Dividend investing remains a tried, tested, and proven wealth-creation strategy. It works, even during an era of a raging Bitcoin and socially hyped meme stocks like Gamestop clamouring for the financial media’s attention. Buying high-yield TSX dividend stocks today could set you up for juicy portfolio income yields in retirement.

Regularly reinvesting portfolio dividends produces a substantial component of returns on long-term holdings. Actually, dividends may cushion a portfolio from unforeseen economic shocks and even rare pandemics like COVID-19.

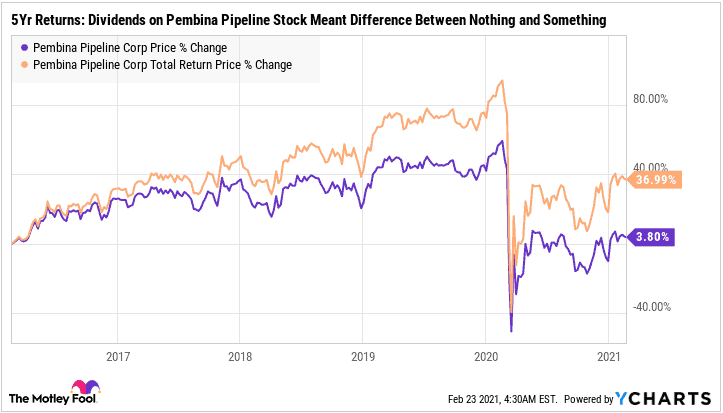

For instance, imagine buying Pembina Pipeline (TSX:PPL)(NYSE:PBA) stock’s 4.5%-yielding dividend five years ago. The re-invested dividend could have made the major difference between a mediocre 3.8% capital gain and a 37% holding period return today.

Pembina is one of the two high-yield TSX dividend stocks I’d buy today.

Why buy Pembina Pipeline’s dividend stock?

Global oil prices have rebounded from 2020 lows. In fact, market calls for a US$72 oil barrel are already out this early in 2021. However, leading Canadian energy stocks, including Pembina Pipeline, are still to fully recover to their pre-COVID-19 crisis levels. Capital gains could be substantial in the near term, and the energy giant’s juicy 7.3% yield could be gone soon.

Pembina provides transportation, midstream services, and hydrocarbon marketing services to the North American energy industry.

Revenues declined during the COVID-19 crisis of 2020, as oil prices plunged on weak demand. However, Pembina’s top line recovered to within 7.7% of the prior year’s quarterly revenue run rate during the third quarter to September 2020. Sales recovery momentum persisted during the final quarter of last year. Analysts expect fourth-quarter 2020 revenue to recover to “just” 2% below the comparable figure for December 2019.

Watch the growing margins

Most noteworthy, challenges in the top line masked some significant operational improvements in the business.

Gross margins expanded from 26% in 2017 to 32% over the 12 months to September 2020. Likewise, operating margins increased from 20.7% in 2017 to 28.7% over the last reported 12-month period.

Evidently, the Canadian energy company became more profitable, yet its forward price-to-normalized-earnings (P/E) ratio remains cheap at 15.5. Revenue and earnings growth in 2021 could bring the valuation multiple back to within the 19 times range seen at the end of 2019. I would expect double-digit capital gains on Pembina Pipeline stock this year.

The company currently pays a $0.21 per share monthly dividend, which should yield 7.3% annually. The dividend has been increased at a respectable compound annual rate of 6.5% annually over the past three years. The high-yield TSX dividend-growth stock is expected to see its monthly payout increase twice in 2021 for a combined 3.1% annual increase for this year.

Buy SmartCentres REIT’s juicy 7.2% yield

The window for income investors to scoop up cheap real estate in the Canadian retail property sector is closing very fast.

Canadian retail real estate investment trusts (REITs) were crushed during the COVID-19 pandemic. And current yields exploded. Many retail store operators failed to pay rent during pandemic lockdowns early last year. However, not all retail REITs are the same. SmartCentres Real Estate Investment Trust (TSX:SRU.UN) had a portfolio of mostly Walmart-anchored, open-air malls serving largely essential service providers.

The trust saw a minimal impact from pandemic-induced government restrictions. Its portfolio of 167 retail properties and mixed-use assets reported industry-leading rent collections during the industry’s toughest year for landlords. About 60% of its gross rent comes from “essential services” providers. Independent retailers, the most vulnerable tenant base, comprised “just” 2-3% of its net operating income.

Most noteworthy, SmartCentres REIT retained a strong in-place occupancy rate of 97% going into 2021. I would expect vaccine rollouts and humanity’s win over the health crisis to continue lifting beaten-down retail REITs as traffic returns to malls this year.

SmartCentres pays a monthly distribution of $0.154 per unit, which currently yields 7.2% annually. Its adjusted cash flow from operations (ACFO) payout rate during a difficult 2020 actually improved year over year from 87.5% for 2019 to 87.2% for 2020, thanks to its mixed-use development projects portfolio.

The high-yield TSX REIT pays one of the safest distributions by any retail property operator today. It has a conservative debt ratio and the majority of its properties remain unencumbered (not pledged to secure mortgage loans).

Actually, one key insider — the founder and chairman — spent close to $24 million buying the high-yield TSX dividend stock’s units last year. Management has enormous confidence in the trust’s future.