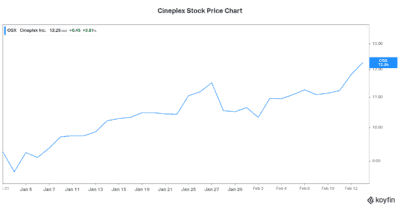

Cineplex (TSX:CGX) stock has been a real roller-coaster ride since the pandemic hit. And not the fun kind — the nauseating kind. While the company is a well-run entertainment company, it is a victim of the times. It’s thrown new twists and turns on an almost daily basis. It continues to struggle to stay afloat. But 2021 has offered glimmers of hope. The COVID vaccine is making its way to the population. Also, Cineplex is receiving help to stay alive. As a result, Cineplex stock is soaring 40% so far in 2021.

COVID vaccine rollout

The COVID vaccine rollout provides hope for Cineplex stock. But hope usually comes with a caveat. In this case, it comes with a few. For example, the rollout is taking longer than planned for logistical reasons. Also, new variants of the virus are emerging, and this is placing the efficacy of the COVID vaccines into question. While nothing is easy, the rollout is moving forward.

And with this, the hope is there — hope that our lives will return to some kind of normalcy, that movie goers will return, and that Cineplex will return to its past glory. And this is what is driving Cineplex stock. In the good, old days, Cineplex was a cash flow machine. This company was churning out massive amounts of cash flow. And its efforts at diversification were paying off. It was well on its way to becoming a premier Canadian entertainment company. The entertainment offering was growing; from movie theatres to Rec Rooms to digital media, food service, and more, Cineplex was branching out.

Today, for obvious reasons, things have changed for Cineplex. Its online offering, Cineplex Store, is ever more important. Cineplex Store is Cineplex’s online movie rental portal. It offers movies for renting and for purchase. The company is filling in its offering of movies today. For example, Cineplex added more than 100 movies for Black History month.

While some movie theatre locations may face permanent closure, Cineplex has made strides in diversifying its business. A return of customers will enable Cineplex to finish the job.

Cineplex stock: Waiting out the crisis by reducing expenses

Since the start of the pandemic, Cineplex has been focusing on its survival. This has meant doing what it had control over. The expense lines are the places where Cineplex has at least some measure of control.

Cineplex’s single largest fixed cost is lease costs. Abatements and conversions from fixed to variable leasing arrangements have helped Cineplex lessen the blow. So far, lease costs have been reduced by over $60 million, with more savings expected in 2021.

Payroll is Cineplex’s largest semi-fixed cost. Cineplex has received over $30 million in government subsidies and has reduced its payroll expense dramatically. These are big savings that are allowing Cineplex to survive this crisis and come out on the other side. And once a vaccine is well established in the population, Cineplex will do just that.

Cineplex stock rallies on the bigger picture

The graph below shows Cineplex stock’s price performance so far in 2021:

So, Cineplex stock has rallied big for all of these reasons. It has faced extinction, but it still stands. It continues to manage its way through the crisis. Cash burn is high, and Cineplex’s cash is dwindling. This is concerning. On the flip side, Cineplex was able to get a suspension of financial covenant testing. This suspension will last until the fourth quarter of 2021.

Nobody wants Cineplex to fail. For example, the government is providing subsidies. Also, financial institutions are providing a debt covenant suspension. And landlords are providing relief on lease payments. This has been a long road. We finally see the light at the end of the road.

Motley Fool: The bottom line

Cineplex stock has been on tear in 2021. The company is being held back through artificial means (lockdowns). But the COVID vaccine is being administered. When the virus is under control, lockdowns will be lifted. At that point, Cineplex will be set free to flourish. But only if it survives.

In the meantime, volatility will continue to rule the day for Cineplex stock.