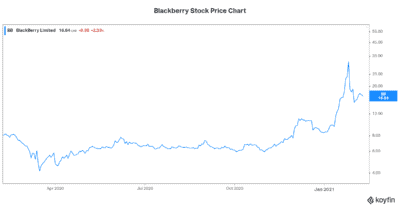

BlackBerry Ltd. (TSX:BB)(NYSE:BB) stock has sure received a lot of attention recently. But it wasn’t the kind of attention that the company would want. A Reddit-influenced trading frenzy was never a sustainable thing. So now Blackberry’s stock price is back down to just over $15. Now what?

BlackBerry is still a leader in its field

Maybe the attention served a greater purpose after all. I mean, Blackberry stock had been languishing for years. Investors didn’t seem to pay it much attention. The company’s track record was tainted. But in recent years, all I could see was the awards it received. The quality of its technology. And the business sense of its strategy.

I noticed that these were the building blocks of a top stock pick, so I pursued BlackBerry. I wanted to buy the stock for my own personal portfolio. And I recommended it to my readers on Motley Fool. It was, in fact, my top stock pick for October 2020. And BlackBerry’s stock price soared.

My thesis was simple. As a cybersecurity expert and a leader in machine-to-machine connectivity, I argued, BlackBerry has a bright future. Simply put, long-term secular growth trends support these businesses. Demand growth for cybersecurity will continue at a healthy clip as remote working increases. And BlackBerry QNX is at the forefront of transforming automobiles into connected systems today and autonomous vehicles tomorrow.

Missed opportunity

For those of you who didn’t buy BlackBerry stock before it skyrocketed, you’re not alone. I think many of us didn’t buy for a variety of reasons. For example, some of us, myself included, believed that the stock market was due for a correction. This encouraged a wait-and-see attitude. Stand back, wait until the market falls, then pull the trigger. It’s a strategy that makes a lot of sense. Nobody should be buying in an overvalued stock market. The problem is, it didn’t make any “cents.” In fact, it meant that we missed the boat. BlackBerry stock is currently trading at double its price at the end of 2020.

But did we really miss the boat? Is Blackberry stock sill a buy at $15?

So when we say we missed the boat, it could mean a lot of things. If it means that we didn’t buy at the bottom, then yes, we missed the boat — sort of. But that’s no big deal. If it means there’s no upside left, then yes, we really missed the boat. Allow me to explain. I learned a long time ago that we cannot be too consumed with picking the bottom or top of any given stock. This is a fool’s game. Nobody has the crystal ball to tell them this information. Therefore, nobody can pick the top or bottom with any degree of accuracy. For me, it’s enough to simply figure out if there’s enough upside to compensate me for the risk I’m taking.

In the case of BlackBerry stock, I feel pretty confident that in the long-term it will be trading much higher than $15. So I just answered my question, right? Yes, for long-term investors I would definitely buy Blackberry stock at $15.

But now I need to personally reconcile my belief that the stock market is due for a fall with this. So if I believe that the market is due for a fall, that implies that in the short term, BlackBerry too is due for a fall. What to do in this situation I guess comes down to preferences. It comes down to the strength of your different beliefs. And it comes down to how “cute” you would like to get with the market.

The bottom line

BlackBerry is a buy at $15. It’s a quality company in two high-growth businesses with a solid financial standing. And it’s really on the cusp of big things.