Top stocks come in many different forms. For example, they can be high-yielding dividend stocks such as AltaGas Ltd. (TSX:ALA) stock. Also, they can be high growth stocks. They can also take the form of undervalued gems. The point is that opportunities come in many different shapes and sizes. At Motley Fool, we’re constantly looking for the next top stocks. We all want to maximize our investment returns. At the same time, we want to minimize our investment risk.

So it follows that we will need a strategy that includes buying a diversified list of investments. In this article I’ll be highlighting three top stocks that are yielding over 5%. They are quality stocks that are paying their shareholders generously today.

A top 5% yielding stock underpinned by stable and growing cash flows

AltaGas is a utility. And it’s an energy infrastructure company. The utilities segment accounts for 60% of AltaGas’ EBITDA. Its remaining EBITDA is derived from its midstream, energy infrastructure segment. This translates to a stable business that has exposure to some healthy growth. So we can think of AltaGas stock as a utility stock with a bonus.

Today, AltaGas stock is yielding 5%. This dividend yield is backed by strong, stable cash flows. It’s also backed by a growing midstream business. A big chunk of its midstream business is in the prolific Montney and Marcellus/Utica basins. These natural gas basins are top class basins. Much of the growth in natural gas demand and LNG demand will benefit this area. Another area of very strong growth for AltaGas is its Ridley Island Propane Facility (RIPET). This facility is expected to see a 60% growth in volumes in the short-term. This facility connects Canadian producers to global market. And there’s huge demand here.

A defensive dividend stock yielding 6%

NorthWest Healthcare Properties REIT (TSX:NWH.UN) owns and operates a variety of medical buildings globally. It’s a leading medical real estate owner in Canada. And a growing real estate owner around the world. NorthWest stock has been pretty steady for the last five years. It’s been trading in the $10 to $13 range. But the yield has been the selling point. It’s a defensive stock. It provides investors with an attractive yield. At one point, the yield was closer to 10%, now it’s just over 6%.

The company continues to grow its medical real estate around the world. These real estate values will continue to be supported by the aging population. Medical facilities will be in strong demand for a very long time. Also, low interest rates further support this.

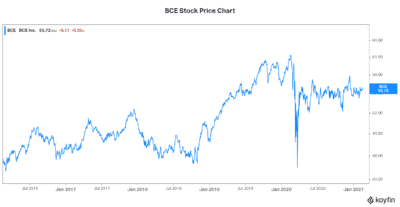

A telecom giant yielding 6.3%

Turning to BCE Inc. (TSX:BCE)(NYSE:BCE) stock for dividend income is a smart move. BCE released its 2020 earnings results last week. At that time, they announced another dividend increase. This time, the dividend was increased by 5.1%. It’s the thirteenth consecutive year of a 5% or higher dividend increase. And it’s reflective of BCE management commitment to its dividend and dividend growth.

This defensive stock is working on upgrading its network. We should be ready to hear all about network improvements and enhancements in the next few years. BCE is laying the foundation for 5G. It’s rolling out its faster, better performing fibre optic network. BCE stock is a cash flow machine with a strong history of delivering shareholder value. All investors should be looking for companies like that.

The bottom line

The three top stocks that I’ve highlighted in this article share the fact that they’re all yielding over 5%. But they also share other characteristics. For example, they’re all quality companies. Also, they’re all striving to maximize cash flows. And they’re all committed to their dividends.