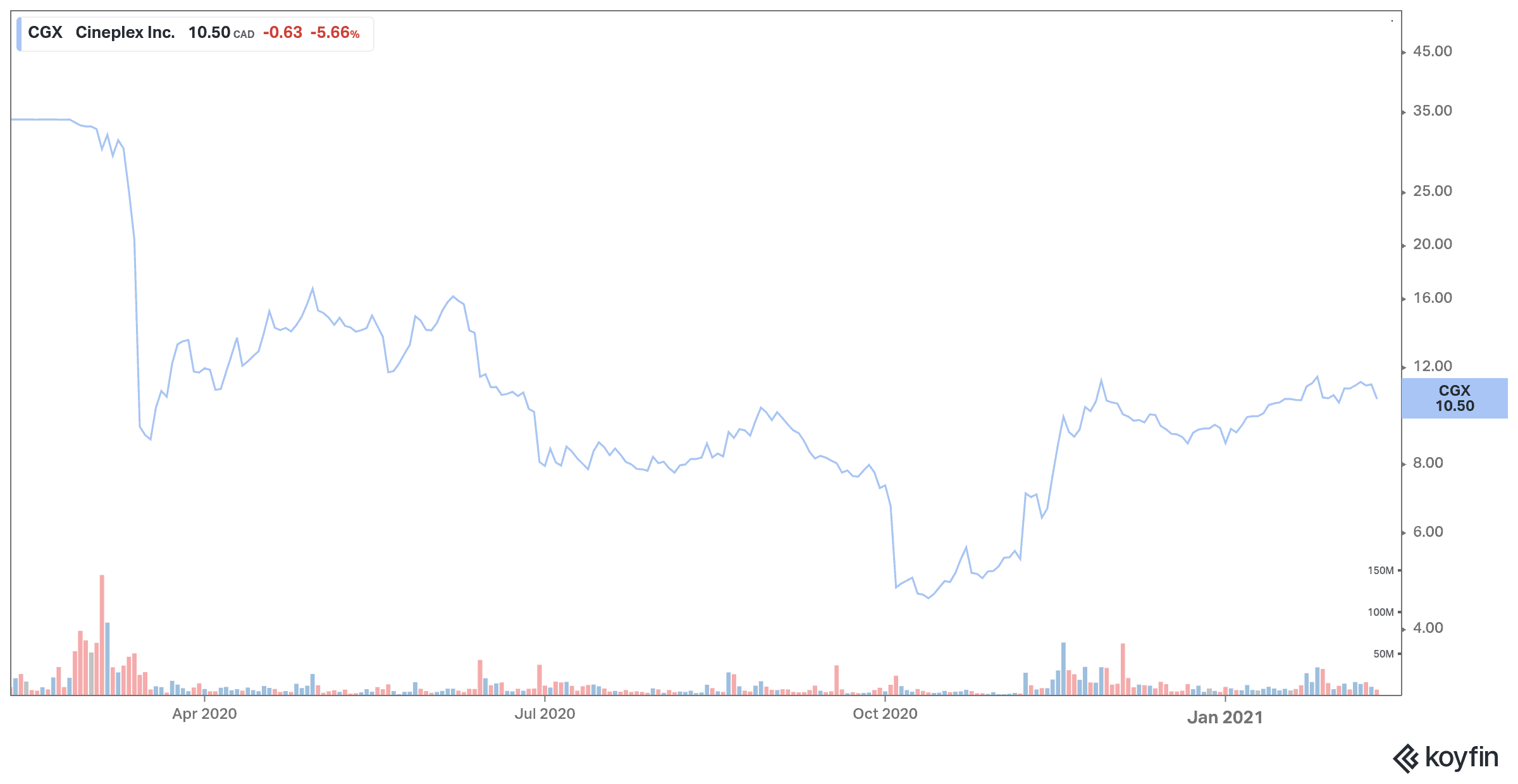

Cineplex (TSX:CGX) stock fell 6% shortly after the opening bell on Thursday after the company reported a huge loss.

The movie theatre company reports a Q4 loss of $230.4 million

Cineplex reported a loss of $230.4 million in the fourth quarter as restrictions to slow the spread of the pandemic were tightened and theatres closed.

The movie company said the loss was $3.64 per diluted share for the quarter ended Dec.31, compared to a profit of $3.5 million or $0.06 per diluted share a year earlier.

Cineplex said revenue fell 88% to $52.5 million from $443 million a year ago, missing average analyst expectations as the Covid-19 pandemic continues to hit the film industry. Total revenue for the year ended December 31, 2020, decreased 74.9%, from $1.2 billion to $418.3 million, compared to the prior-year period.

Cineplex has amended creditor agreement again

Cineplex announced earlier this week it has reached an agreement with lenders to further modify its credit agreement as it battles the financial impact of the Covid-19 virus on its operations.

The company will obtain relief from its financial commitments until the fourth quarter of 2021 under certain conditions, including the completion of a minimum $200 million secured note financing of second lien by the end of March. Net proceeds will be used to repay debt, including $100 million which would constitute a permanent repayment.

Canada’s largest movie theatre chain has been hit by the delay in big-budget films. The release of the latest James Bond film No Time to Die has been moved to October amid a Hollywood-wide bet that the second half of the year will be a safer debut.

The Toronto-based company is trying to slow the pace of cash usage. It burned approximately $24.8 million per month during the quarter. It sold its head office in December in an attempt to generate enough cash to repay its debt.

Cineplex’s theatres are still closed in parts of Canada, many of which were closed when the second wave of coronavirus hit. It is not expected to reopen its locations in Toronto, Ottawa, and the Peel region anytime soon.

Cineplex is continuing its legal action against London-based Cineworld Group Plc after the latter withdrew from a merger that would have created North America’s largest cinema operator. The trial is expected to start in September.

Uncertainty remains regarding return to normalcy

In December 2020, Health Canada approved and licensed the Pfizer–BioNTech and Moderna COVID-19 vaccines for use in Canada with the first doses arriving during the holiday season. The country has started the process of immunizing Canadians. The objective is to have all Canadians immunized by fall 2021. The effective deployment of vaccines is an important step towards the return to normality and the end of the pandemic.

However, the procurement and implementation of approved vaccines in Canada have not been consistent to date and there can be no assurance that vaccines will be widely available or distributed as currently planned, delaying the return to normalcy.

Given the unknown duration of the pandemic and the timing to be determined for the gradual full reopening of Cineplex businesses, as well as consumers’ future health risk tolerance, it is not possible to know the impact of the pandemic on future outcomes, which is why Cineplex stock is a risky bet. If things go well, the company could recover strongly in 2021. However, it appears more prudent to stay on the sidelines until the pandemic is brought under control.