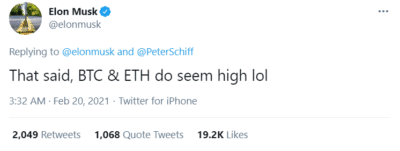

Last night, we witnessed a “flash crash” in Bitcoin, which fell as low as US$45,000 after reaching a US$58,000 high. The move came after Elon Musk said that Bitcoin and Ethereum prices “seemed high,” in a tweet reply to Peter Schiff.

This led to a flurry of news headlines tacitly associating Bitcoin’s crash with Musk’s comments. For example, a recent CNBC headline read: “Bitcoin tanks 10% after Elon Musk says prices seem high.” Musk, with 48 million Twitter followers, is thought to have the ability to move markets. Previously, extreme swings in the prices of Dogecoin, GameStop and Etsy were correlated with his Tweets.

Bubble concerns mount

Recently, concerns have been mounting over a potential bubble in “meme assets” of the type Musk discusses on Twitter. That includes cryptocurrencies as well as stocks. Recently, Dogecoin’s own founder said the internet currency’s price was “far from reality,” and Ray Dalio spoke of an overall bubble in tech stocks. Top tech stocks like Musk’s Tesla are strongly correlated with the crypto market. Michael Burry recently noted that BTC and TSLA had a 0.95 correlation over a six-month period. Presumably, that correlation will grow stronger after Tesla’s $1.5 billion Bitcoin investment.

Blockchain stocks set to get hammered

Blockchain stocks are the class of equities most strongly tied to the price of Bitcoin and crypto in general. Companies like HIVE Blockchain Technologies (TSXV:HIVE) make money by mining and selling crypto. When crypto prices are rising, they make a lot of money. But when they’re too low, these companies don’t turn a profit.

HIVE’s business model involves mining cryptocurrency in low temperature data centers. It specifically selects data centres in cold countries like Sweden to minimize its costs. Mining Bitcoin is extremely energy intensive, and it costs money to cool the servers that are mining it. HIVE should theoretically be able to mine Bitcoin cheaper than most organizations can, as its data centres are already very cold to begin with.

That makes sense in theory. Perhaps HIVE does enjoy better profit margins than a mining operation based in, say, Arizona. Certainly, it was profitable in its most recent quarter, when it had $13 million in revenue and $9 million in net income. However, it lost money in the same quarter a year before. If the price of BTC and ETH is too low for HIVE to make money mining it, then it will be unprofitable until the prices recover.

And Bitcoin is going to get progressively more expensive to mine from here on out. As the supply of BTC shrinks, the energy needed to mine it increases. Currently, it costs about $10,000 in energy to mine a Bitcoin. At any price lower than that, HIVE can’t turn a profit on BTC. This tendency of Bitcoin to become more scarce over time has been highlighted as a positive, because it restricts supply. But this supply restriction doesn’t guarantee that the demand side of the equation will stay in place.

If people lose interest in Bitcoin–whether due to regulation or some other factor–then companies like HIVE won’t be able to make money. As for Elon Musk, he seems to be safe for now. But that $1.5 billion Bitcoin investment could come back to haunt him if the price goes low enough.