Canada Goose Holdings’s (TSX:GOOS)(NYSE:GOOS) stock price hit a new 52-week high of $58.52 per share on strong trading volume on Thursday last week. The latest surge in the premium apparel maker’s shares followed the company’s record sales during the quarter ending December 27, 2020. GOOS released a strong set of earnings results on February 4, which surprised many, including short-sellers who may have run for a quick cover.

The most recent high on Canada Goose’s stock price represents an exhilarating 97% capital gain in under six months. This coincides with my last recommendation to buy GOOS shares on August 19, in which I was confident that “Canada Goose could potentially double your money.” The apparel stock promises to hit my 100% target gain, and I’m happy. But do the company’s shares remain a good buy right now?

Canada Goose recovers from COVID-19 revenue losses

Although uncertainty still remains, Canada Goose Holdings’s business has apparently shrugged off earlier pandemic burdens. The company’s operating results significantly rebounded from a devastating 73% decline in core operating revenue during the June 2020 quarter to a record quarterly sales performance by December 2020.

A full recovery in direct-to-customer (DTC) revenue was driven by e-commerce growth and strong demand growth in China. The DTC sales recovery was combined with a 10% increase in wholesale orders to allow the company to report its first quarter of revenue growth since COVID-19 ravaged its operations early last year. The recent quarter saw sales grow by 4.8% year over year to a record $474 million. Gross margins expanded. Earnings beat analyst estimates, and the company reported a record operating cash flow of nearly $333 million.

Cash and cash equivalents at the end of the period, at $469 million, were three times higher than the cash balance three months earlier. This is wonderful. Operations can go for much longer without the need for fresh capital injections or debt raises.

Earlier market worries on whether the company would have the usual “good festive season of bumper sales this year” were alleviated after the latest earnings report. Investors in GOOS stock now look forward to returning to stable earnings growth, even though COVID-19 is still a factor that threatens to derail corporate plans. Understandably, management couldn’t issue any future earnings guidance last week.

Is GOOS stock still a good buy at these levels?

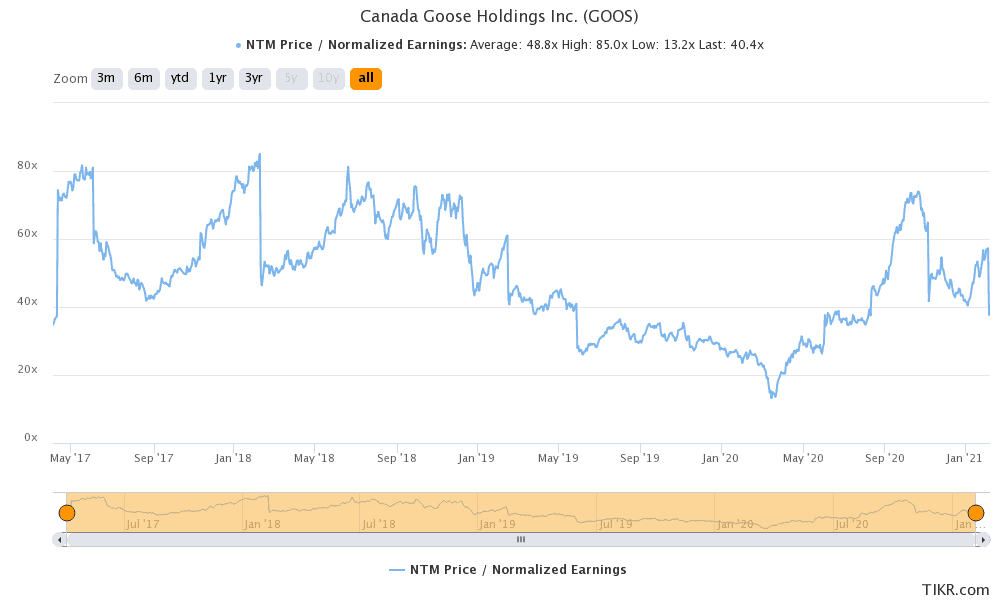

The strong recovery in Canada Goose’s shares over the past six months means the stock is a bit more expensive now. The trailing P/E multiple of 26 in August has expanded beyond 80 now. The multiple is back to the 2018 expensive levels, but the data includes COVID-19 pandemic business losses. Considering that 2020 was an unusual year for GOOS earnings, I would consider the normalized forward-looking P/E multiple as a fair metric to gauge how expensive the cyclical apparel stock is right now.

Normalized earnings remove the effects of unusual items from computations. They reveal the true and repeatable earning power of a company.

A forward-looking normalized P/E of 40.4 on Canada Goose stock today remains below the historical average of 48.8. Valuation is no longer down to earth. This is typical on any profitable and growing firm, but shares aren’t too expensive either. Shares seem fairly valued, if not cheaper. The valuation compares well with that for peers like Moncler S.p.A (normalized forward P/E of 50) and Lululemon Athletica (a 56 normalized forward P/E.)

Long-term-focused investors building sizeable positions in Canada Goose stock may keep making incremental purchases at current valuation levels. That said, consolidations usually follow sharp rallies. It’s okay to yield to the temptation of waiting for a pullback before placing new buy orders.

Foolish bottom line

I can no longer confidently claim that “for investors taking a long-term view of five or 10 years into the future, Canada Goose stock is a potential steal at today’s prices,” as I previously did in August last year. However, shares seem still fairly valued today. We are still far away from the all-time high prices beyond $90 per share seen in late 2018. Considering the double-digit revenue-growth rates expected on GOOS going forward, this goose could honk for investors — again.

Claim Membership Credit

Claim Membership Credit