Canada Goose Holdings (TSX:GOOS)(NYSE:GOOS) and HEXO (TSX:HEXO)(NYSE:HEXO) are two top stocks to buy in March. Here’s why.

Canada Goose Holdings

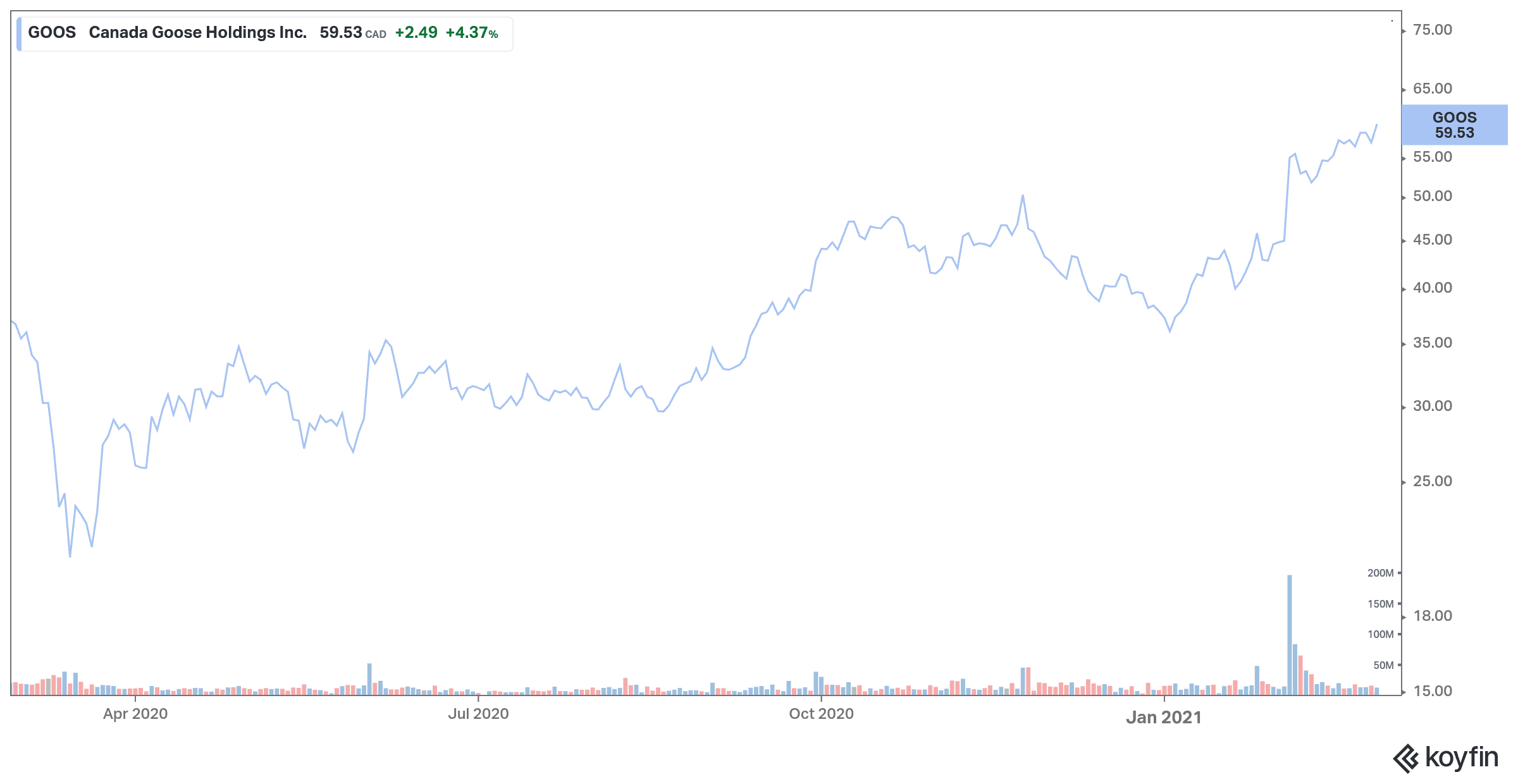

Canada Goose is one of my top stocks to buy in March because it has demonstrated an impressive resilience despite the global pandemic.

The company has beaten expectations in the latest quarter, which marked a return to growth for the company. Sales were driven by e-commerce growth and ongoing demand in China.

Canada Goose sales for the third quarter ending Dec. 27 totaled $474 million, a 5% increase from $452.1 million for the same period last year. The company reported adjusted earnings of $1.01 per diluted share. On average, analysts expected adjusted earnings of $0.86 per share and revenue of $415.3 million.

While 21% of its stores worldwide were forced to shut down in the third quarter due to COVID-19 lockdowns, Canada Goose has seen its online sales increase by 39%. E-commerce sales grew double-digit in major Canada Goose markets, including strong results in Germany, France, Ireland, and the U.K.

At the same time, the company continued to expand its presence in China, which has been a key part of its international growth strategy. Direct-to-consumer sales rose 41.7% in China in the third quarter, helping to offset weakness in Canada and the United States caused by lockdowns and restrictions from COVID-19.

The Chinese consumer has also been important to Canada Goose, given the impact buyers have on sales of luxury goods around the world. Canada Goose’s retail traffic in a given market is generally evenly split between local and international consumers. With tourism on the decline globally, the company is focusing on serving consumers at home and demand in local markets.

The company’s most recent results stand in stark contrast to the same period last year, when the COVID-19 pandemic crippled its operations in China, forcing the company to reduce its outlook for the year.

E-commerce and demand in China should continue to grow in the next quarters. Revenue growth of 30% and profit growth of 150% are expected for 2021.

HEXO

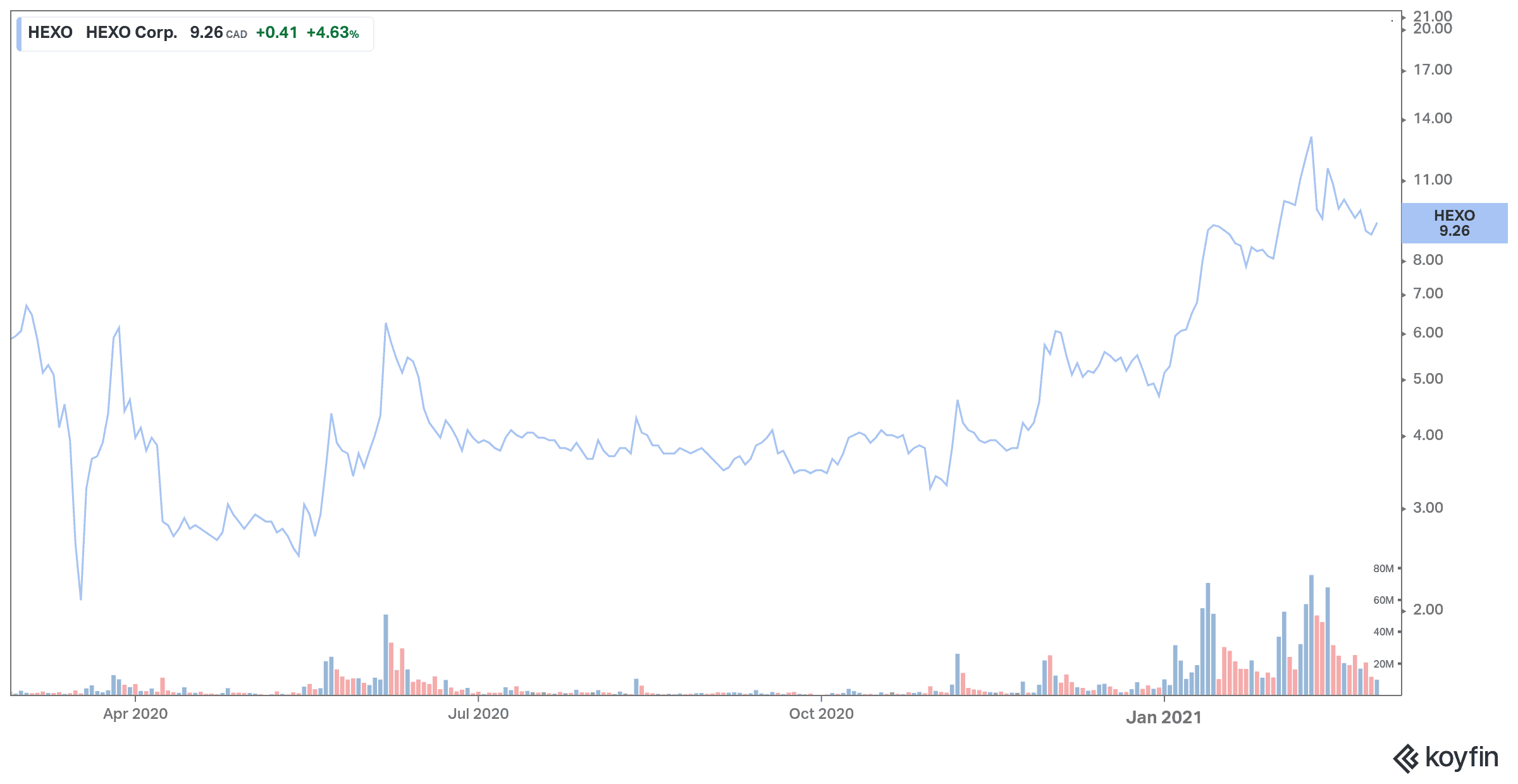

HEXO stock is likely one of the top cannabis stocks to buy now.

With a large addressable market and major expansion plans on the horizon, HEXO has become one of the major players in the industry.

The optimism about the stock is high at the moment, mainly in anticipation of the federal legalization of cannabis in the United States. The Canadian company plans to enter the U.S. market very soon, which will be a major growth engine for HEXO stock for years to come.

Recently, Hexo has partnered with Molson Coors through a joint venture – Truss Beverages – to create THC-infused drinks. Its partnership with Molson Coors will give HEXO access to international markets and increase its gross margins. The deal is expected to increase net revenue in the next quarter.

HEXO is also seeking to expand in Europe. Indeed, the company recently received approval from European authorities for its “Powered By Hexo” brand.

Finally, the company recently announced its acquisition of cannabis company Zenabis in an “all-stock deal” valued at $235 million. This deal will help HEXO to increase its position in the local market.

These recent acquisitions and partnerships suggest a significant upside for HEXO in the near future. In addition to its expansion plans, the financial situation of the pot company also makes it promising.

In the first quarter of 2021, HEXO recorded its sixth sequential improvement in EBITDA. Gross revenue also stand at $41.3 million – the highest in the company’s history. In addition, net revenue increased by 103% compared to the previous year.

Looking ahead, HEXO is well positioned to grow organically in the coming months. Revenue growth of 73% and profit growth of 98% are expected for 2021.