

The 87 stock S&P/TSX Dividend Aristocrats Index includes stocks that have generally “increased ordinary cash dividends every year for five years.” However, some index additions may have maintained the same dividend for a maximum of two consecutive years within the past five years before inclusion. Canadian dividend-growth investors may use this index for new ideas or as a yardstick when creating and rebalancing portfolios every year.

Nine TSX dividend-growth stocks join the Aristocrats index

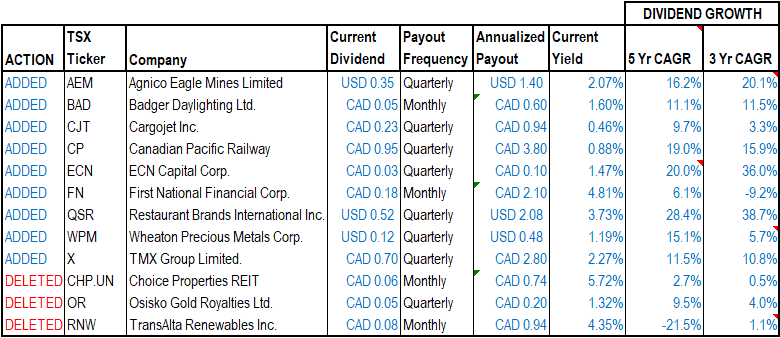

Nine high-quality, TSX dividend-growth stocks have been added to the Canadian Dividend Aristocrats Index. The index is rebalanced once every year in January.

Here are the latest changes to the Canadian Dividend Aristocrats Index for 2021. Some names may appeal to income investors right now.

Canadian Pacific Railway joins its peer CN Railway in the Canadian Dividend Aristocrats Index this year. Badger Daylighting, ECN Capital, and TMX Group have made it into the prestigious dividend stock index, and so did First National Financial (TSX:FN) and airline stock Cargojet (TSX:CJT)

Income investors will notice that companies that keep growing their dividends usually have very low current yields. Reliable dividend-growth stocks are usually high-quality names that enjoy growing free cash flows and steadily growing revenues with strong business moats. These companies are usually consistently profitable, and the market is willing to pay a premium to hold them.

Current income yields are usually low upon initiating a new position. However, the dividend yield will keep increasing with annual dividend increases. The longer you hold the stock, the better the yield on the initial investment.

Three U.S. dollar dividend payers join the TSX dividend aristocrats

Three new Unites States dollar-denominated dividend payers have joined the Canadian Dividend Aristocrats index this year. These are Restaurant Brands International (TSX:QSR)(NYSE:QSR), Agnico Eagle Mines (TSX:AEM)(NYSE:AEM), and Wheaton Precious Metals (TSX:WPM)(NYSE:WPM).

If your portfolio desires some regular USD income, or you anticipate paying some regular USD expenses in retirement, one, two, or all three new names could help with growing USD dividend paychecks.

Restaurant Brands pays a respectable 3.7% yield. Analysts expect the payout to grow by 4.1% this year. However, the company’s earnings payout rate read 110% in 2020 and the cash flow payout rate was at 80%. Restaurant Brands’s US$0.52 quarterly dividend wasn’t well covered during the COVID-19 pandemic. That said, earnings per share and cash flow per share could grow by 41% and 51% sequentially this year. Investors may see healthier dividends in the future.

Most noteworthy, Restaurant Brands’s 4% dividend growth pales in comparison to Agnico Eagle Mines’s 48% and Wheaton Precious Metals’s 38% in expected increases for 2021. The miners look more preferable right now.

Agnico Eagle Mines’s current yield stands at 2.07% and its earnings payout rate was 73% in 2020. The company paid out just about 28% of its cash flow generated per share. Thus, a 48% dividend increase for 2021 shouldn’t be surprising considering a potential 97% surge in 2021 earnings per share.

The mining firms could sustain healthy dividends and keep growing payouts over the next three years if strong commodity prices remain near 2020 highs.

Like Agnico Eagle, Wheaton Precious Metals paid out just 28% of cash flow per share in 2020. The miner had a better earnings payout rate at 42% last year. As things stand, an expected 38% dividend increase for 2021 wouldn’t seem aggressive. Wheaton’s current US$0.48 per share quarterly dividend yields 1.21% annually.

Foolish bottom line

Dividend-growth investing can generate significant capital gains. Choice Properties REIT, Osisko Gold Royalties, and TransAlta Renewables have all been deleted from the index. They failed to increase payouts over the past three consecutive years. However, their dividends still look safe and juicy enough to have. TransAlta Renewables could return to slow dividend growth this year.