Shopify (TSX:SHOP)(NYSE:SHOP) is one of the most iconic Canadian stocks, yet just 15 years ago, the company didn’t exist. The incredible growth of e-commerce has wowed everyone. It’s also a great reminder of the potential that high-quality growth stocks offer.

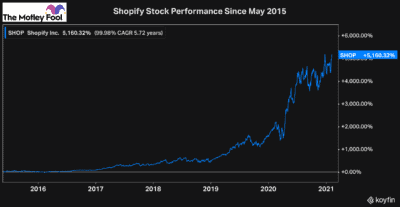

Since Shopify went public back in May of 2015, it’s gained over 5,150%. To date, that’s a 100% compounded annual growth rate. That means if you had invested just $2,000 at its initial public offering, it would be worth more than $105,000 today.

The exceptional growth is due to both Shopify’s exceptional execution and the rapid growth of the industry it operates in. Looking for businesses with both qualities is a prerequisite to finding high-quality growth stocks.

An investment in Shopify stock today is a lot less risky than it was five years ago. In return, though, the growth will likely be slower. Shopify is still worth an investment, however.

Although it likely won’t grow as fast, there is a tonne of growth potential for the company over the long term. The only reason the growth is going to slow down is due to its sheer size. Being a nearly $200 billion company, seeing another 5,000% growth over the next five years is extremely unlikely.

The next Shopify stock

While Shopify is still worth an investment, if you’re looking for a stock that could provide massive growth potential over the next few years, consider WeCommerce Holdings (TSXV:WE).

WeCommerce is a great stock to gain exposure to the massive growth in e-commerce and the Shopify effect. Unlike Shopify stock, though, WeCommerce is a lot smaller of a company. At its current market cap, the stock is worth a little over $900 million.

The small-cap stock only went public in December and still trades on the TSX Venture exchange. So, an investment today will get you exposure long before the stock goes parabolic.

But what does WeCommerce do, exactly? The tech stock is in the business of finding and acquiring companies with sustainable growth, solid profitability, and is operating in industries with attractive economics.

The company sells itself to businesses as a much better option for a partner than venture capital or private equity. WeCommerce is more attractive, because it can offer a much quicker and more flexible process for companies that are looking to sell their business or find an investor.

So far, its top acquisitions have been with key Shopify partners, which is why the stock has so much potential in the short term, in addition to its long-term prospects for growth.

So far, through the first three quarters of 2020, the company has already earned more than $1.3 million on $15 million in sales. The fact that WeCommerce is already profitable this early on is extremely attractive.

At its current pace, the stock has a price to sales of roughly 45 times. This valuation is considerably rich. However, the premium is understandable for such a high-potential, small-cap growth stock that’s benefiting from the Shopify effect.

Bottom line

Buying high-quality growth stocks after they have proven themselves can be an effective strategy. However, if you really want to maximize your returns and find Shopify-like stocks with 5,000% growth potential, you’ll need to get in ahead of the rest of the market.

That’s why WeCommerce looks like one of the best buys investors can make today.