Since the coronavirus selloff back in February and March of last year, Air Canada (TSX:AC) has been one of the most heavily impacted stocks. The selloff in its shares has garnered a tonne of interest from investors, as Air Canada continues to be one of the most popular Canadian stocks investors are looking at.

With its share price trading roughly 60% off from what it was a year ago, the stock looks like it has a lot of value. The hope is that it can recover significantly, offering investors explosive growth. For the better part of the last year, though, Air Canada has traded sideways.

The stock got a slight bump when vaccines were announced. But a devastating second wave has eroded all that optimism. Now, with Air Canada back around $20 a share, investors might be once again considering buying the stock. If that’s the case, here’s what you need to know.

What to know if you want to invest in Air Canada stock

One of the most popular reasons investors want to buy Air Canada stock is because it’s the largest and most dominant airline in Canada.

However, while that may be true, I wouldn’t count on the airline industry returning to normal for years. Even once we have everyone vaccinated in Canada, it could be years until the rest of the world is vaccinated sufficiently. So, it’s anyone’s guess what kind of travel restrictions may remain in place.

There is upside potential in Air Canada, but I wouldn’t expect it to get anywhere near where it was before the pandemic.

Air Canada is also a highly risky stock. So, if you’re going to invest, I would suggest having a long-term time horizon. It could take longer than expected to rally. With that being said, the longer you have to wait, the lower the ultimate potential of the stock.

Air Canada is bleeding millions in cash every single day, so the longer it takes to recover, the more shareholder value is being eroded. It’s also causing the stock to have to take on more debt, which will be a drag on profitability even after the pandemic is over.

Despite several headwinds, analysts are positive on the stock

For the most part, though, analysts are optimistic on the stock. This is not surprising, as the entire market expects an economic recovery by the end of this year and into 2022.

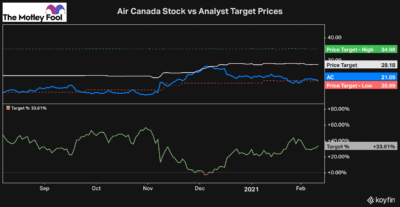

Currently, of the 18 analysts that cover the stock, there are 13 buys, four holds, and one sell rating. And at its current price of just over $21, Air Canada is trading at the bottom of all analyst target prices.

As you can see, Air Canada stock (the blue line) saw a slight bump when the vaccine news was announced in November. Since then, however, it’s slumped back toward the low end of analyst estimates.

This shows clearly that Air Canada has roughly 33% upside, according to analyst consensus. However, it also shows that no analyst sees the stock worth more than $35 a year from now.

Bottom line

Air Canada announces earnings tomorrow, so it will be interesting to see how analyst estimates change. There is clearly potential for the stock. However, investors should be realistic about what to expect.

If you’re buying the stock thinking it can recover to $50, you may be disappointed. Seeing even a $40 stock price anytime soon is likely a long shot.