Canopy Growth (TSX:WEED)(NYSE:CGC) had a pretty great quarter, all things considered. The company announced another loss, this time totaling $829.3 million, mainly by restructuring and impairment charges. Yet it also saw revenue reach $152.5 million, a jump of 23% from the same time last year. But if you dig into the company’s balance sheet, there’s another loss that could be coming. And this one is worth $3.4 billion.

Cue the catalyst

The economic downturn has been hard on companies, but especially cannabis companies. These stocks sunk during the pandemic and are now climbing back up on the back of potential legalization in the United States.

The election of President Joe Biden and subsequent entering of his administration was great for cannabis stocks. An additional four states legalization recreational marijuana use back in November 2020. Now, Biden’s administration has stated it would decriminalize the substance on a federal level. This is a huge step towards federal legalization.

Canopy Growth has set itself to benefit huge from this potential shift. The American market is going to be what causes cannabis to sink or swim for investors. The legal marijuana market could be worth almost US$74 billion by 2027! Much of this on the back of U.S. legalization.

Acquisition station

This potential market in the past few years led Canopy Growth and others to enter acquisition mode and then some. The company loaded up its books with every type of acquisition related to pot. The company can now boast everything from topical creams to Martha Stewart gummies. But it’s the potential acquisitions that cost the big bucks.

The news isn’t new, but it’s still relevant. Back in April 2019, Canopy concluded a deal to pay US$300 million to buy Acreage Holdings Inc. While the company is situated in British Columbia, it has a diverse portfolio across the U.S. of cannabis cultivation, processing, and dispensing operations. There may not be a purchase, but there is an order. Should the federal government legalize marijuana, Canopy would buy 100% of Acreage shares for $3.4 billion. And Chief Executive Officer David Klein is optimistic this change could happen this year.

“We believe that this legislative package or a combination of reform measures could allow Canopy to enter the U.S. THC market during calendar 2021,” Klein said.

Foolish takeaway

So, what are investors to make of this hefty price tag? On the one hand, it’s clear that the acquisition of Acreage would be enormous for Canopy Growth and cannabis stocks as a whole. This market would be taken over by Canopy, with the U.S. market taking the lead in recreational sales. It’s not an if; it’s a when.

And even without the legalization, Canopy Growth expects to reach profitability in the next year. That would be huge for investors waiting so long for profitability, while other major cannabis stocks reached that in the last year or so.

But it also means the company will have to pay down this debt. No matter how much pot is going to expand, it’s doubtful that Canopy will be able to cover the $3.4 billion price tag overnight. That could put off profitability for some time.

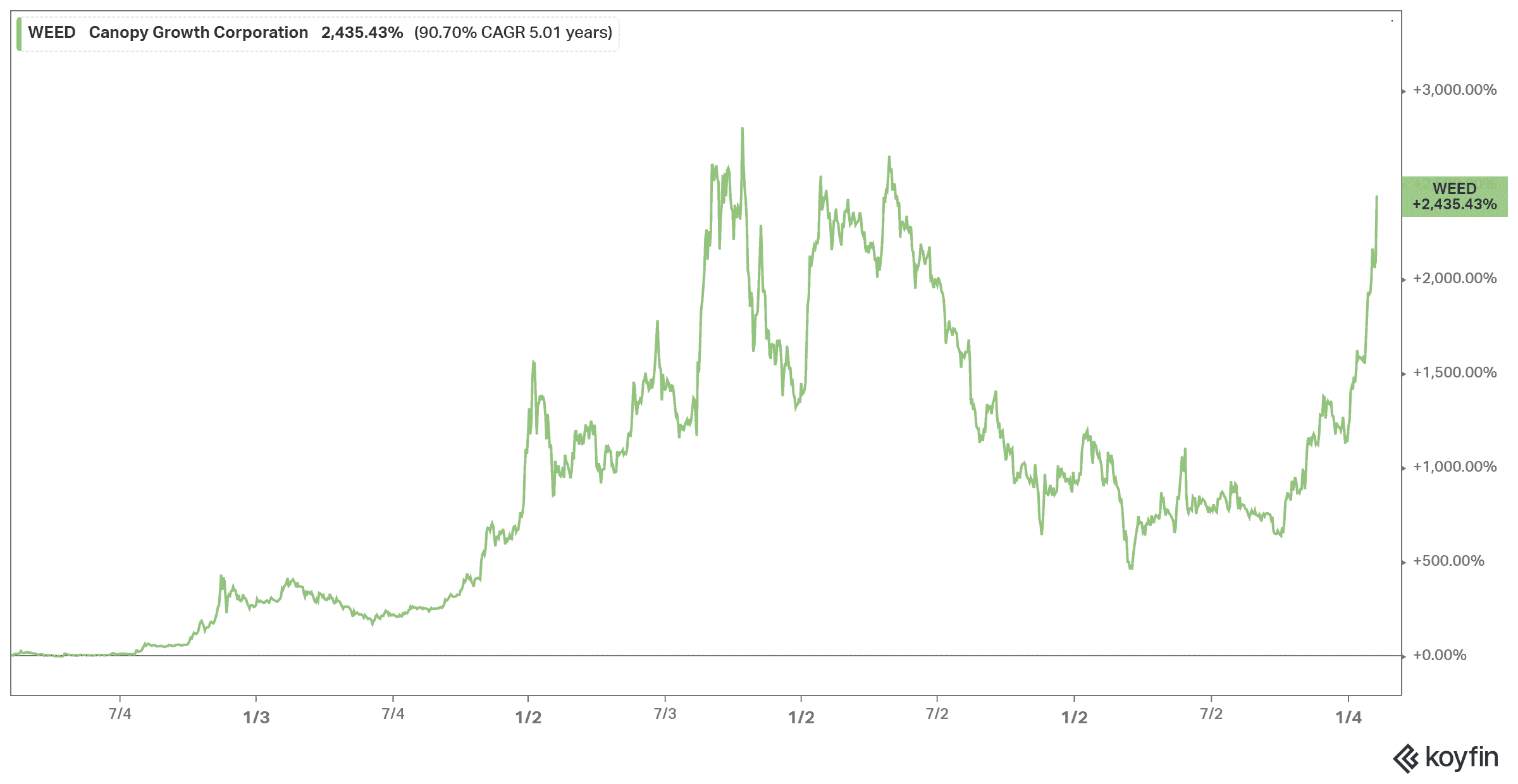

But for shareholders right now, the future looks good. Shares are up 145% in the last year and reaching near all-time highs that haven’t been seen since the April 2019 acquisition. While I would wait for a pullback to invest in this cannabis stock, for long-term investors, this could be the one that takes over the entire game.