Toronto-Dominion Bank (TSX:TD)(NYSE:TD) and Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) capped off the Big Six Banks quarterly earnings reporting on Thursday. CIBC and TD Bank joined major rivals in beating first-quarter profit expectations, thanks to lower provisions for loan losses and trading strength. Let’s look at the two banks’ latest results.

TD Bank profit rises 10%

TD Bank said Thursday that first-quarter profits rose 10% year-over-year to $3.3 billion. The bank reported an adjusted net income of $1.83 a share versus analysts’ expectations of $1.49 a share.

The bank’s Canadian retail unit reported net income of approximately $2.04 billion for the three-month period ended Jan. 31, an increase of 14% from the previous year. TD said this reflected a decrease in provisions for credit losses (PCL) and an increase in revenue. TD reported a decline of 13% in its U.S retail business, while growth in its Canadian banking unit was driven largely by its wealth business, which also helped lift earnings at the other lenders.

“Business momentum was very good this quarter, reflecting strong mortgage originations and chequing account growth in the Personal Bank, record retail net asset growth across our Wealth franchise, and solid Insurance premium growth,” TD said of its Canadian retail unit in a statement.

TD’s total PCL for the first quarter was $313 million, down 66% from a year earlier.

This was in part due to a recovery of $153 million on performing loan provisions, which was itself due in part to the ongoing quarterly releases of allocations in the U.S. consumer loan portfolios largely related to improving economic prospects, according to the bank.

CIBC profit jumps 34%

CIBC reported a profit of $1.63 billion for the quarter ended January 31, an increase of 34% from the previous year. After adjusting for some acquisition-related costs, CIBC saw adjusted income rise to $3.58 a share, up 10% year-on-year. That’s better than analysts’ estimates of $2.81.

CIBC’s capital markets operations reported a first-quarter net income of $493 million, up 30% from the previous year, which was helped by higher trading activity. The lender’s Canadian personal and commercial banking division also saw profits soar 13% year over year to $652 million, as the amount of money set aside for possible losses on loans was decreasing.

Similar to its competitors, CIBC’s first-quarter results were improved by falling costs of credit, which had risen at the start of the pandemic as lenders rushed to build up reserves in a climate of crisis uncertainty. However, the economic forecasts that banks rely on to calculate these loan loss provisions have become more positive, allowing them to recover some of these reserves.

CIBC said provisions for credit losses for the first quarter were $147 million, down 44% from a year earlier. The amount of money the bank had to set aside for performing loans, or those still technically paid off, collapsed in the quarter, allowing a recovery of $89 million. The decline was primarily due to a favourable change in the bank’s economic outlook.

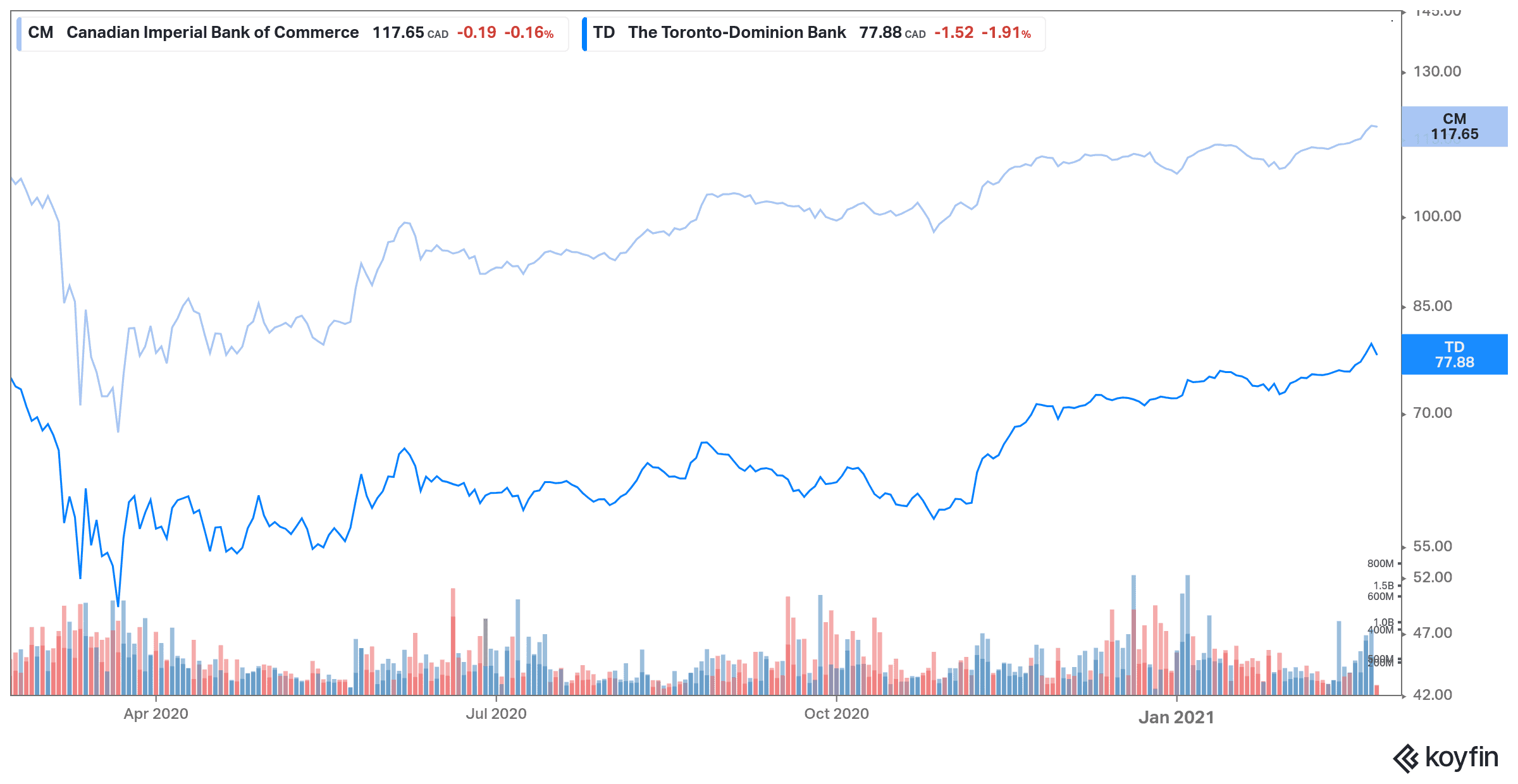

Bank stocks are cheap

The Canadian bank sector is cheap, with low valuations and big dividends. TD Bank stock has a forward P/E of only 11.8, while its dividend yield is close to 4%. CIBC stock is even cheaper and has a higher dividend yield, with a forward P/E of 9.9 and a dividend yield near 5%. CIBC has also better growth prospects than TD Bank. For these reasons, CIBC is a better buy than TD.