The three stocks to buy now are all energy stocks that have been wiped out. They’ve been kicked around. They’ve been beaten down. But lately, they’ve started to rise. Read on to see why I believe this is just the beginning. Energy stocks are making a comeback. They’re finally starting to get the recognition they deserve. Many of us at Motley Fool Canada have been highlighting the value in this sector. It’s good to see that it’s being recognized and rectified.

In my view, the following three stocks to buy now will provide exceptional returns.

Oil and gas prices rally, sending energy stocks higher

Oil and gas prices are a function of supply and demand. And recent supply/demand fundamentals are strengthening big time. For example, the supply of natural gas in the U.S. fell 2.5% in 2020. Also, with the economy reopening, we should see demand increases for both oil and gas. The bottom line here is that commodity prices are on the rise. Oil has risen 20% so far in 2021. And natural gas has risen 19% so far in 2021.

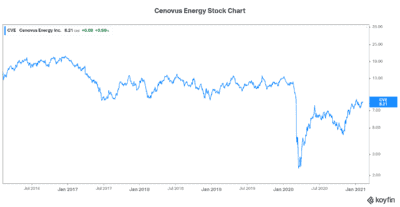

Cenovus Energy stock: Expected to rally from rock-bottom prices

Cenovus Energy (TSX:CVE)(NYSE:CVE) is the third-largest Canadian oil and natural gas producer. It’s also the second-largest Canadian-based refiner and upgrader. In short, Cenovus Energy stock is a force to be reckoned with. Its production of oil and gas is top tier. The company’s oil sands operations are low cost and top quartile. And its newly acquired Husky Energy assets are set to bring $1 billion in synergies in 2021.

Cenovus Energy is reporting its 2020 results tomorrow. The consensus expectation is for a loss of $0.10 per share. But this is not reflective of what the future holds for Cenovus. Everything is changing in 2021. For example, oil and gas prices are rallying. Also, the COVID vaccine is making its way through the population. And lastly, Cenovus is expecting to achieve $1 billion in synergies from its Husky acquisition. 2021 earnings and cash flow will see a dramatic improvement relative to 2020 levels.

Keep your eyes open for Cenovus’s results tomorrow. Cenovus Energy stock is already rallying today in anticipation. Cenovus is trading 31% lower than pre-pandemic levels, so investors have a good opportunity here.

AltaGas: A 5% yield with strong growth ahead

AltaGas (TSX:ALA) is another energy stock that has been down in the dumps for some time. AltaGas is an energy stock, but it’s also a utility. This gives the company a base of stable cash flows plus some healthy growth. All told, AltaGas management is expecting a 12% increase in its EBITDA in 2021. They’re also expecting a 20% increase in earnings per share.

This growth is driven by continued strength in its utilities business and in its natural gas business. But the biggest growth is expected in AltaGas’s Ridley propane facility. Volumes here expected to increase 60%! AltaGas stock is down 12% versus pre-pandemic levels. It’s clear to me that the stock is not fully reflecting all of the company’s positive fundamentals.

Enbridge stock: A generous 7.3% yield plus a stable, steady business

How often does a quality company yield above 7%? I can tell you, not often. This is a very rare occurrence. But Enbridge (TSX:ENB)(NYSE:ENB) stock is. It’s a case of negative investor sentiment. And this is clouding the realities of this top-notch company.

Enbridge isn’t going anywhere. It’s one of Canada’s energy transportation and distribution giants. It has oil and gas assets and operations in North America. Strong cash flows and stability are hallmarks of Enbridge’s business. Enbridge’s cash flows have been consistently rising, as has its dividend. Today, Enbridge is one of the best stocks to buy.

Enbridge stock is trading 19% lower than pre-pandemic levels.

Motley Fool: The bottom line

The three energy stocks that I’ve highlighted in this article have many things in common. First, they are benefitting greatly from rising oil and gas prices. This will continue. Second, despite being high-quality companies, they’re all suffering from negative investor sentiment. And finally, they are all dividend stocks trading at very attractive valuations. These are characteristics we look for at Motley Fool. In short, these three energy stocks are stocks to buy now.