When researching and looking for new Canadian stocks to buy, it’s common for investors to look at what analysts have to say. In fact, one of the things investors are most curious about is the consensus target prices from analysts.

It’s important to remember that good or bad, analyst reports don’t mean all that much. First off, they can sometimes be wrong. Often analysts will have conflicting views with each other, so one of them has to be wrong.

It’s of course beneficial to get their opinion at times. They are usually the ones who know the company you’re researching the best. Plus, having conflicting views is important for investors considering the stock, but it also helps the company address multiple issues from different viewpoints.

When looking at what analysts say or recommend, it can be useful, but you should also take some things with a grain of salt. And after all the research you do, it’s paramount that you form your own opinion on which Canadian stocks you’d like to buy.

One Canadian stock all analysts like

Often though, when you can find a stock that every analyst agrees on, it’s likely going to be an outperformer. Amazon, for example, everyone’s favourite stock has 46 analysts’ who cover the stock, 45 of which have a buy rating.

For Canadians, one stock that’s getting a lot of appreciation from analysts right now is Freehold Royalties Ltd (TSX:FRU). Currently, of the 13 analysts that cover Freehold, 12 have a buy rating, and just one analyst has a hold rating.

The stock has been rallying quite a bit lately. Since October, it’s up 60%, yet it’s still one of the cheapest and best Canadian stocks to buy today.

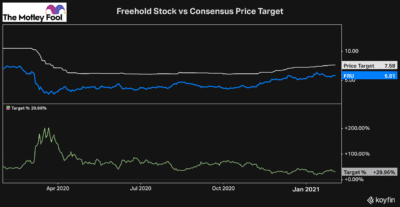

As the price of Freehold has been increasing, analysts’ target prices have slowly been increasing as well, though. And according to the consensus target price, Freehold is still at a 30% discount.

This discount alone isn’t the only reason to buy Freehold, though. Several catalysts make Freehold one of the top Canadian stocks to buy today.

Why Freehold is one of the top Canadian stocks to buy now

Right now, energy stocks offer investors some of the biggest upside when it comes to recovery potential from the coronavirus pandemic. Businesses like Air Canada are a long way off recovery. Meanwhile, others have recovered long ago.

This is leaving energy stocks as some of the only high-quality Canadian value stocks to buy these days. And of all the Canadian energy stocks to buy now, Freehold is one of the best.

First off, it’s not a producer itself. The company makes a royalty on all the oil that’s produced on the land it owns. This offers a much lower way to play the recovery in Canadian energy stocks.

Freehold will still have tremendous upside potential but will also protect investors’ capital in case the recovery takes longer than expected. Plus, the stock has very little debt helping to reduce risk further.

As well, it pays an attractive monthly dividend that has the potential to increase as the energy industry recovers. At current prices, Freehold’s dividend yields 4.1%, which is pretty attractive. The current payout is just 40% of what Freehold was returning to investors before the pandemic, though.

Bottom line

There’s no question that the energy industry has struggled mightily through the pandemic and is due for a recovery once economic activity picks back up.

Freehold, with a tonne of capital gains and dividend growth potential, as well as an endorsement from analysts, is one of the top Canadian stocks to buy today.