Canadian licensed marijuana producer Aurora Cannabis (TSX:ACB)(NYSE:ACB) announced its fiscal Q2 2021 earnings results after the market closed on Thursday. Although quarterly net revenue at $67.7 million was flat sequentially, there were some marked improvements in ACB’s business profile.

The latest on Aurora Cannabis’s earnings profile

Aurora Cannabis’s product recalls and strategic shifts to premium offerings during Q2 2021 weakened consumer pot sales by 16.8% sequentially, but the company made a strong show on the medical cannabis front to reverse fully cover the shortfall.

Net revenue before provisions increased by 11% year over year to $70.3 million. Medical marijuana sales at $38.9 million were 42% stronger than last year’s revenue. The company’s increasing exports to Europe and a recent supply deal into Israel powered a 562% year-on-year increase in medical cannabis revenue during the past quarter.

A recent pivot towards premium products saw Aurora increase its market share in Ontario’s vapes market from zero to 8% within three months to December 31, 2020.

Although gross margins were weaker at 42% against a 48% reading for the same quarter in 2019, this was mostly a result of the underutilization of production facilities during a transition period.

Finally, ACB’s selling, general, and administrative expenses and its research and development costs have fallen within the company targeted long-term run-rate range at $42.3 million.

Aurora Cannabis’s operating profile is now very close to attaining adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). Although the quarterly EBITDA loss actually widened by over 60% sequentially from a $10.5 million loss by September to a $16.8 million loss by December of the same year, analysts see a potential for a positive adjusted EBITDA run rate within the next two quarters.

Better cash position?

Aurora Cannabis’s cash burn has declined significantly over the last six months. Cash used in operations declined from $84.8 million a year ago to $22.7 million last quarter. Quarterly cash burn is down from $273 million during a comparable quarter last year and $143 million by September 2020 to “just” $70.5 million by December last year.

Lower cash burn is better, but $70 million per quarter remains too high a figure for a company generating less than $70 million in revenue and reporting gross margins lower than 50%. Cash flow from operations isn’t expected to turn positive over the next 12 months still. However, the cash burn rate could continue to decline during this calendar year.

Most noteworthy, Aurora’s balance sheet has improved significantly over the past few months. The company boasted of holding $565 million on its books by February 10 this week.

That said, ACB diluted its shareholders after raising $365 million during the quarter. It continued to do so in January this year and raised US$138 million in gross proceeds from a public offering of 13,200,000 common share units on January 26.

Time to buy ACB stock?

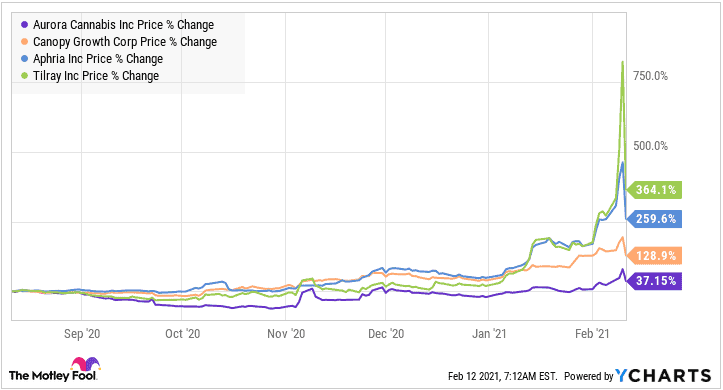

Shares in Aurora Cannabis have been extremely volatile of late, and ACB stock price has lagged its peers by wide margins over the past six months.

Canadian pot stocks have surged lately, as the market turned bullish over a potential political shift in U.S. policy in favour of federal legalization of cannabis. Recent acquisition transactions in the pot space and the power in Reddit forums fueled bullishness, too.

However, the nearly 24% decline on ACB shares and a nearly 50% plunge on Tilray stock on Thursday should give enough warning to investors that money can easily be lost in today’s frothy trading conditions.

Analysts expect Aurora’s revenue to revert to growth during this calendar year, starting with a 7.6% sequential increase to $72.8 million by March to end the calendar year at $92.3 million for the December 2021 quarter. Estimates for the quarter ending in December 2021 show a respectable 36.4% year-over-year revenue growth.

Perhaps the anticipated sales growth, aided by better product representation in Canada, a shift to higher-margin products, and highly contained operating costs could help the company please its shareholders through positive operating earnings numbers (adjusted EBITDA) later this year, and lift ACB’s stock price.

Shares could potentially surge when the company finally reports positive operating earnings. If analyst estimates for positive EBITDA come to pass, investors could finally hear ACB’s management brag about an earnings positive quarter during the second half of 2021. I would love to listen to such an earnings call.