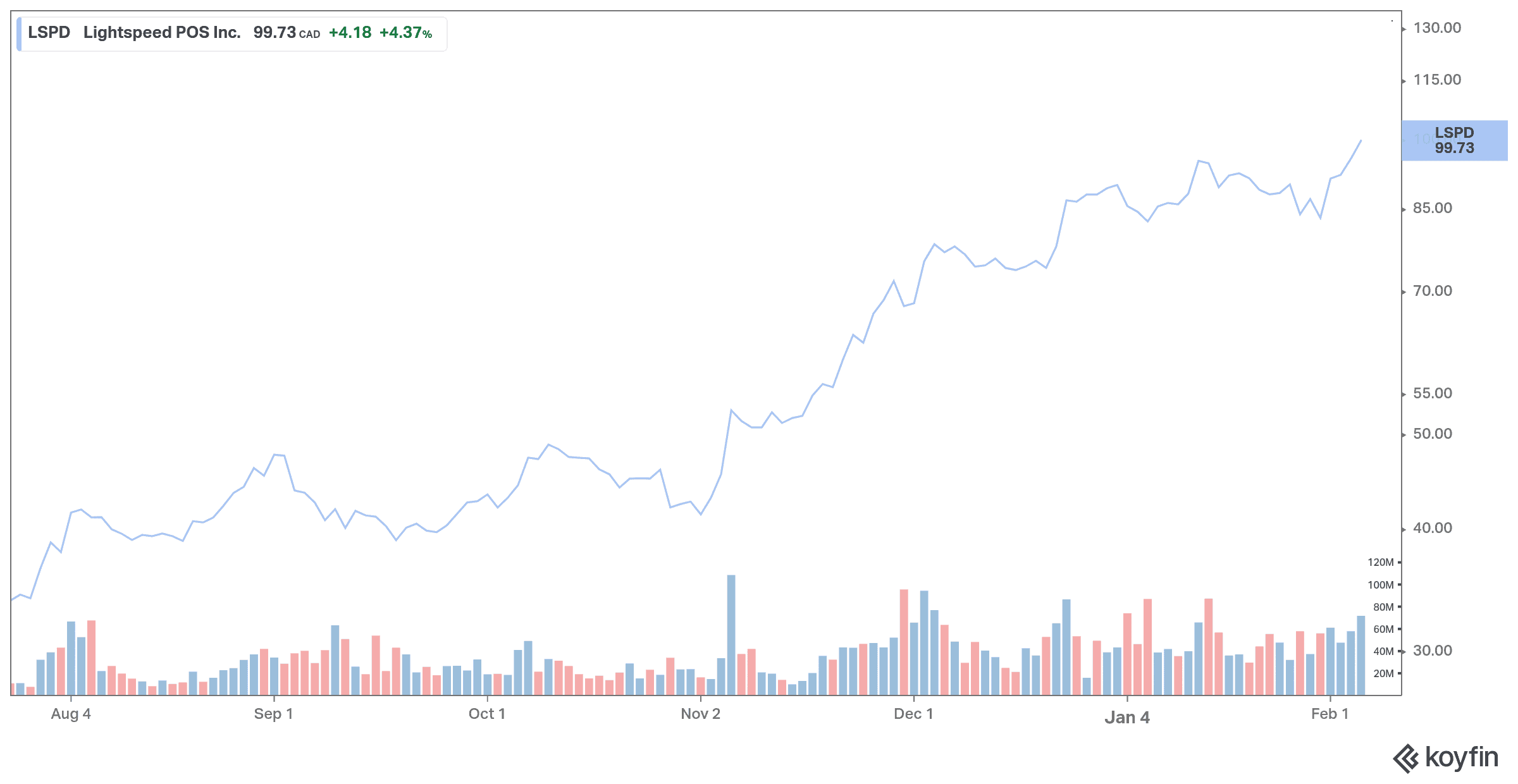

Lightspeed POS (TSX:LSPD)(NYSE:LSPD) announced its third-quarter results on Thursday. Lightspeed stock surged almost 10% following the news, as the company beat expectations.

Lightspeed reports a smaller loss and higher revenue than expected

The leading provider of cloud-based, omnichannel commerce platforms reported a loss of US$42.7 million in its most recent quarter, as revenue increased 79% from a year ago.

The company, which maintains its books of account in U.S. dollars, says its loss was US$0.39 per share for the quarter ended Dec. 31, compared with a loss of US$15.8 million, or US$0.18 per share a year earlier.

Revenues for the third quarter totalled US$57.6 million compared to US$32.3 million a year earlier.

On an adjusted basis, Lightspeed says it lost US$0.06 per share for the quarter, down from an adjusted loss of US$0.07 per share a year earlier.

Despite the challenges associated with the COVID-19 pandemic, Lightspeed continues to enjoy success in the markets, as small and midsize businesses embrace the company’s cloud platform to deploy their omnichannel strategies. Lightspeed saw its number of customer locations grow to almost 84,000 during the quarter and to nearly 115,000 in total, including Upserve and ShopKeep.

Software sales revenue has increased in part because more Lightspeed customers are adopting more than one software module.

In addition, the adoption of Lightspeed Payments is steadily increasing, both in terms of the number of customer locations and the proportion of GTV (gross transaction volume) processed, with regular revenues generated by Lightspeed Payments having reached another historic high. GTV is the total dollar value of transactions processed through Lightspeed’s cloud-based SaaS platform during the period, less any refunds, including shipping and handling charges, customs duties, and value-added taxes.

Analysts on average expected an adjusted loss of US$17 per share and revenue of US$50.2 million, according to financial data firm Refinitiv.

“Independent merchants worldwide continue to turn to Lightspeed to provide them with the digital tools they need to survive the current environment and advance their omnichannel strategies.” said Dax Dasilva, founder and CEO of Lightspeed. “In addition to maintaining our strong execution we continue to deliver ground breaking innovations with the launch of the Supplier Network, demonstrating how Lightspeed remains deeply committed to democratizing access to the strategic capabilities our customers need to grow their businesses.”

Strong revenue growth is expected

In its outlook for its fourth quarter, Lightspeed says it expects revenue of between US$68 million and US$70 million and that its adjusted earnings before interest, taxes, depreciation, and amortization will show a loss of US$12 million to US$14 million. For the full fiscal year, revenue is expected to reach about US$198 million, an increase of 64% from a year earlier. Next year, revenue is expected to hit US$319 million, which would represent an increase of 61% from 2021.

With very solid revenue growth, Lightspeed may be on the path to profitability. Companies that are not yet profitable are often risky, but they can also offer great rewards. You can reduce the risk by diversifying your investments and allocate only a small portion of your portfolio to high-risk tech stocks like Lightspeed.