These days, despite several tech stocks with revolutionary technology, one of the best investments you can make today is in Bitcoin. Bitcoin was created over a decade ago, yet the cryptocurrency continues to be one of the most controversial assets you can buy.

Many Bitcoin bulls suggest that the cryptocurrency and its blockchain technology has major long-term potential. It also has a huge runway for growth as more investors and businesses adapt to Bitcoin.

We have seen this, specifically over the last year, with several well-known investors and businesses investing in Bitcoin and praising its incredible potential.

However, just because it’s rapidly gaining in popularity doesn’t mean it’s not volatile. Just in 2021, Bitcoin has already gained 90% and then subsequently lost a third of that gain for a year-to-date increase of 60%.

In just the last five days last week, the cryptocurrency lost nearly 20% of its value. This makes it crucial to invest in Bitcoin long-term. And when you invest with a long-term mindset, you can use these opportunities to buy the dip.

So make sure that if you do decide to invest in Bitcoin, you understand the risks you’re taking. You shouldn’t need this cash for years. Furthermore, you should only invest a small amount of your portfolio because of the heightened volatility.

With that in mind, here are some of the most popular ways to buy bitcoin today.

The new Bitcoin ETF

The newest Bitcoin ETF that’s gotten all the hype lately is the Purpose Bitcoin ETF (TSX:BTCC.B). The fund is a low-cost and simple way of gaining exposure to Bitcoin. This way, investors don’t have to create their own Bitcoin wallet and go through the complicated tasks of buying and holding Bitcoin themselves.

Plus, if you buy the ETF in a registered account, you get all this exposure to the cryptocurrency’s incredible potential tax-free.

The fund is similar in a lot of ways to The Bitcoin Fund (TSX:QBTC.U). However, it’s a slightly lower-cost fund. More importantly, though, because it’s classified as an ETF, it won’t trade with such massive differences in the price of the fund and the net asset value of the units.

It’s worth noting that this is a lower-risk, lower-reward way of investing in Bitcoin. It’s still going to be volatile, however it will have a lot less volatility than a mining stock.

A cryptocurrency mining stock

Apart from gaining exposure to the actual cryptocurrency, the other most popular way of investing in the industry is through a mining company.

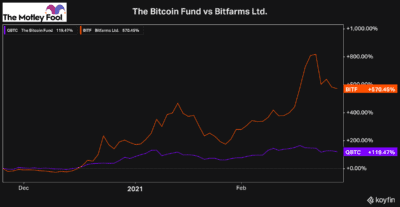

Stocks such as BitFarms Ltd (TSXV:BITF) offer investors huge potential but also higher volatility. These stocks are incredible investments when the price of Bitcoin is rising. However, they can fall extremely rapidly when the price of the coin is on the decline.

Last Tuesday, Bitcoin was down 11.7% through the trading day. Bitfarms, however, sank roughly double that, down a whopping 23.4%. This is why taking a long-term position is so crucial. It’s also why you should consider dollar-cost averaging when you have the chance.

Over the longer term, when the price of Bitcoin is rising, the company can perform well. In the last three months, you can see just how well Bitfarms has performed.

Bitfarms has been one of the top cryptocurrency miners when it comes to execution. The space is extremely competitive, and companies will continue to have to improve their computer power in order to compete in the space.

So while the stock is performing exceptionally well at the moment, that’s the main risk of investing in a cryptocurrency miner. It’s possible that the price of Bitcoin could continue to increase, but if Bitfarms starts losing competitiveness, the stock could fall despite the cryptocurrency’s rising price.

For this reason, if you’re interested in a miner, you may also want to buy the ETF as well. That way, you’ll still have some exposure to the price of the coin as well as the leveraged potential of the miner.