Some say that bitcoin is the new gold. Is this true? Does bitcoin really have what it takes to displace gold now and in the long term? The one thing we know for sure is there’s certainly a lot of buzz around it. Bitcoin has rallied more than 600% since the beginning of 2020. In fact, the bitcoin price is over $67,000 today. Let’s take a look at what’s going on. What does this all mean for gold stocks like Barrick Gold?

What is bitcoin anyway?

Bitcoin is a digital currency. It’s known to have gotten its start as a currency for illegal activity. But the hopes are to bring it into the light. Simple put bitcoin bulls want bitcoin to be a main transaction currency for all. To this end, a shift is happening. Bitcoin is increasingly being used in the real economy.

For example, Elon Musk’s Tesla plans to accept bitcoin as payment for car purchases. Also, he put $1.5 billion of cash into bitcoin. This has sparked new conversation. The debate about the new age currency is raging. Has Elon Musk’s involvement with bitcoin validated it?

To a certain extent, yes, of course. There may be some valid use for the crypto technology. It promises to be the private electronic currency that ensures security. It certainly has value in this technological age. And it’s increasingly likely that there will be a place for it. But the crypto currency is only a decade old. Can it replace gold?

Similarly, Bill Gates has a clear opinion on bitcoin. He recently stated that “Bitcoin can go up and down just based on mania…and I have no way of predicting that.” This sounds like a speculative game to me. And this is the main reason that I’d forget bitcoin.

Gold is the proven safe haven

Conversely, gold has centuries behind it as the ultimate store of value. It’s known as a safe haven. It’s quite stable and it’s accepted worldwide. Governments and financial communities regard gold as the building block of global money. It is for these reasons that I would buy gold stocks today over bitcoin.

With gold stocks, you gain exposure to this safe haven. You also get dividend-paying entities. And you get companies that are increasingly creating shareholder value. So let’s take a look at two gold stocks to buy today.

Agnico-Eagle Mines Ltd. (TSX:AEM)(NYSE:AEM) is a top rate gold stock. It’s a gold stock that has a long history of paying dividends. And these days, that dividend is growing rapidly. So why do I call Agnico a top rate stock? Well, first, all of the company’s mines are located in politically safe areas, so it escapes a common risk of gold companies.

Second, Agnico is a top quartile operator. That means its costs and efficiencies are extremely competitive. Finally, Agnico’s cash flows are strong and fast-growing. In fact, in 2020 Agnico generated record cash flow of over $1 billion. This cash flow has driven large increases in the dividend.

For example, the dividend has increased 75% in 2020. This is shareholder value creation. Conversely, bitcoin doesn’t have anything of this sort. While bitcoin has soared, it’s pure speculation.

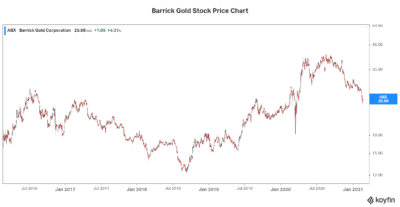

Barrick Gold Corp. (TSX:ABX)(NYSE:GOLD) is another top gold stock. Actually, Barrick is the most well-known gold stock. It’s the one that investors flock to first when looking for gold exposure. This makes sense, as Barrick Gold stock is the $44 billion gold behemoth. Once a heavily indebted gold company that struggled to move forward, Barrick’s fortunes are rapidly improving. Cash flows and dividends are rapidly rising.

The bottom line

At a time of global crisis, the price of gold continues to have support. And gold companies like Agnico-Eagle Mines and Barrick Gold continue to reap the rewards. Surging cash flows and dividends will continue to drive their stock prices higher.

Bitcoin remains a more speculative bet. Elon Musk’s seeming acceptance of it notwithstanding, its future is uncertain. Also, there’s no way to fundamentally analyze and value it. We can’t value bitcoin to arrive at a fair price. I choose the safer bet any day – gold stocks like Barrick Gold and Agnico-Eagle.