It’s been nearly a month since GameStop’s (NYSE:GME) stock began its incredible rise and fall, yet the memory is still fresh in investors’ minds. It was clear at the time the rally was bubble driven by speculation. That’s even more evident today, as the stock down more than 85% since January 29.

And although it was a rare event caused by speculation, it’s still inspiring to see such incredible growth and the potential stocks offer investors every day.

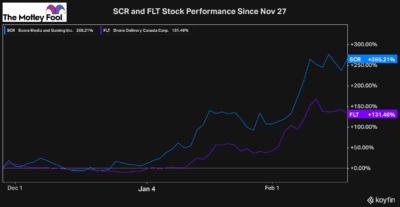

Just look at stocks like The Score or Drone Delivery Canada Corp. These are stocks I’ve been recommending to investors since last November. Already they have gained 265% and 130% respectively. And unlike GME, these stocks are rising on their own merit.

It’s these high-potential growth stocks like these that investors should be looking for. However, because it’s generally difficult to tell when the broader market will become aware of these stocks and when they will rally, investors should take a long-term position.

Over time the businesses will continue to grow and more investors take notice. Eventually, you see rapid increases in share price, which is what The Score and Canada Drone Delivery investors have experienced recently.

There’s no telling which stock will be the next to rally like GME. But if you find a high-quality business with major potential, it’s only a matter of time until it does.

Today several businesses offer investors incredible capital gains potential. One of the fastest-growing industries, though, that some of the best Canadian growth stocks can be found in is the psychedelics industry.

Psychedelics could be the next GME stocks

Over the past year, psychedelics have quickly grown to become one of the highest potential industries for growth investors. Over the past year, several stocks provided investors incredible returns. It’s therefore understandable these stocks could have slipped through the crack for some investors.

The potential for these stocks looks extremely impressive, though. Many have already compared the potential in psychedelics to the early potential cannabis stocks offered investors.

That’s something that’s generating a great deal of interest from Canadians, as pot stocks were some of the best growth stocks to buy during their massive rally only a few years ago.

If psychedelics and their potential is something you might be interested in, one of the top Canadian stocks in the industry to consider is Numinus Wellness Inc (TSXV:NUMI). It’s extremely cheap, currently worth less than $300 million, making it a far better investment than GME stock.

Numinus is most attractive, though, because it has a major advantage being one of the first companies to begin research on psychedelics and the impact they can have on mental health.

It possesses a highly coveted dealer’s license from Health Canada. This allows it to import, test, and distribute several high-potential chemical substances that are otherwise considered illegal.

It also has a cannabis testing business that offers more long-term growth potential for the business and helps to bring in revenue today.

The psychedelics industry is still early, so just like any high-potential growth stock, there is a tonne of risk. With that said, though, it’s still a much better investment than GME stock.