There’s no question that tech stocks are some of the most important stocks you can own in a portfolio. These days, tech stocks offer some incredible growth potential.

Because they can grow so quickly and trade at massive valuations, these stocks are inherently volatile. This has been evident the last few days in stock markets.

There are a lot of risks in the tech industry. And while volatility is something investors generally try to avoid, if you’re investing for the long term, it shouldn’t matter.

Investors should focus on buying well-established businesses that you’re confident can continue to grow market share and dominate for decades to come. If you do this and focus on the long term, you’ll have nothing to worry about.

Here are two of the best Canadian tech stocks to buy today.

The top tech stock in Canada

Shopify (TSX:SHOP)(NYSE:SHOP) is one of the best long-term tech stocks in Canada. Any time Shopify goes on sale, investors should consider adding to their position.

The tech stock has benefitted from the major growth in e-commerce in the last few years. However, because the tools it gives its customers are so beneficial, you could also argue it’s one of the reasons e-commerce has grown so quickly as well.

The pandemic also had a positive effect, and the resulting growth has seen Shopify’s business expand rapidly. This will only continue to create more growth as businesses will be forced to go online to stay competitive.

And because each time its business grows, the sales are recurring. So, it’s an extremely attractive business model with years of potential.

The tech stock takes a bit of criticism every now and then for the premium it trades at. However, you rarely hear any criticism about the business or its operations.

There’s a reason Shopify trades at a major premium. Investors recognize its significant long-term growth potential. So, any time you can buy it on the dip, you’re getting a major bargain.

A rapidly growing Canadian tech stock

Lightspeed POS (TSX:LSPD)(NYSE:LSPD) is another promising Canadian tech stock. As e-commerce grows, so does the need to process payments, which is why Lightspeed’s business has been growing so rapidly as of late.

In 2020, Lightspeed reported 79% growth in revenue year over year. The Canadian tech stock now has over 115,000 locations and operates in more than 100 countries. Much of this growth has come organically. However, Lightspeed has also made some excellent acquisitions as well.

Plus, similar to Shopify, the majority of its revenue is recurring. At the end of 2020, 91% of Lightspeed’s revenue was classified as recurring, giving the company a tonne of potential over the long term.

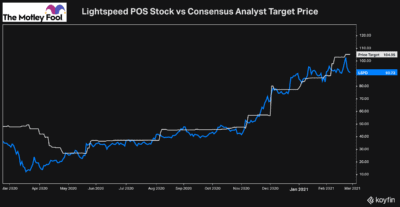

Analysts have been increasingly bullish on Lightspeed too. So, although its incredibly rapid growth seems too good to be true, you can see the stock has actually mostly followed in line with the consensus target price.

This goes to show just how impressive Lightspeed’s operations have been. As recent as November, the target price was below $50 a share. Today, it stands at roughly $105. So, Lightspeed shares, which are trading around $90, are offering investors a roughly 15% discount.

Bottom line

These two tech stocks are some of the best growth investments you can buy today. They have years of potential and will only continue to grow shareholder value. So, anytime these stocks go on sale, investors should strongly consider adding exposure.